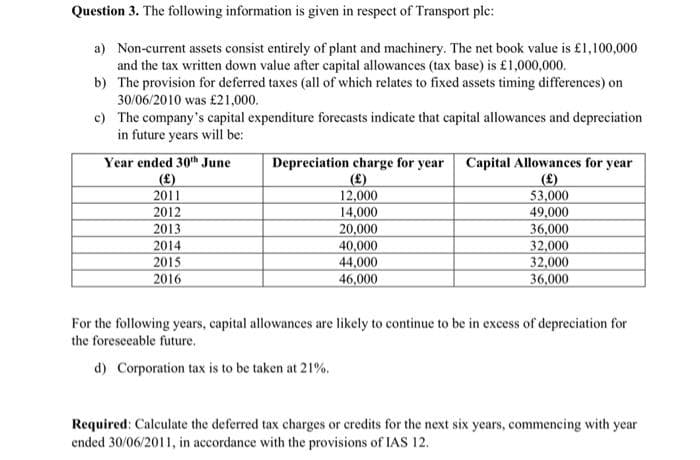

Question 3. The following information is given in respect of Transport plc: a) Non-current assets consist entirely of plant and machinery. The net book value is £1,100,000 and the tax written down value after capital allowances (tax base) is £1,000,000. b) The provision for deferred taxes (all of which relates to fixed assets timing differences) on 30/06/2010 was £21,000. c) The company's capital expenditure forecasts indicate that capital allowances and depreciation in future years will be: Year ended 30th June (£) 2011 2012 2013 2014 Depreciation charge for year (£) 12,000 14,000 20,000 40,000 44,000 46,000 Capital Allowances for year (£) 53,000 49,000 36,000 32,000 32,000 36,000 2015 2016

Question 3. The following information is given in respect of Transport plc: a) Non-current assets consist entirely of plant and machinery. The net book value is £1,100,000 and the tax written down value after capital allowances (tax base) is £1,000,000. b) The provision for deferred taxes (all of which relates to fixed assets timing differences) on 30/06/2010 was £21,000. c) The company's capital expenditure forecasts indicate that capital allowances and depreciation in future years will be: Year ended 30th June (£) 2011 2012 2013 2014 Depreciation charge for year (£) 12,000 14,000 20,000 40,000 44,000 46,000 Capital Allowances for year (£) 53,000 49,000 36,000 32,000 32,000 36,000 2015 2016

Chapter14: Taxes On The Financial Statements

Section: Chapter Questions

Problem 11DQ

Related questions

Question

Transcribed Image Text:Question 3. The following information is given in respect of Transport ple:

a) Non-current assets consist entirely of plant and machinery. The net book value is £1,100,000

and the tax written down value after capital allowances (tax base) is £1,000,000.

b) The provision for deferred taxes (all of which relates to fixed assets timing differences) on

30/06/2010 was £21,000.

c) The company's capital expenditure forecasts indicate that capital allowances and depreciation

in future years will be:

Year ended 30th June

(£)

2011

Depreciation charge for year

(£)

12,000

14,000

20,000

40,000

44,000

46,000

Capital Allowances for year

(£)

53,000

49,000

36,000

32,000

32,000

36,000

2012

2013

2014

2015

2016

For the following years, capital allowances are likely to continue to be in excess of depreciation for

the foresecable future.

d) Corporation tax is to be taken at 21%.

Required: Calculate the deferred tax charges or credits for the next six years, commencing with year

ended 30/06/2011, in accordance with the provisions of IAS 12.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning