Question 4 Respond to each 'of the following independent situations involving auditor reports. For each scenario (1) identify the reporting issue involved; (2) explain the type of opinion that should be- issued; (3) identify any requiredmodifications of the standard auditor'sreport. The auditor has a disagreem ent with a client over the adequacy of the recorded bad debt expense and allowance for doubtful accounts. The auditor is convinced that the expense and allowance are understated by a material (but not highly material) amount, but the client has refusedto adjust the accounts. 1.e The auditor has issued a report on a client's financial statements prepared on a regulatory basis of accounting. The auditoris also preparing to issue a separate report on the same client's GAAP financial statements, which will be issued to the public. The auditor feels that the issuance of the report on the regulatory basis statem ents should be disclosed in the report on the GAAP statem ents. The auditor has not identified any other reasons to'depart from the standard unqualifiedreport. 2.4 The auditor was hired after the balance sheet date and consequently was not present to observe/count the client's year-endinventory. The client's internal controls over purchasing and inventory are strong, and the auditoris able to satisfy herselfregarding the ending inventory balance using alternative auditing procedures. 3.e

Question 4 Respond to each 'of the following independent situations involving auditor reports. For each scenario (1) identify the reporting issue involved; (2) explain the type of opinion that should be- issued; (3) identify any requiredmodifications of the standard auditor'sreport. The auditor has a disagreem ent with a client over the adequacy of the recorded bad debt expense and allowance for doubtful accounts. The auditor is convinced that the expense and allowance are understated by a material (but not highly material) amount, but the client has refusedto adjust the accounts. 1.e The auditor has issued a report on a client's financial statements prepared on a regulatory basis of accounting. The auditoris also preparing to issue a separate report on the same client's GAAP financial statements, which will be issued to the public. The auditor feels that the issuance of the report on the regulatory basis statem ents should be disclosed in the report on the GAAP statem ents. The auditor has not identified any other reasons to'depart from the standard unqualifiedreport. 2.4 The auditor was hired after the balance sheet date and consequently was not present to observe/count the client's year-endinventory. The client's internal controls over purchasing and inventory are strong, and the auditoris able to satisfy herselfregarding the ending inventory balance using alternative auditing procedures. 3.e

Auditing: A Risk Based-Approach to Conducting a Quality Audit

10th Edition

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter13: Auditing Debt Obligations And Stockholders’ Equity Transactions

Section: Chapter Questions

Problem 62FF

Related questions

Question

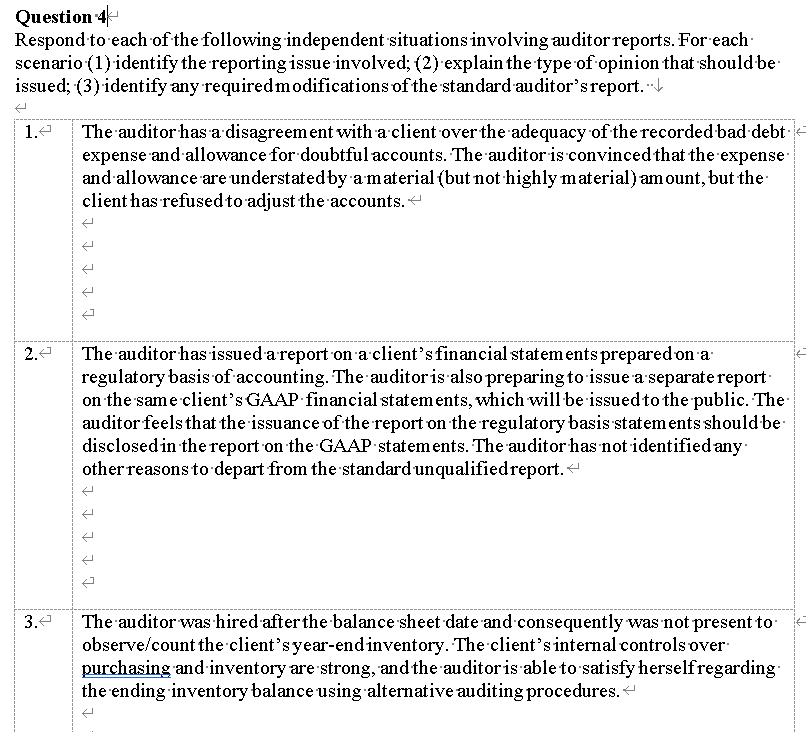

Transcribed Image Text:Question 4

Respond to each of the following independent situations involving auditor reports. For each

scenario (1)identify the reporting issue involved; (2) explain the type of opinion that should be

issued; (3) identify any requiredmodifications of the standard auditor'sreport.

The auditor has a disagreem ent with a client overthe adequacy of the recorded bad debt

expense and allowance for doubtful accounts. The auditor is convinced that the expense

and allowance are understatedby amaterial (but not highly material) amount, but the

client has refused to adjust the accounts.

1.4

The auditor has issued a report on a client's financial statem ents prepared on a

regulatory basis of accounting. The auditor is also preparing to issue a separate report-

on the same client's GAAP financial statements, which will be issued to the public. The

auditor feels that the issuance of the report on the regulatory basis statements should be

disclosed in the report on the GAAP statements. The auditor has not identified any

other reasons to depart from the standardunqualifiedreport.

2.

The auditor was hired after the balance sheet date and consequently was not present to

observe/count the client's year-endinventory. The client's internal controls over

purchasing and inventory are strong, and the auditoris able to satisfy herselfregarding

the ending inventory balance using alternative auditing procedures.

3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning