QUESTION 43 A company with a Degree of Financial Leverage of 2.0 means: O A. For every 1% increase in Operating Income, Earnings Per Share would increase 0% O B. For every 19% increase in Operating Income, Earnings Per Share would increase 3% O C. For every 19% increase in Operating Income, Earnings Per Share would increase 2% The Giants will win the Super Bowl QUESTION 44 For a company with a Degree of Operating Leverage of 3.5: OA. A. For every 1% increase in production and sales, Earnings Per Share would increase 3.5% OB. B. For every 1% increase in production and sales, Operating Income would increase 3.5% Oc.C. For every 1% increase in production and sales, Net Income would increase 3.5% OD.D. The Yankees will win the World Series QUESTION 45 To reduce the overall risk of a company, the CEO should seek out acquisitions that are: OA. A. Highly correlated to their existing business B. B. Negatively correlated to their existing business Oc.C. Buy US Treasury Bonds OD. D. None of the above

QUESTION 43 A company with a Degree of Financial Leverage of 2.0 means: O A. For every 1% increase in Operating Income, Earnings Per Share would increase 0% O B. For every 19% increase in Operating Income, Earnings Per Share would increase 3% O C. For every 19% increase in Operating Income, Earnings Per Share would increase 2% The Giants will win the Super Bowl QUESTION 44 For a company with a Degree of Operating Leverage of 3.5: OA. A. For every 1% increase in production and sales, Earnings Per Share would increase 3.5% OB. B. For every 1% increase in production and sales, Operating Income would increase 3.5% Oc.C. For every 1% increase in production and sales, Net Income would increase 3.5% OD.D. The Yankees will win the World Series QUESTION 45 To reduce the overall risk of a company, the CEO should seek out acquisitions that are: OA. A. Highly correlated to their existing business B. B. Negatively correlated to their existing business Oc.C. Buy US Treasury Bonds OD. D. None of the above

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter22: Performance Evaluation Using Variances From Standard Costs

Section: Chapter Questions

Problem 22.2CP

Related questions

Question

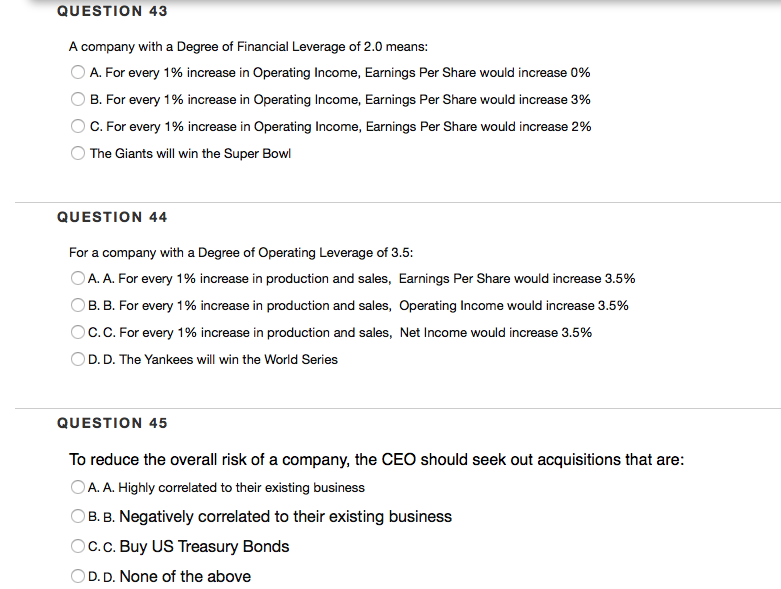

Transcribed Image Text:QUESTION 43

A company with a Degree of Financial Leverage of 2.0 means:

A. For every 1% increase in Operating Income, Earnings Per Share would increase 0%

B. For every 1% increase in Operating Income, Earnings Per Share would increase 3%

C. For every 1% increase in Operating Income, Earnings Per Share would increase 2%

O The Giants will win the Super Bowl

QUESTION 44

For a company with a Degree of Operating Leverage of 3.5:

OA. A. For every 1% increase in production and sales, Earnings Per Share would increase 3.5%

B. B. For every 1% increase in production and sales, Operating Income would increase 3.5%

Oc.C. For every 1% increase in production and sales, Net Income would increase 3.5%

D. D. The Yankees will win the World Series

QUESTION 45

To reduce the overall risk of a company, the CEO should seek out acquisitions that are:

OA. A. Highly correlated to their existing business

B. B. Negatively correlated to their existing business

Oc.c. Buy US Treasury Bonds

OD. D. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning