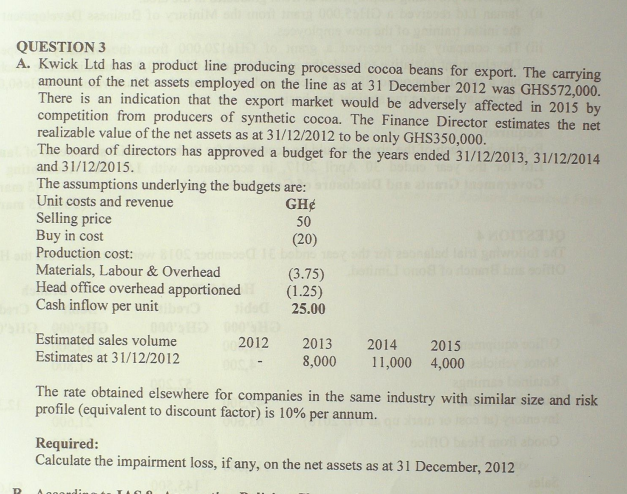

QUESTION 3 A. Kwick Ltd has a product line producing processed cocoa beans for export. The carrying 306 amount of the net assets employed on the line as at 31 December 2012 was GHS572,000. There is an indication that the export market would be adversely affected in 2015 by competition from producers of synthetic cocoa. The Finance Director estimates the net realizable value of the net assets as at 31/12/2012 to be only GHS350,000. The board of directors has approved a budget for the years ended 31/12/2013, 31/12/2014 and 31/12/2015. The assumptions underlying the budgets are: GHe Unit costs and revenue Selling price Buy in cost 50 (20) Production cost: 100 bobne Materials, Labour & Overhead Head office overhead apportioned Cash inflow per unit 000 Estimated sales volume 2012 2013 Estimates at 31/12/2012 2014 2015 11,000 4,000 8,000 The rate obtained elsewhere for companies in the same industry with similar size and risk profile (equivalent to discount factor) is 10% per annum. Required: Calculate the impairment loss, if any, on the net assets as at 31 December, 2012 (3.75) (1.25) 25.00

QUESTION 3 A. Kwick Ltd has a product line producing processed cocoa beans for export. The carrying 306 amount of the net assets employed on the line as at 31 December 2012 was GHS572,000. There is an indication that the export market would be adversely affected in 2015 by competition from producers of synthetic cocoa. The Finance Director estimates the net realizable value of the net assets as at 31/12/2012 to be only GHS350,000. The board of directors has approved a budget for the years ended 31/12/2013, 31/12/2014 and 31/12/2015. The assumptions underlying the budgets are: GHe Unit costs and revenue Selling price Buy in cost 50 (20) Production cost: 100 bobne Materials, Labour & Overhead Head office overhead apportioned Cash inflow per unit 000 Estimated sales volume 2012 2013 Estimates at 31/12/2012 2014 2015 11,000 4,000 8,000 The rate obtained elsewhere for companies in the same industry with similar size and risk profile (equivalent to discount factor) is 10% per annum. Required: Calculate the impairment loss, if any, on the net assets as at 31 December, 2012 (3.75) (1.25) 25.00

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter13: Emerging Topics In Managerial Accounting

Section: Chapter Questions

Problem 49E: Refer to Exercise 13-48. Suppose that Kamber is considering building a new plant inside a foreign...

Related questions

Question

Transcribed Image Text:QUESTION 3

A. Kwick Ltd has a product line producing processed cocoa beans for export. The carrying

amount of the net assets employed on the line as at 31 December 2012 was GHS572,000.

There is an indication that the export market would be adversely affected in 2015 by

competition from producers of synthetic cocoa. The Finance Director estimates the net

realizable value of the net assets as at 31/12/2012 to be only GHS350,000.

The board of directors has approved a budget for the years ended 31/12/2013, 31/12/2014

and 31/12/2015.

The assumptions underlying the budgets are:

Unit costs and revenue

GH¢

50

Selling price

Buy in cost

(20)

bobne 100

Hand Production cost: 8105

(3.75)

Materials, Labour & Overhead

Head office overhead apportioned

Cash inflow per unit

(1.25)

25.00

Estimated sales volume

2012

2013

Estimates at 31/12/2012

2014 2015

8,000 11,000 4,000

The rate obtained elsewhere for companies in the same industry with similar size and risk

profile (equivalent to discount factor) is 10% per annum.

Required:

Calculate the impairment loss, if any, on the net assets as at 31 December, 2012

Р

JH

T100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning