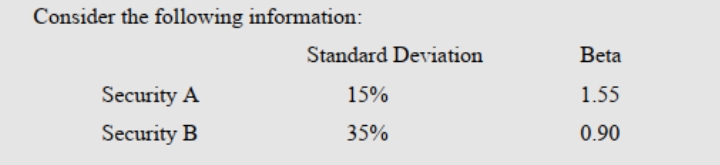

Question 3. a) Which security has more total risk? b) Which security has more systematic risk? c) Which security should have the higher expected return? Why?

Question 3. a) Which security has more total risk? b) Which security has more systematic risk? c) Which security should have the higher expected return? Why?

Chapter12: Capital Structure

Section: Chapter Questions

Problem 6PROB

Related questions

Question

Mf3.

Question 3.

a) Which security has more total risk?

b) Which security has more systematic risk?

c) Which security should have the higher expected return? Why?

QUESTION 4.

The company XYZ has 2.5 million share of common stock outstanding and 60,000

The common stock has a beta of 1.34 and sells for $42 a share. The US. Treasury bill is yielding 2.8 percent and the return on the market is 11.2 percent

The corporate tax rate is 21 percent. What is the Company's weighted average cost of capital?

Transcribed Image Text:Consider the following information:

Security A

Security B

Standard Deviation

15%

35%

Beta

1.55

0.90

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you