QUESTION 3 Matt has inherited a large sum of money wo and is deciding how much to invest in a low interest savings account with fixed rate of return r f = 0.1 and how much to invest in his friend's new business, which is a risky asset with random rate of return ã given by with prob. 7 = 0.4 with prob. 1 – T = 0.6 S-0.6 0.9 Suppose Matt inherited wo 8000 to invest and has a utility function over final portfolio value v given by u(v) = =20.6. (a) Calculate the optimal amount a* for Matt to invest in the risky asset. (b) Now suppose that wo 20000 instead. Calculate the new optimal investment in the risky asset and compare to your answer in part (a). Is there a shortcut way to quickly determine, based on (a), how much Matt would invest in the risky asset when his wealth is higher?

QUESTION 3 Matt has inherited a large sum of money wo and is deciding how much to invest in a low interest savings account with fixed rate of return r f = 0.1 and how much to invest in his friend's new business, which is a risky asset with random rate of return ã given by with prob. 7 = 0.4 with prob. 1 – T = 0.6 S-0.6 0.9 Suppose Matt inherited wo 8000 to invest and has a utility function over final portfolio value v given by u(v) = =20.6. (a) Calculate the optimal amount a* for Matt to invest in the risky asset. (b) Now suppose that wo 20000 instead. Calculate the new optimal investment in the risky asset and compare to your answer in part (a). Is there a shortcut way to quickly determine, based on (a), how much Matt would invest in the risky asset when his wealth is higher?

Algebra & Trigonometry with Analytic Geometry

13th Edition

ISBN:9781133382119

Author:Swokowski

Publisher:Swokowski

Chapter10: Sequences, Series, And Probability

Section10.8: Probability

Problem 32E

Related questions

Question

please see photo, cant write notation in text box

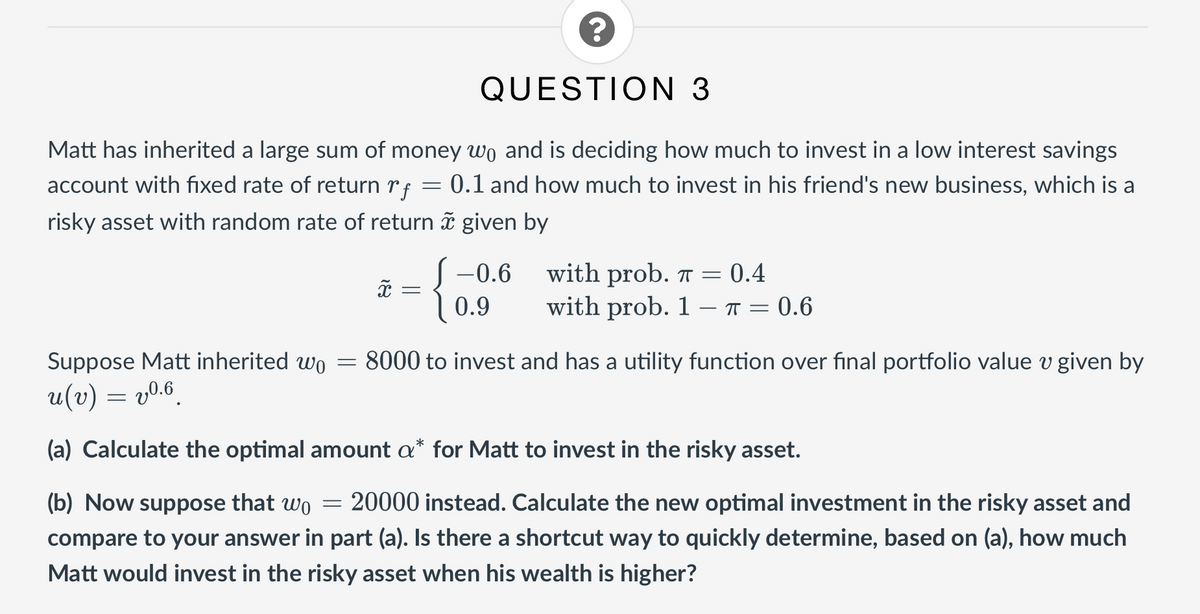

Transcribed Image Text:QUESTION 3

Matt has inherited a large sum of money wo and is deciding how much to invest in a low interest savings

account with fixed rate of return rf

0.1 and how much to invest in his friend's new business, which is a

risky asset with random rate of return ã given by

S-0.6 with prob. 7 = 0.4

with prob. 1 – T = 0.6

0.9

Suppose Matt inherited wo

:8000 to invest and has a utility function over final portfolio value v given by

u(v) = v0.6.

(a) Calculate the optimal amount a* for Matt to invest in the risky asset.

(b) Now suppose that wo

20000 instead. Calculate the new optimal investment in the risky asset and

compare to your answer in part (a). Is there a shortcut way to quickly determine, based on (a), how much

Matt would invest in the risky asset when his wealth is higher?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill