Question 27 of 35 What is the suggested method for voiding and re-issuing a paycheck? AO Make a journal entry to reverse the original paycheck. Then, issue a new paycheck using the current date. BO Void the original paycheck using the QuickBooks "void" feature. Then, issue a new paycheck using the current date. CO Reverse the original check using the QuickBooks "reversal" feature. Then, issue a new paycheck using the current date. DO Void a new check with the same check number. Then, change the number of the original check to the new check number or print the check.

Question 27 of 35 What is the suggested method for voiding and re-issuing a paycheck? AO Make a journal entry to reverse the original paycheck. Then, issue a new paycheck using the current date. BO Void the original paycheck using the QuickBooks "void" feature. Then, issue a new paycheck using the current date. CO Reverse the original check using the QuickBooks "reversal" feature. Then, issue a new paycheck using the current date. DO Void a new check with the same check number. Then, change the number of the original check to the new check number or print the check.

Chapter7: Payroll

Section: Chapter Questions

Problem 1M

Related questions

Question

1.

These two questions are for quickbooks desktop 2022. Please inlcude explaination. Thank you!

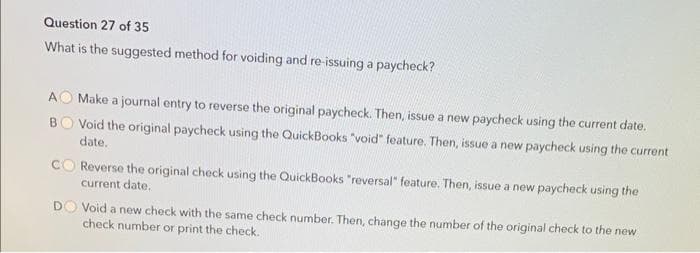

Transcribed Image Text:Question 27 of 35

What is the suggested method for voiding and re-issuing a paycheck?

AO Make a journal entry to reverse the original paycheck. Then, issue a new paycheck using the current date.

BO Void the original paycheck using the QuickBooks "void" feature. Then, issue a new paycheck using the current

date.

CO Reverse the original check using the QuickBooks "reversal" feature. Then, issue a new paycheck using the

current date.

DO Void a new check with the same check number. Then, change the number of the original check to the new

check number or print the check.

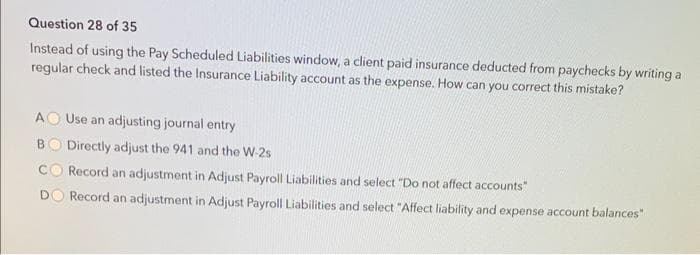

Transcribed Image Text:Question 28 of 35

Instead of using the Pay Scheduled Liabilities window, a client paid insurance deducted from paychecks by writing a

regular check and listed the Insurance Liability account as the expense. How can you correct this mistake?

AO Use an adjusting journal entry

BO Directly adjust the 941 and the W-2s

Record an adjustment in Adjust Payroll Liabilities and select "Do not affect accounts"

Record an adjustment in Adjust Payroll Liabilities and select "Affect liability and expense account balances"

D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning