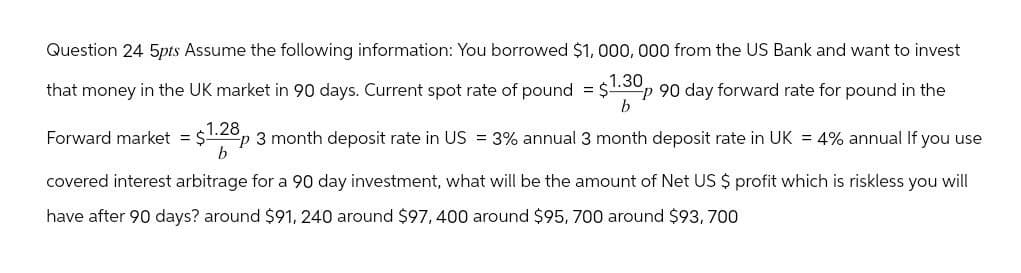

Question 24 5pts Assume the following information: You borrowed $1,000,000 from the US Bank and want to invest that money in the UK market in 90 days. Current spot rate of pound = $1.30p 90 day forward rate for pound in the b Forward market = $1.28p 3 month deposit rate in US = 3% annual 3 month deposit rate in UK = 4% annual If you use b covered interest arbitrage for a 90 day investment, what will be the amount of Net US $ profit which is riskless you will have after 90 days? around $91, 240 around $97,400 around $95, 700 around $93,700

Question 24 5pts Assume the following information: You borrowed $1,000,000 from the US Bank and want to invest that money in the UK market in 90 days. Current spot rate of pound = $1.30p 90 day forward rate for pound in the b Forward market = $1.28p 3 month deposit rate in US = 3% annual 3 month deposit rate in UK = 4% annual If you use b covered interest arbitrage for a 90 day investment, what will be the amount of Net US $ profit which is riskless you will have after 90 days? around $91, 240 around $97,400 around $95, 700 around $93,700

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter19: Multinational Financial Management

Section: Chapter Questions

Problem 5P

Question

Transcribed Image Text:Question 24 5pts Assume the following information: You borrowed $1,000,000 from the US Bank and want to invest

that money in the UK market in 90 days. Current spot rate of pound = $1.30p 90 day forward rate for pound in the

b

Forward market = $1.28p 3 month deposit rate in US = 3% annual 3 month deposit rate in UK = 4% annual If you use

b

covered interest arbitrage for a 90 day investment, what will be the amount of Net US $ profit which is riskless you will

have after 90 days? around $91, 240 around $97,400 around $95, 700 around $93,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning