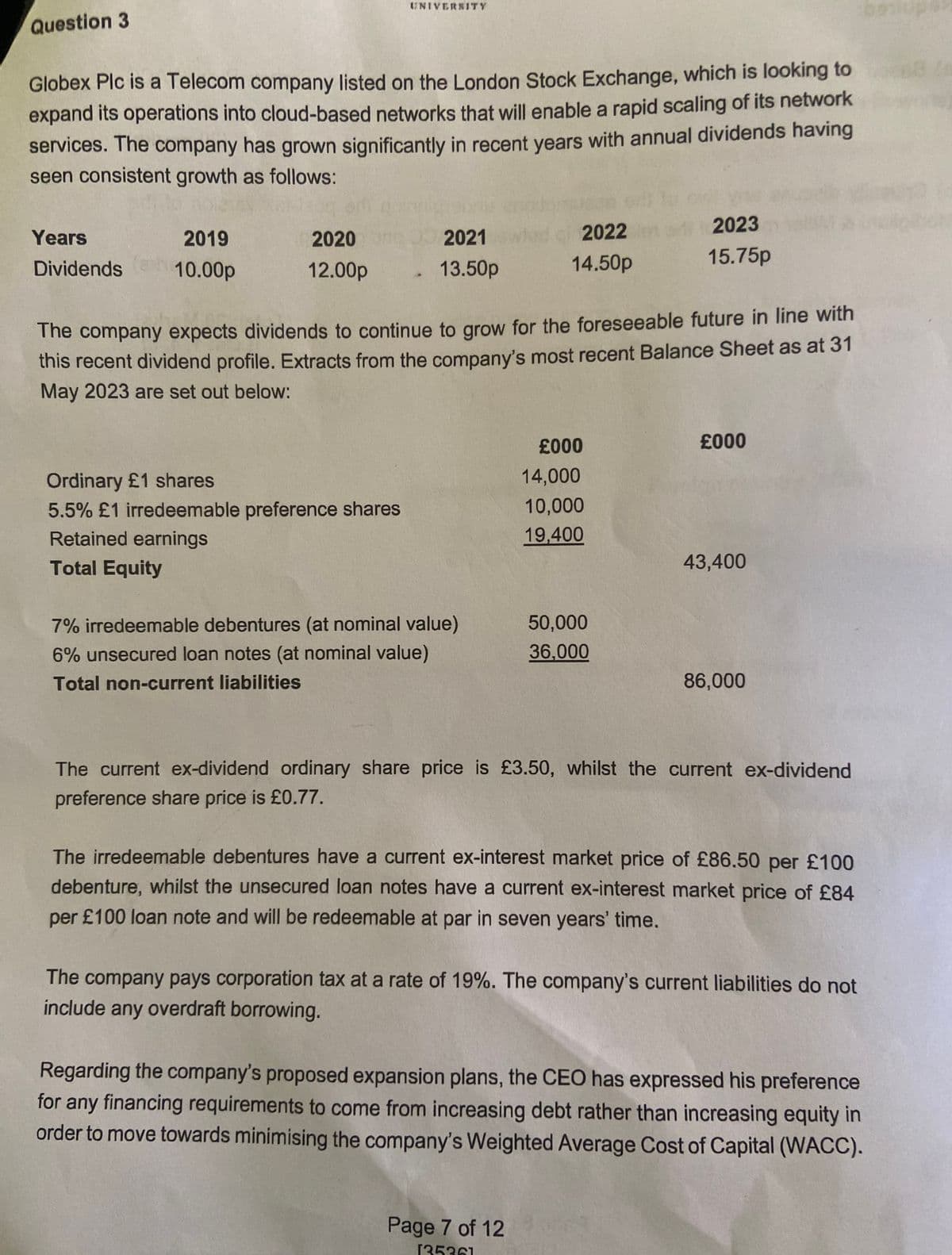

Question 3 UNIVERSITY Globex Plc is a Telecom company listed on the London Stock Exchange, which is looking to expand its operations into cloud-based networks that will enable a rapid scaling of its network services. The company has grown significantly in recent years with annual dividends having seen consistent growth as follows: Years Dividends to abla 2019 10.00p 2020 12.00p 2021 13.50p 2022 14.50p 2023 15.75p The company expects dividends to continue to grow for the foreseeable future in line with this recent dividend profile. Extracts from the company's most recent Balance Sheet as at 31 May 2023 are set out below: £000 £000 Ordinary £1 shares 14,000 5.5% £1 irredeemable preference shares 10,000 Retained earnings 19,400 Total Equity 43,400 7% irredeemable debentures (at nominal value) 50,000 6% unsecured loan notes (at nominal value) 36,000 Total non-current liabilities 86,000 The current ex-dividend ordinary share price is £3.50, whilst the current ex-dividend preference share price is £0.77. The irredeemable debentures have a current ex-interest market price of £86.50 per £100 debenture, whilst the unsecured loan notes have a current ex-interest market price of £84 per £100 loan note and will be redeemable at par in seven years' time. The company pays corporation tax at a rate of 19%. The company's current liabilities do not include any overdraft borrowing. Regarding the company's proposed expansion plans, the CEO has expressed his preference for any financing requirements to come from increasing debt rather than increasing equity in order to move towards minimising the company's Weighted Average Cost of Capital (WACC). Page 7 of 12 135361

Question 3 UNIVERSITY Globex Plc is a Telecom company listed on the London Stock Exchange, which is looking to expand its operations into cloud-based networks that will enable a rapid scaling of its network services. The company has grown significantly in recent years with annual dividends having seen consistent growth as follows: Years Dividends to abla 2019 10.00p 2020 12.00p 2021 13.50p 2022 14.50p 2023 15.75p The company expects dividends to continue to grow for the foreseeable future in line with this recent dividend profile. Extracts from the company's most recent Balance Sheet as at 31 May 2023 are set out below: £000 £000 Ordinary £1 shares 14,000 5.5% £1 irredeemable preference shares 10,000 Retained earnings 19,400 Total Equity 43,400 7% irredeemable debentures (at nominal value) 50,000 6% unsecured loan notes (at nominal value) 36,000 Total non-current liabilities 86,000 The current ex-dividend ordinary share price is £3.50, whilst the current ex-dividend preference share price is £0.77. The irredeemable debentures have a current ex-interest market price of £86.50 per £100 debenture, whilst the unsecured loan notes have a current ex-interest market price of £84 per £100 loan note and will be redeemable at par in seven years' time. The company pays corporation tax at a rate of 19%. The company's current liabilities do not include any overdraft borrowing. Regarding the company's proposed expansion plans, the CEO has expressed his preference for any financing requirements to come from increasing debt rather than increasing equity in order to move towards minimising the company's Weighted Average Cost of Capital (WACC). Page 7 of 12 135361

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

a. Based on the information in the picture, calculate, using market values, Globex PLC weighted average cost of capital. Please show workings

b. Criticallly discuss any two assumptions underpinning the post tax version of Modigliani & Miller model of the relationship between WACC and gearing

Transcribed Image Text:Question 3

UNIVERSITY

Globex Plc is a Telecom company listed on the London Stock Exchange, which is looking to

expand its operations into cloud-based networks that will enable a rapid scaling of its network

services. The company has grown significantly in recent years with annual dividends having

seen consistent growth as follows:

Years

Dividends

to abla

2019

10.00p

2020

12.00p

2021

13.50p

2022

14.50p

2023

15.75p

The company expects dividends to continue to grow for the foreseeable future in line with

this recent dividend profile. Extracts from the company's most recent Balance Sheet as at 31

May 2023 are set out below:

£000

£000

Ordinary £1 shares

14,000

5.5% £1 irredeemable preference shares

10,000

Retained earnings

19,400

Total Equity

43,400

7% irredeemable debentures (at nominal value)

50,000

6% unsecured loan notes (at nominal value)

36,000

Total non-current liabilities

86,000

The current ex-dividend ordinary share price is £3.50, whilst the current ex-dividend

preference share price is £0.77.

The irredeemable debentures have a current ex-interest market price of £86.50 per £100

debenture, whilst the unsecured loan notes have a current ex-interest market price of £84

per £100 loan note and will be redeemable at par in seven years' time.

The company pays corporation tax at a rate of 19%. The company's current liabilities do not

include any overdraft borrowing.

Regarding the company's proposed expansion plans, the CEO has expressed his preference

for any financing requirements to come from increasing debt rather than increasing equity in

order to move towards minimising the company's Weighted Average Cost of Capital (WACC).

Page 7 of 12

135361

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education