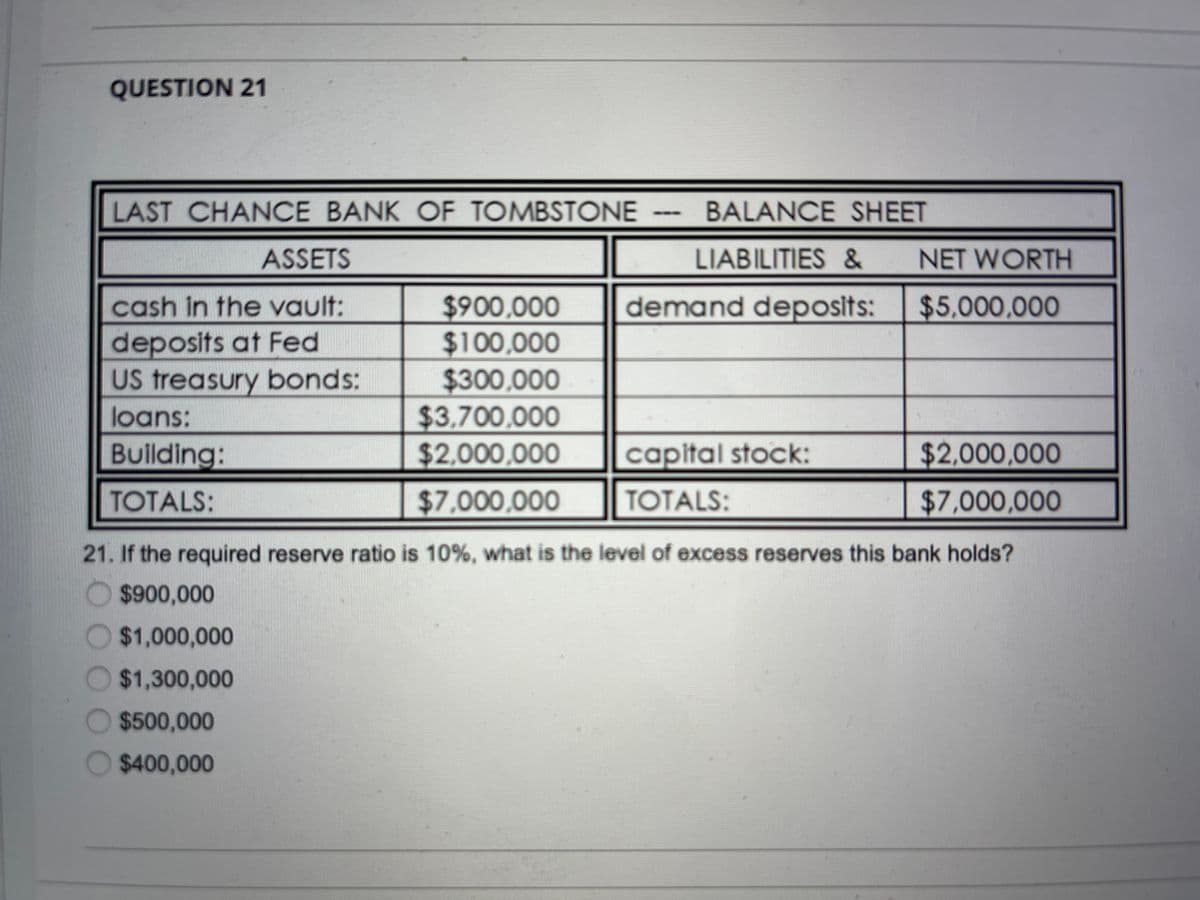

QUESTION 21 LAST CHANCE BANK OF TOMBSTONE BALANCE SHEET -- ASSETS LIABILITIES & NET WORTH cash in the vault: deposits at Fed US treasury bonds: loans: Building: demand deposits: $900,000 $100,000 $300,000 $3.700,000 $2.000,000 $7,000,000 $5,000,000 capital stock: TOTALS: $2,000,000 $7,000,000 TOTALS: 21. If the required reserve ratio is 10%, what is the level of excess reserves this bank holds? $900,000 O $1,000,000 O $1,300,000 $500,000 O $400,000

Q: 9) All of the listed items below are considered cash or cash equivalents, EXCEPT: a) Coins b) Cash…

A: Cash and cash equivalents: These are the most liquid current assets which includes both cash and…

Q: Problem 4 Basics of Proof of Cash Data regarding the cash in bank for the current year of Basic…

A: We shall prepare the Bank Reconciliation on January 31 to compute the Adjusted Cash in Bank, January…

Q: In the month of July, if a firm had a net cash inflow of RM2,000, beginning cash balance of RM5,000…

A: Amount to be borrowed = Ending Cash Balance - (Beginning Cash Balance + Net Cash Inflow)

Q: James & Company had the following balances at December 31, 2019: Cash in checking account…

A: Current Assets: Current assets are those assets which are having the maturity duration of leaser…

Q: 3 7 The current asset section of the balance sheet prepared by the accountant of Dagupan Co. as at…

A: Current assets means those short term assets in the business, which are either in cash or can be…

Q: Empathy State Bank Assets Vault Cash Deposits at the Federal Reserve Loans Reference: Ref 12-1 This…

A: Disclaimer: "Since you have asked multiple questions, we will solve the first question for you. If…

Q: Acme Bank: Net profit after taxes = $10 million Assets = 200…

A: Assets are the total belongings of the business which are used in income generation. Equity is the…

Q: Assets Liabilities and Equity Reserves $20,000 Deposits S100,000 Loans 95,000 Debt 30,000 Securities…

A: Currency in circulation = $40000 Checkable deposits = $100000 Bank reserves = $20000

Q: Problem 4 Basics of Proof of Cash Data regarding the cash in bank for the current year of Basic…

A: Cash disbursement is the subsidiary journal format in which all cash outflow transactions are…

Q: Problem 9-16 A firm’s balance sheets for the last two years are as follows: YEAR 20X1 Assets…

A: 1) The computation of current ratio: Hence, the current ratios for 20X1 and 20X2 are 1.42 and 1.33…

Q: Exercise 16-10 (Algo) Cash flows from financing activities LO P3 a. Net income was $475,000. b.…

A: Cash flows from financing activities is one of the section of cash flows statement, it shows all…

Q: Exercise 12-10 (Algo) Cash flows from financing activities LO P3 a. Net income was $466,000. b.…

A: Cash flow statement includes: Cash flow from operating activities Cash flows from investing…

Q: Problem 21-4 (Algo) Statement of cash flows; direct method [LO21-3, 21-8] The comparative balance…

A: Introduction Cashflow statement is a statement that shows cash inflow and outflow during a year, it…

Q: Restricted foreign bank account (equivalent to pesos_ 1,000,000 IOU from eldest brother of Jonathan…

A: The companies keep cash and cash equivalents to fulfill their…

Q: December 31, 2018 Cash P500, 000 900, 000 650, 000 45, 000 Accounts receivable Inventory Prepaid…

A: We’ll answer the first question since the exact one wasn’t specified. Please submit a new question…

Q: Question 24 The following information was taken from the 2021 financial statements of Dunlop…

A: The cash flow statement is prepared to record the cash flow from various activities during the…

Q: Exercise 8-14 a Wynn Company has recorded the following items in its financial records. Cash in bank…

A: Cash and cash equivalents means those liquid assets which can be converted into cash within short…

Q: Bank B Assets Liabilities 32,400,000 Deposits 129,600,000 Capital Cash Nonliquid Assets 145,250,000…

A: Given Information, Total withdrawals = $40,000,000 Cash = $32,400,000 Shortfall = $40,000,000 -…

Q: Assets Liabilities and net worth 1 (a) (b) 1' (a) (b) Reserves $58 Checkable deposits…

A: Reserves are the amount of cash which cannot be invested or lent out by the bank. It is the amount…

Q: Question 26 Metropolis National Bank Assets Liabilities Reserves $60,000 Deposits $500,000 Loans·…

A: Bank's required reserves is the minimum cash/amount the bank should hold in hands. The explanation…

Q: In preparing Titan Inc.'s statement of cash flows for the year ended December 31, 2021, the…

A: Cash flow statement provided information about the cash inflows and cash outflows of the…

Q: Katie Wright’s banker has asked her to submit a personal balance sheet as of June 30, 2020, in…

A: 1. Determination of balance sheet Katie Wright's Balance sheet Ended June 30, 2020 Assets $…

Q: Harlan Mining Co. has recently decided to go public and has hired you as an independent CPA. One…

A: Cash flow statement provided information about the cash inflows and cash outflows of the company.…

Q: Problem 4 Basics of Proof of Cash Data regarding the cash in bank for the current year of Basic…

A: Calculation of cash in bank as on February 28-

Q: Problem 2: ForesCompany had the following balances on December 31, 2020: Cash in RC Bank -savings…

A: Cash and Cash Equivalents include cash and highly liquid assets convertible into cash.

Q: ROBLEM 1. 4111 Company had the following items in its "Cash and cash equivalents" account as of…

A: Hi There, Thanks for choosing Bartleby. As per the Honor code we are supposed to answer the first…

Q: (30) Bonds with a face value of $270,000 are issued at 103. The statement of cash flows would report…

A: Cash flow from investing activities consists of cash inflows and cash outflows from investment…

Q: Problem 1. GABRIEL Company has the following balances for the year 2018: 3,000 10,000 15,000 50,000…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: 20. Cash and cash equivalents on the statement of financial position include A. cash reserved for…

A: 1. Cash reserved for acquisition of property, plant and equipment items is not considered as the…

Q: PROBLEM NO.1- Composition of cash and cash equivalents The following data pertain to PRTC…

A: Computation of the cash and cash equivalents to be reported on the entity's December 31 2018…

Q: Mi Tierra Bank Assets Liabilities S10,000 Demand deposits $5,000 $85,000 Owner's equity $100,000…

A: answer are as follows.

Q: Item Billions of Dollars Checkable Deposits Small Time Deposits Currency Held By The Public Savings…

A: Physical cash, traveler's checks, demand deposits, and other checkable deposits are included in M1,…

Q: Series of deposits worth P10, 000, P20, 000 P8, 000 and P5,000 were made at t=0,1,4,6 quarter,…

A: Future value is the worth of today’s amount on a future date.

Q: Problem 10-4 (AICPA Maped) On December 31, 2000 Kale Company had the following balances in the accou…

A: Given: - Checking account #101= 1,750,000 Checking account #201= (100,000) Time deposit= 250,000…

Q: Task 3 Assume the following balance sheet for a bank. Assets risk class 1 (A1): 200 million with a…

A: Asset Risk Class 1 (A1) = 200 mn Duration = 7 years Asset Risk Class 2 (A2) = 300 mn Duration = 5…

Q: 31) ABC Company had the following account balances on December 31, 2021: Cash in bank - current…

A: Note: Cash restricted will be shown separately from cash on the balance sheet. Its purpose will be…

Q: Q25 Examine the chart below which contains Bank 1’s balance sheet. If the legal reserve requirement…

A: Reserves are profits that have been put aside for a specific purpose.. Reserves are occasionally…

Q: Assets Liabilities Reserves $ 200 Deposits $800 Loans $700 Debt $100 Securities $ 100 Capital $100…

A: Value of Asset = LValue of Loans + Value of Securities +Reserves Value of Liabilities = Deposits +…

Q: 7. Suppose the First National Bank of Naboo has a T-account as follows: Assets Liabilities Reserves…

A: After all of a company's liabilities have been deducted, capital is defined as the remaining stake…

Q: ES.16 (LO 3) (Preparation of a Statement of Cash Flows) A comparative balance sheet for Shabbona…

A: Statement of cash flows forms a part of financial statements of the entity and is prepared with a…

Step by step

Solved in 2 steps

- Question 21 In preparing Titan Inc.'s statement of cash flows for the year ended December 31, 2021, the following amounts were available: Collect note receivable $615,000 Issue bonds payable 639,000 Purchase treasury stock 300,000 What amount should be reported on Titan, Inc.'s statement of cash flows for investing activities? $339,000 $315,000 $615,000 $1,254,000TB Problem 21-167 (Algo) The Murdock Corporation reported the following balance sheet data for 2021 and 2020: 2021 2020 Cash $ 96,245 $ 33,155 Available-for-sale debt securities (not cash equivalents) 24,000 102,000 Accounts receivable 97,000 83,550 Inventory 182,000 160,300 Prepaid insurance 3,030 3,700 Land, buildings, and equipment 1,284,000 1,142,000 Accumulated depreciation (627,000 ) (589,000 ) Total assets $ 1,059,275 $ 935,705 Accounts payable $ 91,640 $ 165,670 Salaries payable 26,800 33,000 Notes payable (current) 40,300 92,000 Bonds payable 217,000 0 Common stock 300,000 300,000 Retained earnings 383,535 345,035 Total liabilities and shareholders' equity $ 1,059,275 $ 935,705 Additional information for 2021: (1) Sold available-for-sale debt securities costing…TB Problem 21-167 (Algo) The Murdock Corporation reported the following balance sheet data for 2021 and 2020: 2021 2020 Cash $ 96,245 $ 33,155 Available-for-sale debt securities (not cash equivalents) 24,000 102,000 Accounts receivable 97,000 83,550 Inventory 182,000 160,300 Prepaid insurance 3,030 3,700 Land, buildings, and equipment 1,284,000 1,142,000 Accumulated depreciation (627,000 ) (589,000 ) Total assets $ 1,059,275 $ 935,705 Accounts payable $ 91,640 $ 165,670 Salaries payable 26,800 33,000 Notes payable (current) 40,300 92,000 Bonds payable 217,000 0 Common stock 300,000 300,000 Retained earnings 383,535 345,035 Total liabilities and shareholders' equity $ 1,059,275 $ 935,705 Additional information for 2021: (1) Sold available-for-sale debt securities costing…

- PROBLEM 1. 4111 Company had the following items in its "Cash and cash equivalents" account as of December 31, 2022: Cash on hand P125,000Bank time deposit (acquired 12/30/2022; due in 2/28/2023) 150,000Petty cash fund - including P2,550 unreplenished vouchers dated December 27-30, 2022; and P1,200 dated January 4, 2023 10,000Cash in foreign bank - unrestricted ($5,000; average rate - P50; closing rate - P52) 250,000Cash restricted for additions to plant (to be disbursed in 2025) 1,200,000Cash in bank - to be used for payment of 2023 dividends and taxes 1,380,000 How much should be reported as cash and cash equivalents as of December 31, 2022? a. P1,875,450 b. P1,922,450 c. P1,921,250 d. P1,944,250 PROBLEM 2. The following data were taken from the accounting records of 423, Inc Balance at January 1, 2022 5,000 balls @ P20Purchases:…Required information Exercise 21-13 (Static) Identifying cash flows from investing activities and financing activities [LO21-5, 21-6] Skip to question [The following information applies to the questions displayed below.] In preparation for developing its statement of cash flows for the year ended December 31, 2024, Rapid Pac, Incorporated, collected the following information: ($ in millions) Fair value of shares issued in a stock dividend $ 65 Payment for the early extinguishment of long-term bonds (book value: $97 million) 102 Proceeds from the sale of treasury stock (cost: $17 million) 22 Gain on sale of land 4 Proceeds from sale of land 12 Purchase of Microsoft common stock 160 Declaration of cash dividends 44 Distribution of cash dividends declared in 2023 40 Exercise 21-13 (Static) Part 2 2. In Rapid Pac’s statement of cash flows, what were net cash inflows (or outflows) from financing activities for 2024? Note: Cash outflows should be indicated…CP 14–8 Assume the following income statement and balance sheet information: Service revenue (all cash) $175 Operating expenses Salaries (all cash)$ 85 Net income $90 2020 2019 Current assets Cash $1,250 $1,600 Short‐term invest. 100 200 $1,350 $1,800 Liabilities Borrowings 600 1,000 Stockholders’ equity Common stock 200 300 Retained earnings 550 500 750 800 $1,350 $1,800 Other information: The short‐term investments are riskless and will be converted to a known amount of cash in 60 days. Borrowings are non‐ current. No gain or loss occurred when common stock was repurchased. Required: Calculate cash flow from operating activities .2.Prepare…

- Question 19 Examine the chart below which contains Bank 1’s balance sheet. If the commercial bank has $300 in excess reserves, then the legal reserve requirement must be: Assets Liabilities Total Reserves $500 Demand Deposits $1000 Loans $500 Question 19 options: a) 10% b) 30% c) 20% d) 80%Statement of cash flows direct method The comparative balance sheet of Martinez Inc. for December 31, 20Y4 and 20Y3, is as follows: Dec. 31, 20Y4 Dec. 31, 20Y3 Assets Cash 661,920 683,100 Accounts receivable (net) 992,640 914,400 Inventories 1,394,400 1,363,800 Investments 0 432,000 Land 960,000 0 Equipment 1,224,000 984,000 Accumulated depreciationequipment (481,500) (368,400) Total assets 4,751,460 4,008,900 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) 1,080,000 966,600 Accrued expenses payable (operating expenses) 67,800 79,200 Dividends payable 100,800 91,200 Common stock, 5 par 130,000 30,000 Paid in capital: Excess of issue price over parcommon stock 950,000 450,000 Retained earnings 2,422,860 2,391,900 Total liabilities and stockholders' equity 4,751,460 4,008,900 The income Statement for the year ended December 51. 20Y3. is as follows: Sales 4,512,000 Cost of goods sold 2,352,000 Gross profit 2,160,000 Operating expenses: Depredation expense 113,100 Other operating expenses 1,344,840 Total operating expenses 1,457,940 Operating income 702,060 Other income: Gain on sale of investments 156,000 Income before income tax 858,060 Income tax expense 299,100 Net income 558,960 Additional data obtained from an examination of the accounts in the ledger for 20Y3 are as follows: A. Equipment and land were acquired for cash. B. There were no disposals of equipment during the year. C. The investments were sold for 588,000 cash. D. The common stock was issued for cash. E. There was a 528,000 debit to Retained Earnings for cash dividends declared. Instructions Prepare a statement of cash flows, using the direct method of presenting cash flows from operating activities.Statement of cash flows direct method applied to PR 131A The comparative balance sheet of Livers Inc. for December 31, 20Y3 and 20Y2 is as follows: Dec. 31, 20Y3 Dec. 31, 20Y2 Assets Cash 155,000 150,000 Accounts receivable (net) 450,000 400,000 Inventories 770,000 750,000 Investments 0 100,000 Land 500,000 0 Equipment 1,400,000 1,200,000 Accumulated depreciationequipment (600,000) (500,000) Total assets Liabilities and Stockholders' Equity 2,675,000 2,100,000 Accounts payable (merchandise creditors) 340,000 300,000 Accrued expenses payable (operating expenses) 45,000 50,000 Dividends payable 30,000 25,000 Common stock, 4 par 700,000 600,000 Paid-in capital: Excess of issue price over parcommon stock 200,000 175,000 Retained earnings 1,360,000 950,000 Total liabilities and stockholders' equity 2,675,000 2,100,000 The income statement for the year ended December 31, 20Y3, is as follows: Sales 3,000,000 Cost of goods sold 1,400,000 Gross profit 1,600,000 Operating expenses: Depreciation expense 100,000 Other operating expenses. 950,000 Total operating expenses 1,050,000 Operating income 550,000 Gain on sale of investments 75,000 Income before income tax 625,000 Income tax expense 125,00 Net income 500,000 Additional data obtained from an examination of the accounts in the ledger for 20Y3 are as follows: A. The investments were sold for 175,000 cash. B. Equipment and land were acquired for cash. C. There were no disposals of equipment during the year. D. The common stock was issued for cash. E. There was a 90,000 debit to Retained Earnings for cash dividends declared. Instructions Prepare a .statement of cash flows, using the direct method of presenting cash flows from operating activities.

- Required information Exercise 21-13 (Static) Identifying cash flows from investing activities and financing activities [LO21-5, 21-6] [The following information applies to the questions displayed below.] In preparation for developing its statement of cash flows for the year ended December 31, 2024, Rapid Pac, Incorporated, collected the following information: ($ in millions) Fair value of shares issued in a stock dividend $ 65 Payment for the early extinguishment of long-term bonds (book value: $97 million) 102 Proceeds from the sale of treasury stock (cost: $17 million) 22 Gain on sale of land 4 Proceeds from sale of land 12 Purchase of Microsoft common stock 160 Declaration of cash dividends 44 Distribution of cash dividends declared in 2023 40 Exercise 21-13 (Static) Part 1 Required: 1. In Rapid Pac’s statement of cash flows, what were net cash inflows (or outflows) from investing activities for 2024? Note: Cash outflows should be indicated with a…Question 11 James & Company had the following balances at December 31, 2019: Cash in checking account $350,000 Cash in Money Market 250,000 U.S. Treasury bill purchased 12/1/2019, maturing 1/31/2020 800,000 U.S Treasury Bond purchased 3/1/2019, maturing 4/30/2020 500,000 What amount should Cook report as cash and cash equivalents on its 12/31/2019 balance sheet? Answers: A. $600,000 B. $1,150,000 C. $1,400,000 D. $1,900,000Exhibit 12-4 Balance SheetBANK XYZ($ millions) Assets Liabilities Required Reserves $ 30 Checkable Deposits $ 250 Excess Reserves 0 Nontransaction Deps 350 Loans 700 Borrowings 25 Securities 140 Bank Capital (A) Refer to Exhibit 12-4. How much bank capital does Bank XYZ have (i.e. what dollar amount belongs in blank (A)? Refer to Exhibit 12-4. What is the required reserve ratio?