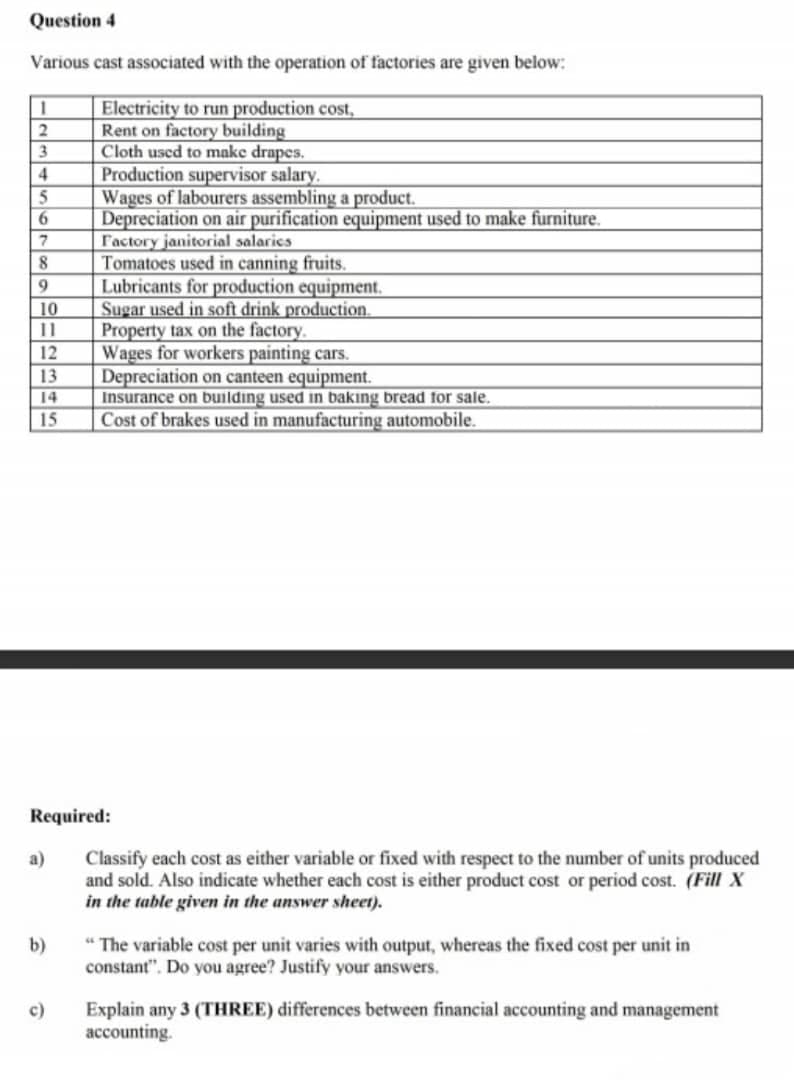

Question 4 Various cast associated with the operation of factories are given below: Electricity to run production cost, Rent on factory building Cloth used to make drapes. Production supervisor salary. Wages of labourers assembling a product. Depreciation on air purification equipment used to make furniture. F'actory janitorial salarics Tomatoes used in canning fruits. Lubricants for production equipment. Sugar used in soft drink production. Property tax on the factory. Wages for workers painting cars. Depreciation on canteen equipment. Insurance on building used in bakıng bread for sale. Cost of brakes used in manufacturing automobile. 6. 8 10 11 12 13 14 15 Required: Classify each cost as either variable or fixed with respect to the number of units produced and sold. Also indicate whether each cost is either product cost or period cost. (Fill X in the table given in the answer sheet). a) " The variable cost per unit varies with output, whereas the fixed cost per unit in constant". Do you agree? Justify your answers. b) Explain any 3 (THREE) differences between financial accounting and management accounting. c)

Question 4 Various cast associated with the operation of factories are given below: Electricity to run production cost, Rent on factory building Cloth used to make drapes. Production supervisor salary. Wages of labourers assembling a product. Depreciation on air purification equipment used to make furniture. F'actory janitorial salarics Tomatoes used in canning fruits. Lubricants for production equipment. Sugar used in soft drink production. Property tax on the factory. Wages for workers painting cars. Depreciation on canteen equipment. Insurance on building used in bakıng bread for sale. Cost of brakes used in manufacturing automobile. 6. 8 10 11 12 13 14 15 Required: Classify each cost as either variable or fixed with respect to the number of units produced and sold. Also indicate whether each cost is either product cost or period cost. (Fill X in the table given in the answer sheet). a) " The variable cost per unit varies with output, whereas the fixed cost per unit in constant". Do you agree? Justify your answers. b) Explain any 3 (THREE) differences between financial accounting and management accounting. c)

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:Question 4

Various cast associated with the operation of factories are given below:

Electricity to run production cost,

Rent on factory building

Cloth used to make drapes.

Production supervisor salary.

Wages of labourers assembling a product.

Depreciation on air purification equipment used to make furniture.

Factory janitorial salaries

Tomatoes used in canning fruits.

Lubricants for production equipment.

Sugar used in soft drink production.

Property tax on the factory.

Wages for workers painting cars.

Depreciation on canteen equipment.

Insurance on building used in bakıng bread for sale.

Cost of brakes used in manufacturing automobile.

3

6.

9

10

11

12

13

14

15

Required:

Classify each cost as either variable or fixed with respect to the number of units produced

and sold. Also indicate whether each cost is either product cost or period cost. (Fill X

in the table given in the answer sheet).

a)

" The variable cost per unit varies with output, whereas the fixed cost per unit in

constant". Do you agree? Justify your answers.

b)

Explain any 3 (THREE) differences between financial accounting and management

accounting.

c)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education