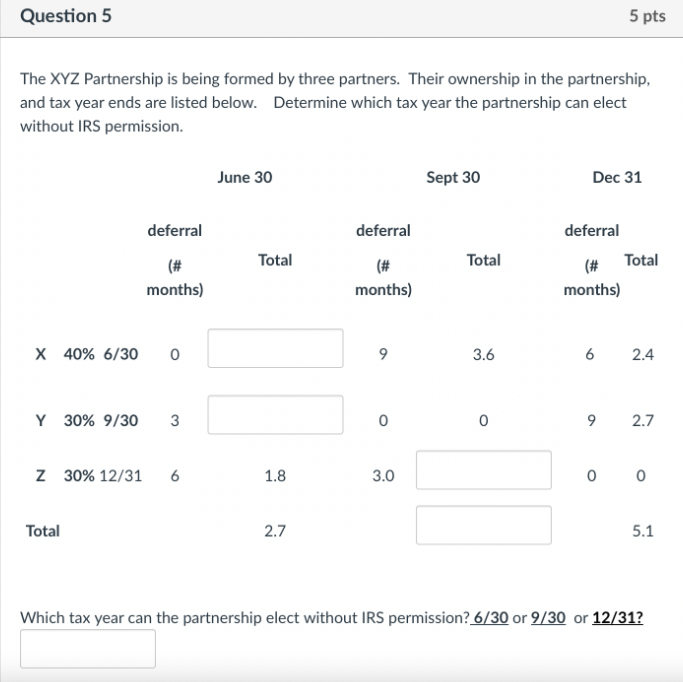

Question 5 5 pts The XYZ Partnership is being formed by three partners. Their ownership in the partnership, and tax year ends are listed below. Determine which tax year the partnership can elect without IRS permission. June 30 Sept 30 Dec 31 deferral deferral deferral (# Total months) (# months) Total (# months) Total X 40% 6/30 0 Y 30% 9/30 3 6 3.6 6 2.4 0 0 9 2.7 Z 30% 12/31 6 1.8 3.0 Total 2.7 0 0 5.1 Which tax year can the partnership elect without IRS permission? 6/30 or 9/30 or 12/31?

Question 5 5 pts The XYZ Partnership is being formed by three partners. Their ownership in the partnership, and tax year ends are listed below. Determine which tax year the partnership can elect without IRS permission. June 30 Sept 30 Dec 31 deferral deferral deferral (# Total months) (# months) Total (# months) Total X 40% 6/30 0 Y 30% 9/30 3 6 3.6 6 2.4 0 0 9 2.7 Z 30% 12/31 6 1.8 3.0 Total 2.7 0 0 5.1 Which tax year can the partnership elect without IRS permission? 6/30 or 9/30 or 12/31?

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 12.4EX

Related questions

Question

Transcribed Image Text:Question 5

5 pts

The XYZ Partnership is being formed by three partners. Their ownership in the partnership,

and tax year ends are listed below. Determine which tax year the partnership can elect

without IRS permission.

June 30

Sept 30

Dec 31

deferral

deferral

deferral

(#

Total

months)

(#

months)

Total

(#

months)

Total

X 40% 6/30

0

Y 30% 9/30

3

6

3.6

6

2.4

0

0

9 2.7

Z 30% 12/31 6

1.8

3.0

Total

2.7

0 0

5.1

Which tax year can the partnership elect without IRS permission? 6/30 or 9/30 or 12/31?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning