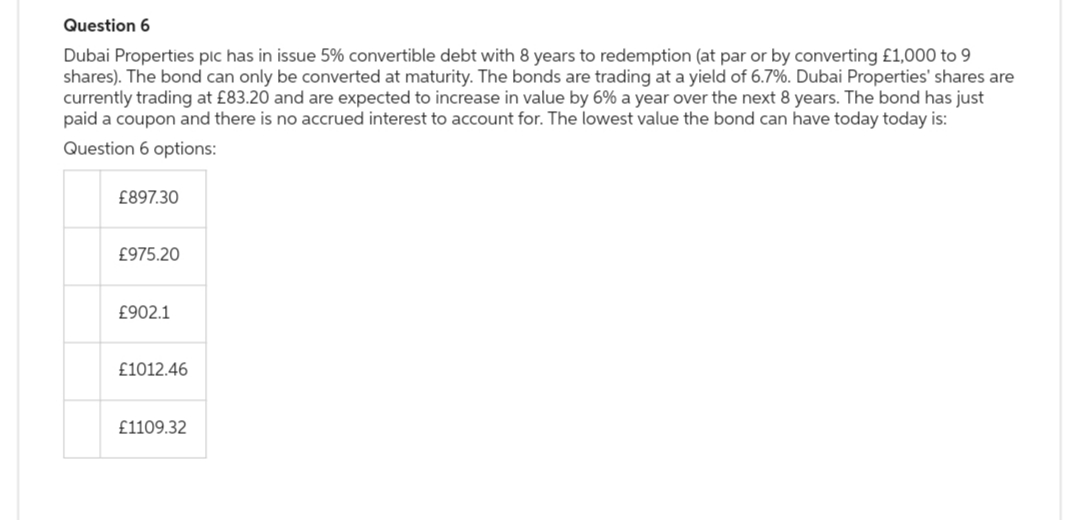

Question 6 Dubai Properties pic has in issue 5% convertible debt with 8 years to redemption (at par or by converting £1,000 to 9 shares). The bond can only be converted at maturity. The bonds are trading at a yield of 6.7%. Dubai Properties' shares are currently trading at £83.20 and are expected to increase in value by 6% a year over the next 8 years. The bond has just paid a coupon and there is no accrued interest to account for. The lowest value the bond can have today today is: Question 6 options: £897.30 £975.20 £902.1 £1012.46 £1109.32

Question 6 Dubai Properties pic has in issue 5% convertible debt with 8 years to redemption (at par or by converting £1,000 to 9 shares). The bond can only be converted at maturity. The bonds are trading at a yield of 6.7%. Dubai Properties' shares are currently trading at £83.20 and are expected to increase in value by 6% a year over the next 8 years. The bond has just paid a coupon and there is no accrued interest to account for. The lowest value the bond can have today today is: Question 6 options: £897.30 £975.20 £902.1 £1012.46 £1109.32

Chapter6: Bonds (debt) - Characteristics And Valuation

Section: Chapter Questions

Problem 15PROB

Related questions

Question

Give typing answer with explanation and conclusion

Transcribed Image Text:Question 6

Dubai Properties pic has in issue 5% convertible debt with 8 years to redemption (at par or by converting £1,000 to 9

shares). The bond can only be converted at maturity. The bonds are trading at a yield of 6.7%. Dubai Properties' shares are

currently trading at £83.20 and are expected to increase in value by 6% a year over the next 8 years. The bond has just

paid a coupon and there is no accrued interest to account for. The lowest value the bond can have today today is:

Question 6 options:

£897.30

£975.20

£902.1

£1012.46

£1109.32

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you