QUESTION 3 On January 1, 2016, a company placed into capitalized cost of $1,200,000. The equipme $30,000 and an estimated useful life of 5 ye: depreciation at December 31, 2017, if the s used? a. $468,000. O b. $480,000. O c. $240,000. O d. $234,000.

QUESTION 3 On January 1, 2016, a company placed into capitalized cost of $1,200,000. The equipme $30,000 and an estimated useful life of 5 ye: depreciation at December 31, 2017, if the s used? a. $468,000. O b. $480,000. O c. $240,000. O d. $234,000.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter4: Income Measurement And Accrual Accounting

Section: Chapter Questions

Problem 4.9E: Working Backward: Depreciation Polk Corp. purchased new store fixtures for $55,000 on January 31,...

Related questions

Question

Question 3?

Transcribed Image Text:Ud.credit a $35,000 los.

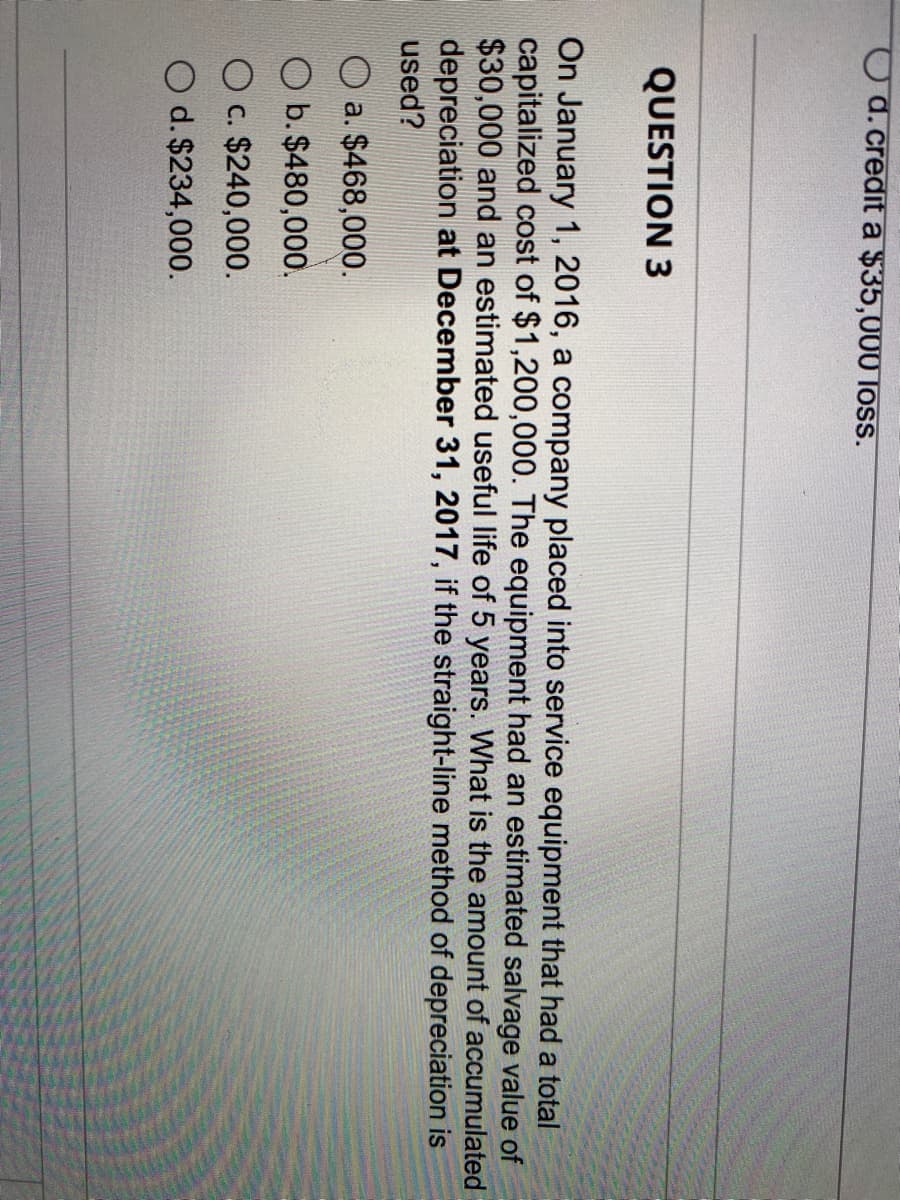

QUESTION 3

On January 1, 2016, a company placed into service equipment that had a total

capitalized cost of $1,200,000. The equipment had an estimated salvage value of

$30,000 and an estimated useful life of 5 years. What is the amount of accumulated

depreciation at December 31, 2017, if the straight-line method of depreciation is

used?

a. $468,000.

O b. $480,000.

O c. $240,000.

O d. $234,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning