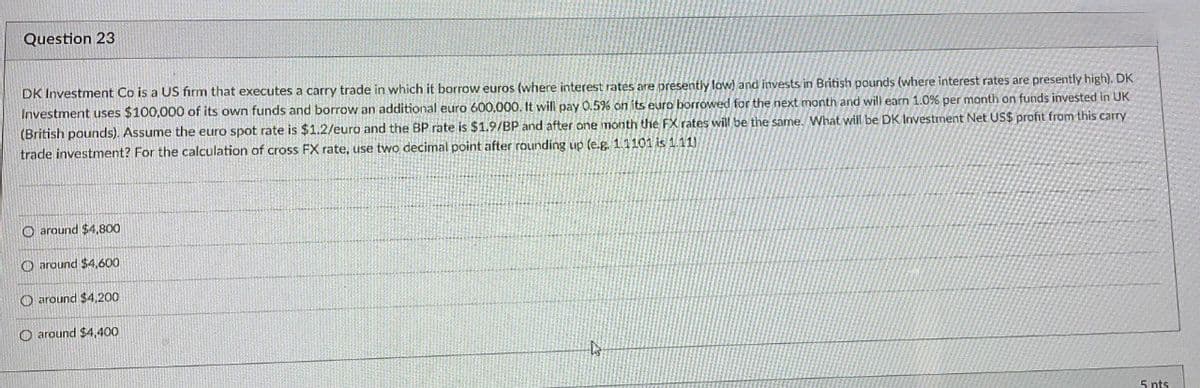

Question 23 DK Investment Co is a US firm that executes a carry trade in which it borrow euros (where interest rates are presently low) and invests in British pounds (where interest rates are presently high). DK Investment uses $100,000 of its own funds and borrow an additional euro 600,000. It will pay 0.5% on its euro borrowed for the next month and will earn 1.0% per month on funds invested in UK (British pounds). Assume the euro spot rate is $1.2/euro and the BP rate is $1.9/BP and after one month the FX rates will be the same. What will be DK Investment Net US$ profit from this carry trade investment? For the calculation of cross FX rate, use two decimal point after rounding up (e.g. 1.1101 is 1.11) O around $4,800 O around $4,600 around $4,200 O around $4,400 D 5 nts

Question 23 DK Investment Co is a US firm that executes a carry trade in which it borrow euros (where interest rates are presently low) and invests in British pounds (where interest rates are presently high). DK Investment uses $100,000 of its own funds and borrow an additional euro 600,000. It will pay 0.5% on its euro borrowed for the next month and will earn 1.0% per month on funds invested in UK (British pounds). Assume the euro spot rate is $1.2/euro and the BP rate is $1.9/BP and after one month the FX rates will be the same. What will be DK Investment Net US$ profit from this carry trade investment? For the calculation of cross FX rate, use two decimal point after rounding up (e.g. 1.1101 is 1.11) O around $4,800 O around $4,600 around $4,200 O around $4,400 D 5 nts

Chapter7: International Arbitrage And Interest Rate Parity

Section: Chapter Questions

Problem 18QA

Question

Transcribed Image Text:Question 23

DK Investment Co is a US firm that executes a carry trade in which it borrow euros (where interest rates are presently low) and invests in British pounds (where interest rates are presently high). DK

Investment uses $100,000 of its own funds and borrow an additional euro 600,000. It will pay 0.5% on its euro borrowed for the next month and will earn 1.0% per month on funds invested in UK

(British pounds). Assume the euro spot rate is $1.2/euro and the BP rate is $1.9/BP and after one month the FX rates will be the same. What will be DK Investment Net US$ profit from this carry

trade investment? For the calculation of cross FX rate, use two decimal point after rounding up (e.g. 1.1101 is 1.11)

O around $4,800

O around $4,600

around $4,200

O around $4,400

D

5 nts

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning