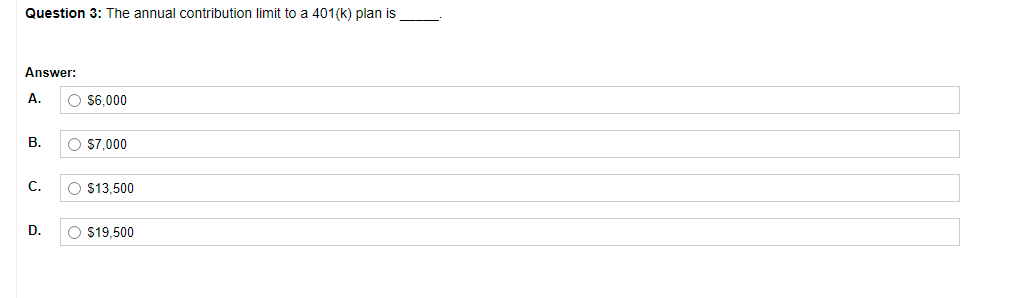

Question 3: The annual contribution limit to a 401(k) plan is Answer: А. S6,000 В. S7,000 С. $13,500 D. $19,500

Q: ne Years

A: Introduction:- Ratio analysis is a statistical method that examines financial documents such as the ...

Q: 10 In July, TPM Co. incurred total costs of $60,000 and made 6000 units. In December it produced 400...

A: Fixed cost is the cost which do not change or remains same at all activity level. Variable cost per ...

Q: Explain why accurate accountinginformation and audited financialstatements are important.

A: The importance of accounting information and audited financial statement is as follows:

Q: Muller Computers stores its inventory in a warehouse that burned to the ground in late November, 201...

A: Calculation of ending inventory Ending inventory = Beginning inventory + Purchases - Cost of Goods s...

Q: It costs Homer's Manufacturing $0.95 to produce baseballs and Homer sells them for $8.00 a piece. Ho...

A: Formula: Contribution margin = Sales revenue - variable cost.

Q: Book Value P40,000 170,000 Market Value P40,000 230,000 700,000 Cash Inventory Plant Assets (net) Co...

A: Non-Controlling Interest: Non-Controlling Interest, also known as minority interest, is an ownership...

Q: On July 1, 2020, Shroff Company leased a warehouse building under a 10-year lease agreement. The lea...

A:

Q: Selected data from Design Corporation for 2016 is as follows: Inventories Beginning $34,000 Ending $...

A: Manufacturing cost= Prime cost + manufacturing overheads Manufacturing overheads= Indirect Material+...

Q: Poster Corp. Sign Co. P 600,000 P 420,000 450,000 335.000

A: Following is the original cost of goods in sings inventory acquired from poster Corp.

Q: The following is a partial trial balance for the Green Star Corporation as of December 31, 2021: Acc...

A: The income statement is one of the financial statements of the business which tells about the profit...

Q: Assuming that you were a tax consultant of a certain company, discuss the specific provisions of the...

A: Tax Planning: Tax planning is the investigation of a monetary circumstance or plan to guarantee that...

Q: Lee, Min and Ho have been in partnership for more than 10 years. They see that the business profits ...

A: On liquidation of partnership, all the non-cash assets and liabilities are transferred to realisatio...

Q: Bev bought a small mom and pop grocery store. The sale was completed and Bev obtained ownership on J...

A: Intangible Assets: An intangible asset is an asset that needs real substance. This is as opposed to ...

Q: The following are the comparative financial statements for three years for Plastic Works Limited. Yo...

A: Comparative financial statements comprise of financial statements of various organisations at once f...

Q: Moran owns a building he bought during year 0 for $150,000. He sold the building in year 6. During t...

A: The question is based on the concept of Financial Accounting.

Q: . Entity A leases computer equipment to customers under direct-financing leases. The equipment has n...

A: A lease is an arrangement where a lessor agrees to allow a lessee to control the use of the asset fo...

Q: Mundall Company is considering a project that will require an initial investment of $600,000 and is ...

A: GIVEN Year 1 $100,000 Year 2 $250,000 Year 3 $250,000 Year 4 $200,000 Year 5 $100,000 ...

Q: Jenny purchased equipment at the beginning of July 2017 for $250,000. Jenny decided to depreciate th...

A: The depreciation expense is charged on fixed assets as reduced value of the fixed asset with usage a...

Q: Ashley Company had the following balance sheet extract at December 31, 20X8: Cash $100,000 Accounts ...

A: Merchandising company refers to the company which is dealing in retail sale, spent lot of money on a...

Q: Particulars Credit balance as per cash book 5,000 Cheques issued, but not yet presented for payment ...

A: Bank reconciliation was an statementwhich was prepared by an entity to reconcile general ledger and ...

Q: Problem 2 (Statement of Stockholders' Equity) In its most recent financial statements, Newhouse Inc....

A: Solution.. Retained earnings at the beginning = 780 Retained earnings at the end = 810 Net inc...

Q: In year 0, Canon purchased a machine to use in its business for $56,000. In year 3, Canon sold the m...

A: The correct answer for the above mentioned question is given in the following steps for your referen...

Q: Nicole organized a new corporation. The corporation began business on April 1 of year 1. She made th...

A: Proprietorship Business: Unincorporated company with just one owner who is responsible for paying pe...

Q: Intangible Long-Term Assets Track Town Co. had the following transactions involving intangible asset...

A: Amortization - Amortization of intangibles is the expense incurred on the intangibles. Amortization ...

Q: The statement of financial position of XYZ Company on December 31, 2011 is as follows: Assets Liabil...

A: Calculation of fair value of net identifiable assets acquired : Particulars Amount Cash P100...

Q: Allocation of Cash Dividends to Preference and Ordinary Shareholders)

A: Dear As you have highlighted part D. So, I am sending you solution of Part D only.

Q: Under-applied manufacturing overhead costs are always the result of which of the following situation...

A: Applied overhead = Overhead rate x Actual hours incurred where, Overhead rate = Budgeted Overhead co...

Q: and marginal cost functions ar 203and MC=500-40Q+302 ate will average cost be a minir r all other fi...

A: The marginal cost is the additional cost to the output. The rise in output causes falls in marginal ...

Q: ABC Company and XYZ Company reported the following condensed Statements of Financial Position on Jan...

A: The word "business consolidation" refers to the merging of multiple business divisions or enterprise...

Q: Nicole organized a new corporation. The corporation began business on April 1 of year 1. She made th...

A: Organizational expenses are those that are directly tied to the company's establishment. taxable on ...

Q: The “line of best fit” may also be described as: a.the total variable cost line b.the total fixed co...

A: Variable cost- A variable cost is a commercial expense that changes in amount to how much a corporat...

Q: On January 1, 2021, Nath-Langstrom Services, Inc., a computer software training firm, leased several...

A: Journal entry refers to recording the financial data of any organization in the chronological order,...

Q: Question 4: Taxable earnings for Social Security tax are always the same as taxable earnings for fed...

A: Social security tax pays for the retired people, disable persons, handicapped, widows, children and...

Q: Alexander Company purchased a piece of equipment for $14,000 and depreciated it for three years over...

A: Disclaimer: “Since you have asked multiple question, we will solve the first question for you. If yo...

Q: Bonita Company’s unadjusted trial balance at December 31, 2020, included the following accounts. ...

A: Allowance for the doubtful account is considered as a contra asset account. It is used to decrease t...

Q: QUESTION S fa company has non-cument assets worth 753, current kabites worth 378, longlerm labites w...

A: Lets understand the basics. As per balance sheet equation, all the asset equals to liabilities and e...

Q: Book Value P60,000 Market Value P60,000 Cash 130,000 580,000 200,000 40,000 (250,000) (10,000) (450,...

A: Non controlling interest also known minority interest means where share holder own less then 50 % of...

Q: shares capital, P100 par, 30,000 shares 3,000,000 Share premium 500,000 Retained earnings ...

A: Dividend refers to the cash distributed by a company to its shareholders.

Q: 18. On January 2, 20x5 Felix paid P4,500,000 cash for a 80% interest in Rivera at a price of P150,00...

A: Introduction Option 3. Value of Closing Investment = P 4,820,000

Q: The graph below shows monthly data collected on facilities maintenance department costs and on the n...

A: Total cost consists of fixed cost and variable cost. Fixed cost is the cost which remains same at a...

Q: uilding of 12,500 s annual maintenan I maintenance cos s (starting 18 vear

A: Alternative: AW=-1900000×0.15-8000-15000A1F,15%,18AW=-285000-8000-150000.0132AW=-285000-8000-198AW=-...

Q: 450,000

A: Inter company sale of inventory Inter company sales are the sales made by the head office to their...

Q: Peter Corp acquired the net identifiable assets of Simon Corp by issuing its own 5,000 ordinary shar...

A: Credit balance of Share premium = 5,000 shares x (P125 - P100) = P125,000 Expenses relating to the i...

Q: QUESTION 7 Match the statement on the left with the category on the right. v "Everyone is going to c...

A: An audit is when an auditor examines or inspects numerous accounting records, accompanied by a physi...

Q: On August 1, ABC Corporation acquired 80 percent of XYZ Corporation for P560,000. XYZ Corporation ha...

A: Introduction Goodwill is considered as an intangible assets that is linked with purchasing of one co...

Q: Walman Company has budgeted to produce 44,000 units of Product Y for March 20Y9. To make one unit of...

A: Given Walman Company has budgeted to produce 44,000 units Actual beginning and desired ending inven...

Q: year 0, Canon purchased a machine to use in its business for $56,000. In year 3, Canon sold the mach...

A: Solution... Cost = $56,000 Sales value = $42,000 Accumulated Depreciation expense = $32,000

Q: ABC Corporation acquired 70 percent of XYZ Corporation on August 1 for P420,000. On that date, XYZ C...

A: Purchase acquisition accounting is a method that is used for recording the purchase of a company on ...

Q: Peter acquired 80% of the outstanding ordinary shares of Simon on January 2, 20x1. During 20x1, Pete...

A: Workings: 1) Computation of unrealized profit on downstream transactions: Beginning unrealized profi...

Q: Each of the three Independent situations below describes a finance lease in which annual lease payme...

A: Answer - Statement showing claculation of Annual Lease rent payment amount Situation 1 2...

Step by step

Solved in 3 steps

- Benefit obligation, 1/1/2022, P9MFVPA, 1/1/2022, P10MCurrent service cost, P1.7MPast service cost, P500KBenefits paid to retirees, P2.2MContribution to the plan, P2MActual return on plan assets, P1.5MActuarial loss due to remeasurement of benefit obligation, P400KDiscount rate, 12%There are no asset ceilings at the beginning and end of the year.What is the benefit obligation of DEF Co. on Dec. 31, 2022?Benefit obligation, 1/1/2022, P9MFVPA, 1/1/2022, P10MCurrent service cost, P1.7MPast service cost, P500KBenefits paid to retirees, P2.2MContribution to the plan, P2MActual return on plan assets, P1.5MActuarial loss due to remeasurement of benefit obligation, P400KDiscount rate, 12%There are no asset ceilings at the beginning and end of the year.How much is the defined benefit cost for 2022?3b. The following information is available for the pension plan of Vaughn Company for the year 2020. Actual and expected return on plan assets $ 14,700 Benefits paid to retirees 40,800 Contributions (funding) 81,100 Interest/discount rate 10 % Prior service cost amortization 7,600 Projected benefit obligation, January 1, 2020 458,000 Service cost 63,900 (a) Your answer has been saved. See score details after the due date. Compute pension expense for the year 2020. Pension expense for 2020 $enter pension expense for 2017 in dollars Attempts: 1 of 1 used (b) Prepare the journal entry to record pension expense and the employer’s contribution to the pension plan in 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for…

- LO.2 Oak Corporation has the following general business credit carryovers. If the general business credit generated by activities during 2019 equals 36,000 and the total credit allowed during the current year is 60,000 (based on tax liability), what amounts of the current general business credit and carryovers are utilized against the 2019 income tax liability? What is the amount of unused credit carried forward to 2020?5b. Indigo Company provides the following information about its defined benefit pension plan for the year 2020. Service cost $91,000 Contribution to the plan 104,000 Prior service cost amortization 9,400 Actual and expected return on plan assets 62,900 Benefits paid 39,900 Plan assets at January 1, 2020 630,400 Projected benefit obligation at January 1, 2020 701,800 Accumulated OCI (PSC) at January 1, 2020 153,000 Interest/discount (settlement) rate 10 % (b) Prepare the journal entry recording pension expense. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount enter an…Ma1. Assume the below information about a firm’s defined benefit pension plan: Pension Fund Beginning Balance Cash Funding by the Firm Actual Investment Income Payments to Retirees Ending Balance 2 + 5 - 15 42 Pension Obligation Beginning Balance Service Interest Payments to Retirees Changes in Assumptions Ending Balance 9 5 0 49 Expected investment income was greater than actual investment income by $5. What was the funded status of the pension plan at the beginning of the year? Select one: a. Underfunded by $15 b. Overfunded by $10 c. Fully funded d. Underfunded by $10

- 6) The following facts apply to the pension plan of Trudy Borke Inc. for the year 20X1: Plan assets, January 1 20X1 $490,000Projected benefit obligation January 1 20X1 490,000Settlement rate 8.5%Annual pension service cost 40,000Contributions (funding) 30,000Actual return on plan assets 49,700Benefits paid to retirees 33,400 What is the pension expense for 20X1?Question 9# Oriole Company provides the following information about its defined benefit pension plan for the year 2020. Service cost $91,700 Contribution to the plan 104,300 Prior service cost amortization 10,800 Actual and expected return on plan assets 65,300 Benefits paid 39,700 Plan assets at January 1, 2020 633,400 Projected benefit obligation at January 1, 2020 711,600 Accumulated OCI (PSC) at January 1, 2020 148,000 Interest/discount (settlement) rate 10 % (b) Prepare the journal entry recording pension expense. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount…Question 20 ## Bonita Company sponsors a defined benefit pension plan. The corporation’s actuary provides the following information about the plan. January 1, 2020 December 31, 2020 Vested benefit obligation $1,520 $1,930 Accumulated benefit obligation 1,930 2,700 Projected benefit obligation 2,510 3,360 Plan assets (fair value) 1,730 2,670 Settlement rate and expected rate of return 10% Pension asset/liability 780 ? Service cost for the year 2020 400 Contributions (funding in 2020) 690 Benefits paid in 2020 200 (a3) Indicate the pension amounts reported in the balance sheet. Bonita Company’sBalance Sheet (Partial) $…

- Question 20 Bonita Company sponsors a defined benefit pension plan. The corporation’s actuary provides the following information about the plan. January 1, 2020 December 31, 2020 Vested benefit obligation $1,520 $1,930 Accumulated benefit obligation 1,930 2,700 Projected benefit obligation 2,510 3,360 Plan assets (fair value) 1,730 2,670 Settlement rate and expected rate of return 10% Pension asset/liability 780 ? Service cost for the year 2020 400 Contributions (funding in 2020) 690 Benefits paid in 2020 200 (a2) Partially correct answer icon Your answer is partially correct. Prepare the journal entries at December 31, 2020, to record pension expense and related pension transactions. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.)…Question 20 Bonita Company sponsors a defined benefit pension plan. The corporation’s actuary provides the following information about the plan. January 1, 2020 December 31, 2020 Vested benefit obligation $1,520 $1,930 Accumulated benefit obligation 1,930 2,700 Projected benefit obligation 2,510 3,360 Plan assets (fair value) 1,730 2,670 Settlement rate and expected rate of return 10% Pension asset/liability 780 ? Service cost for the year 2020 400 Contributions (funding in 2020) 690 Benefits paid in 2020 200 (a2) Prepare the journal entries at December 31, 2020, to record pension expense and related pension transactions. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31, 2020…Question 20### Bonita Company sponsors a defined benefit pension plan. The corporation’s actuary provides the following information about the plan. January 1, 2020 December 31, 2020 Vested benefit obligation $1,520 $1,930 Accumulated benefit obligation 1,930 2,700 Projected benefit obligation 2,510 3,360 Plan assets (fair value) 1,730 2,670 Settlement rate and expected rate of return 10% Pension asset/liability 780 ? Service cost for the year 2020 400 Contributions (funding in 2020) 690 Benefits paid in 2020 200 (a3) New attempt is in progress. Some of the new entries may impact the last attempt grading. Your answer is partially correct. Indicate the pension amounts reported in the balance sheet. Bonita Company’sBalance Sheet (Partial)…