Question 4.11 (i) David can receive one of the following two payment streams: 100 at time 0, 200 at time n years, and 300 at time 2n years 600 at time n years The present values of the two payment streams are equal. You are given that the annual force of interest is 12.21%. Calculate n. A 8.0 B 8.5 C 9.0 After 5 years, the value in each account is the same. Calculate 8. A 2.56% B 2.59% Question 4.14 Suzie deposits $200 into an account that earns an annual simple interest rate of 5%. At the same time, John deposits $220 into an account that earns a constant force of interest of 8. D 9.5 C 2.65% E 10.0 D 2.73% E 2.97%

Question 4.11 (i) David can receive one of the following two payment streams: 100 at time 0, 200 at time n years, and 300 at time 2n years 600 at time n years The present values of the two payment streams are equal. You are given that the annual force of interest is 12.21%. Calculate n. A 8.0 B 8.5 C 9.0 After 5 years, the value in each account is the same. Calculate 8. A 2.56% B 2.59% Question 4.14 Suzie deposits $200 into an account that earns an annual simple interest rate of 5%. At the same time, John deposits $220 into an account that earns a constant force of interest of 8. D 9.5 C 2.65% E 10.0 D 2.73% E 2.97%

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 12PROB

Related questions

Question

Transcribed Image Text:Question 4.11

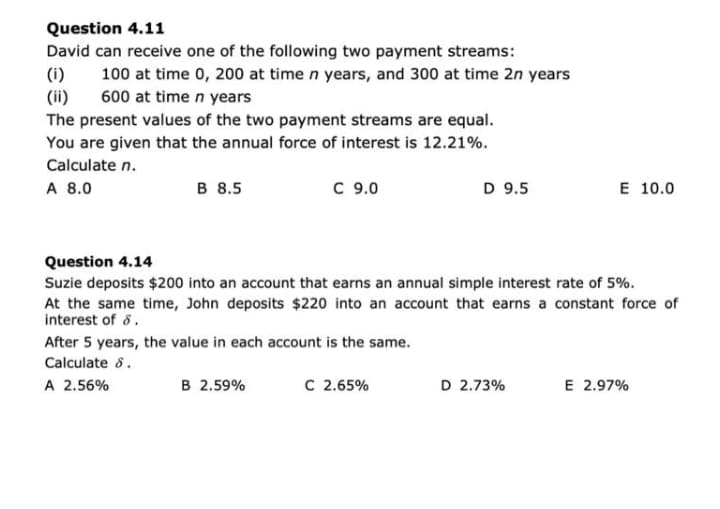

David can receive one of the following two payment streams:

(i) 100 at time 0, 200 at time n years, and 300 at time 2n years

600 at time n years

The present values of the two payment streams are equal.

You are given that the annual force of interest is 12.21%.

Calculate n.

A 8.0

B 8.5

C 9.0

After 5 years, the value in each account is the same.

Calculate 8.

A 2.56%

B 2.59%

Question 4.14

Suzie deposits $200 into an account that earns an annual simple interest rate of 5%.

At the same time, John deposits $220 into an account that earns a constant force of

interest of 8.

D 9.5

C 2.65%

E 10.0

D 2.73%

E 2.97%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning