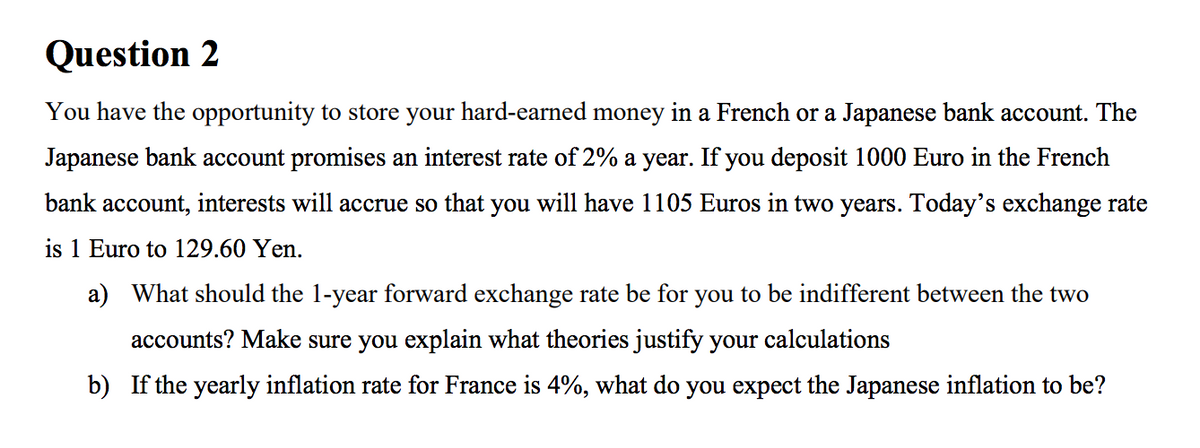

Question 2 You have the opportunity to store your hard-earned money in a French or a Japanese bank account. The Japanese bank account promises an interest rate of 2% a year. If you deposit 1000 Euro in the French bank account, interests will accrue so that you will have 1105 Euros in two years. Today's exchange rate is 1 Euro to 129.60 Yen. a) What should the 1-year forward exchange rate be for you to be indifferent between the two accounts? Make sure you explain what theories justify your calculations b) If the yearly inflation rate for France is 4%, what do you expect the Japanese inflation to be?

Question 2 You have the opportunity to store your hard-earned money in a French or a Japanese bank account. The Japanese bank account promises an interest rate of 2% a year. If you deposit 1000 Euro in the French bank account, interests will accrue so that you will have 1105 Euros in two years. Today's exchange rate is 1 Euro to 129.60 Yen. a) What should the 1-year forward exchange rate be for you to be indifferent between the two accounts? Make sure you explain what theories justify your calculations b) If the yearly inflation rate for France is 4%, what do you expect the Japanese inflation to be?

Chapter7: International Arbitrage And Interest Rate Parity

Section: Chapter Questions

Problem 30QA

Related questions

Question

Transcribed Image Text:Question 2

You have the opportunity to store your hard-earned money in a French or a Japanese bank account. The

Japanese bank account promises an interest rate of 2% a year. If you deposit 1000 Euro in the French

bank account, interests will accrue so that you will have 1105 Euros in two years. Today's exchange rate

is 1 Euro to 129.60 Yen.

a) What should the 1-year forward exchange rate be for you to be indifferent between the two

accounts? Make sure you explain what theories justify your calculations

b) If the yearly inflation rate for France is 4%, what do you expect the Japanese inflation to be?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning