Question 25 B's basis in the property received is m $10,000 m $20,000 m $30,000 m None of these_ Question 26 Z Co.'s recognized gain or loss on the distribution to A is m None of these_ m S35.000 capital gain m $<40,000> ordinary loss m 0 Question 27 Z Co.'s recognized gain or loss On the distribution to B is m None of these_ m $2O,0OO capital gain m $10,000 capital gain m 0 Question 28 Z Co.'s recognized gain or loss on the distribution to C is $70,000 capital gain None of these_ $20,000 capital gain $40,000 gain Question 29 Z Co.'s recognized gain or loss on the distribution to D is m <$1,600> capital loss m 0 m <$400> capital loss m None of these

Question 25 B's basis in the property received is m $10,000 m $20,000 m $30,000 m None of these_ Question 26 Z Co.'s recognized gain or loss on the distribution to A is m None of these_ m S35.000 capital gain m $<40,000> ordinary loss m 0 Question 27 Z Co.'s recognized gain or loss On the distribution to B is m None of these_ m $2O,0OO capital gain m $10,000 capital gain m 0 Question 28 Z Co.'s recognized gain or loss on the distribution to C is $70,000 capital gain None of these_ $20,000 capital gain $40,000 gain Question 29 Z Co.'s recognized gain or loss on the distribution to D is m <$1,600> capital loss m 0 m <$400> capital loss m None of these

Chapter20: Corporations: Distributions In Complete Liquidation And An Overview Of Reorganizations

Section: Chapter Questions

Problem 15CE

Related questions

Question

|

Question 25 B's basis in the property received is m $10,000 m $20,000 m $30,000 m None of these_ |

|

|

|

Question 26 Z Co.'s recognized gain or loss on the distribution to A is m None of these_ m S35.000 m $<40,000> ordinary loss m 0 |

|

|

|

Question 27 Z Co.'s recognized gain or loss On the distribution to B is m None of these_ m $2O,0OO capital gain m $10,000 capital gain m 0 |

||

Question 28

Z Co.'s recognized gain or loss on the distribution to C is

$70,000 capital gain

- None of these_

$20,000 capital gain

- $40,000 gain

|

Question 29 Z Co.'s recognized gain or loss on the distribution to D is m <$1,600> capital loss m 0 m <$400> capital loss m None of these |

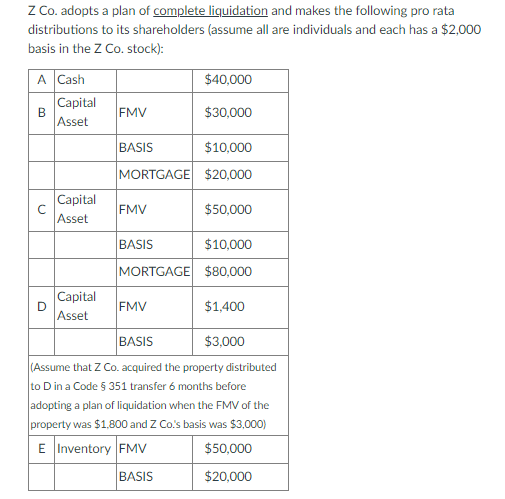

Transcribed Image Text:Z Co. adopts a plan of complete liquidation and makes the following pro rata

distributions to its shareholders (assume all are individuals and each has a $2,000

basis in the Z Co. stock):

A Cash

$40,000

Capital

B

Asset

FMV

$30,000

BASIS

$10,000

MORTGAGE $20,000

Capital

FMV

$50,000

Asset

BASIS

$10,000

MORTGAGE $80,000

Capital

FMV

$1,400

Asset

BASIS

$3,000

(Assume that Z Co. acquired the property distributed

to Din a Code 5 351 transfer 6 months before

adopting a plan of liquidation when the FMV of the

property was $1,800 and Z Co's basis was $3,000)

E Inventory FMV

$50,000

BASIS

$20,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Define partnership liquidations:

VIEWStep 2: Determine the B's basis in the property received:

VIEWStep 3: Determine the Z Co.'s recognized gain or loss on the distribution to A:

VIEWStep 4: Determine the Z Co.'s recognized gain or loss On the distribution to B:

VIEWStep 5: Determine the Z Co.'s recognized gain or loss on the distribution to C:

VIEWStep 6: Determine the Z Co.'s recognized gain or loss on the distribution to D:

VIEWSolution

VIEWStep by step

Solved in 7 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning