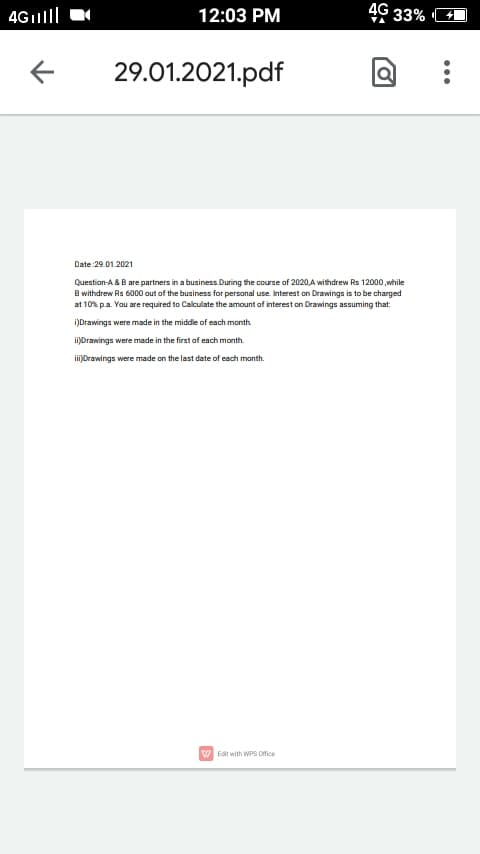

Question-A &B are partners in a business During the course of 2020,A withdrew Rs 12000 ,while B withdrew Rs 6000 aut of the business for personal use. Interest on Drawings is to be charged at 10% pa. You are required to Calculate the amount of interest on Drawings assuming that: )Drawings were made in the middle of each month Drawings were made in the first of each month Drawings were made on the last date of each month.

Q: On July 1, 2022, Sheridan Company pays $18,500 to Wildhorse Co. for a 2-year insurance contract.…

A: Journal Entry: Date General Journal Debit Credit Jul. 1 Cash $18,500…

Q: Bharam is a partner in a firm. He withdraws Rs. 3,000 at the starting of each month for 12 months.…

A: Drawings is the amount withdrawn in cash or in kind, for personal purposes. A drawing account is…

Q: Novak Corporation obtained a franchise from Windsor Inc. for a cash payment of $105,600 on April 1,…

A:

Q: Mr. Wa Is started a service business on October 1,2020 with an initial investment of P400,000.…

A: Cash basis accounting is the concept of accounting that states the revenue is recognized at the…

Q: total amount of revenue t

A: Revenue recognition refers to the concept that enables the business for computing the amount of…

Q: On January 1, 2022, Kristine Compar transaction cost of P100,000. The mature on January 1, 2027 and…

A: Bonds are priced by discounting future cash flows. Future cash flows include coupons and par value…

Q: Mr. A, a real estate dealer, sold real estate for P2,000,000 on November 30, 2019. The cost of the…

A: Sales are the proceeds received from the delivery of goods and services. Cost means actual expenses…

Q: A widower was granted a loan of P20,000 by her employer with an interest of 6% for 3 months. The…

A: A promissory note is a sort of debt instrument that consists of a written commitment from one party…

Q: Bygone Company manufactures and sells computers. On January 1, 2021, the entity sold a computer…

A: Answer - Working Note : Calculation of Unearned interest Income : Particulars Amount Face…

Q: Nakasiguro Company insured its president for P 5,000,000 with an annual premium, paid initially at…

A: The insurance taken here is the key insurance by Nakasiguro company for its president P, to avoid…

Q: How much should be the capital balance of Mr. Wa Is on December 31, 2020, under the cash basis of…

A: Given Information: Initial Investment = P400,000 Service to customers during 2020 = P 800,000 Amount…

Q: A, a real estate dealer sold a house and lot for 600,000 on November 20, 2021. The cost of the…

A: Income calculation for 2021 Installment = 125,000/600,000 = 20.83% Total gain on sale of house =…

Q: One July 1, 2020 Bob signed an agreement to operate as a franchisee of abc co for an initial…

A: Down payment in this case, is the initial or upfront amount that need to be made while entering into…

Q: AS 23 On January 1, 2019, Haven Company loaned P24,000,000 from a bank in order to finance…

A: Hello. Since your question has multiple parts, we will solve first question for you. If you want…

Q: July 1,2020, Joshua leased an quipment to Gerald under 3 year operating ase. Gerald will pay 100,000…

A: Lease Rent / Royalty : It is the amount of rent on the assets which is given for use to the person…

Q: Under the assumptlon: Unused vacation leaves vest (accumulating and ves What Is the balance of…

A: Employees are having paid leave provided by the company but if they do not take they are paid for…

Q: (c) The annual insurance premium for Claire's business premiséš (COvering th 2018 to 31 August 2019)…

A: Given that: Annual insurance premium for the period Sep 1,2018 to March 31,2019 = $7200

Q: 21. A company has sublet part of its offices and in the year ended 30 November 2020 the rent…

A: Accrual system of accounting says that every thing which is accrued has to be provided in books of…

Q: On January 1, 20x1, HYBE acquired a machine by using a 3%, P4,000,000 note due on January 1, 20x4.…

A: The capital is the backbone of the company, and the company will be willing to raise the capital for…

Q: On October 1, 2021, Grey Corp. purchased land by signing a six-month, 4% note for $225,000. The…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: Each of Picha Pie Co. 21 new franchisee contracted to pay an initial franchisee of 30,000. By…

A: Deferred or unearned revenue occurs when an organization receives cash for its services but does not…

Q: On December 31, 2019, Speedo’s Limited bought a yacht for $55,000, but made a down payment of…

A: Given, Cost of yacht= $55,000 Down payment =$10,000 Balance amount =$55000 -$10000 Balance amount…

Q: The following tutorial questions serve as practice questions on TVM and Bond Valuation. (Show…

A: Under this method, interest will be calculated on the balances at the end of period as specified. As…

Q: (b) According to the new renumeration scheme, the starting pay of a technician is RM2029 per month…

A: Meaning of Remuneration:- It's the compensation that an employee gets. It is the base salary and the…

Q: On 1 July 2020, Sharp Ltd purchased a debenture in Soft Ltd with a 5 year term for $20.000. The…

A: Calculation of effective rate of interest:- Interest annually=25000*3%=$750 Present value of cash…

Q: The company bought kitchen equipment (a commercial oven) for $29,000 on November 1, 2021 and signed…

A: Cashflow Statement - It is type of financial documents provides the details of cash inflows and cash…

Q: BB, wW and FF agree to sell construction tools for a period of one month. BB agrees to construct a…

A: Gross Profit: It is the difference between direct income and direct expenses. In the given scenario,…

Q: Under the assumptlon: Unused vacation leaves vest (accumulating and vesting), What Is the balance of…

A: Here ABC Corp Allows 15 Days Vacation leaves to each employee hence total leaves allowed by the…

Q: Accrued salaries owed by Zane amounted to 4 days at $400 per day as of December 31, 2022. Dr. Cr.…

A: According to the given question, we are required to prepare the journal entries in our books of…

Q: of cost. All other sales are to be made at 100% mark-up on cost. The activity of the joint…

A: Profit Sharing Ratio: It is the ratio in which the profits or losses of a business unit are shared:

Q: 2.Hawks Company started selling subscriptions to a semi-annual magazine that is delivered to…

A: Subscription is the amount you pay yearly, It is basically an agreement you make in advance that if…

Q: On August 1, Costco Lubbock collects sells 150,000 one-year family memberships to customers for $45.…

A: Given, Number of memberships = 150,000 Selling price of one year membership = $45

Q: How much should be the capital balance of Mr. Wa Is on December 31,2020 under the cash basis of…

A: Working capital: Managing day to day operations of an organisation is called working capital…

Q: Aron and Nora Company grant all employees 2 weeks paid vacation for each full year of employment.…

A: The question is based on the concept of Business Accounting.

Q: Prepare journal entries to record the following transactions which are independent of each other. 1.…

A: Adjusting journal entry: At year-end when the company finalizes its accounts then any unrecognized…

Q: January 2, 2018 Mr. B contracted a 1-year loan fro Metrobank for the purchase ad a depreciable life…

A: When you take loans from the banks than interest are to be paid and expenses to be recognized but…

Q: On January 2, 2020, Cluckin' Bells Company entered into a franchise agreement with Mr. Princeton to…

A: Initial Franchise Fees Cash 700,000 Other 1800,000 Interest on Balance Amount of…

Q: On September 1, 2021, Feeling Company began a service proprietorship with an initial investment of…

A: Cash basis of accounting is a method where the income and expenses are recognized as and when they…

Q: On January 1, 2018, the Montgomery Company agreed to purchase a building by making six payments. The…

A: 1)

Q: On January 2, 2019, Ivan got the franchise of PPP Inc. The franchise agreement provides a P500,000…

A: For Calculating the Earned Franchise Fees which are included with the details of the down payment…

Q: Principal P obtained a loan from Agent A in the amount of P50,000. P promised to pay A after 6…

A: P and A were in a contract for agency where A was the agent of Principal P. A contract of agency…

Q: On August 31, 2022, Nova Corporation signed a four-year contract to provide services for Minefield…

A: Under the accounting, the accrual basis is the one where the revenues are recognized or recorded…

Q: (Franchise Fee, Initial Down Payment) On January 1, 2017, Lesley Benjamin signed an agreement,…

A:

Q: Entity A provides bookkeeping services to Entity B for a monthly retainer fee (fixed monthly fee) of…

A: Advance receipt of fees is unearned revenue at the time of receipt it needs to be adjusted at the…

Q: A. Jamal Textile Enterprise is a textile manufacturer operating in Selangor. The company was…

A: Capital allowances are similar to expenses that can be claimed from the profit of a company, for the…

Q: Dr. Erica Chan, MD owns EC Health Clinic. She prepares annual financial statements and has a…

A: Increase in assets should be debited and decrease in assets should be credited. Increase in…

Q: Calculate the qualifying building expenditure. Select one:

A: As Given In the question Description Amount(RM) Land 580,000.00 Legal fees for an…

Q: Marlin bought goods from Nadal for RM16,000. Nadal draws a bill on 1.1.202: for 3 months which was…

A: Journal entries are accounting entries in which the transactions of an entity are accounted for in…

Step by step

Solved in 2 steps

- 25- Our company, which prepares its financial statements on a monthly basis, has leased its workplace on 01.08.2020 from 3.000 TL per month for 1 year. One-year rental fee and 18% VAT have been deposited into the bank account of the enterprise. Assuming that the financial statements are prepared on a monthly basis , in which account, how and in what amount is the rental income for the period January 2021-July 2021 recognized? a) 380 Revenues for the Next Months Hs .36.000 TL Creditor B) 380 Revenues for Future Months Hs. 12.000 TL Creditor NS) 380 Revenues for Future Months Hs. 12.000 TL Debt D) 480 Income for Future Years Hs. 21.000 TL Creditor TO) 480 Income for Future Years Hs. 21.000 TL Debtor18.ABC Co received from a customer a 4-year 12% note of P200,000 on July1, 20X1. Principal and interest are due on June 30, 20X5.The accrued interest at Dec 31, 20X2 would be: 12,000 24,000 36,000 48,0008- Our business paid 48.000 TL from the bank for the store it rented for two years on 01.07.2020 . (The entity prepares its financial statements on a monthly basis.) Accordingly, in which account, how and in what amount is the rental expense for July 2020 recognized? a) 180 Expenses for Future Months Hs. 10,000 TL Borrowed B) 280 Expenses for Future Years Hs. 36,000 TL Debtor NS) 760 Marketing Sales and Distribution Expenses 2.000 TL Debtor D) 102 Banks Hs. 48,000 TL Creditor TO) 760 Marketing Sales and Distribution Expenses 2.000 TL Creditor

- 6- Our company, which prepares its financial statements on a monthly basis, has leased its workplace on 01.08.2020 from 3.000 TL per month for 1 year. One-year rental fee and 18% VAT have been deposited into the bank account of the enterprise. How many TL is the total amount deposited into our business's bank account? a) 36.000 TL B) 42,480 TL NS) 18,000 TL D) 3,000 TL TO) 21.000 TLIntermediate Accounting 2 2021 edition by Millan PROBLEM 4: MULTIPLE CHOICE - COMPUTATIONAL On March 1, 20X4, Fine Co. borrowed P10,000 and signed a two-year note bearing interest at 12% per annum compounded annually. Interest is payable in full at maturity on February 28, 20X6. What amount should Fine report as a liability for accrued interest at December 31, 20X5? 0 b. 1,000 c. 1,320 d. 2,320 (AICPA) On January 1, 20x1, Sunset Co. issues a P5,000,000 noninterest bearing note due on December 31, 20x4. The effective interest rate is 15%. How much is the unamortized balance of the discount on notes payable account on January 1, 20x3? 652,174 b. 1,219,282 c. 1,712,419 d. 2,141,234 The next two items are based on the following information: House Publishers offered a contest in which the winner would receive P1,000,000, payable over 20 years. On December 31, 2000, House announced the winner of the contest and signed a note payable to the winner for P1,000,000,…Beg. Retained Earnings= $34 for nov. 30, 2022. . Then, The following transactions occurred during December of 2022: Paid $14 for December rent, Paid $6 to reduce the amount of accounts payable, Sold inventory costing $5 for $60, Collected $10 accounts receivable, Accrued $5 owed to employees for work performed in December to be paid in January, Recorded $8 depreciation on the new equipment. What is retained earnings at 12/31/2022?

- 14. ABM company purchased a two-year fire insurance coverage policy on June 1, 20XX with a cost of ₱200,000. At its December 31, 20XX, how much should be recorded as an expense? A. ₱100,000 B. ₱50,000 C. ₱200,000 D. ₱062. A hospitality company is the maker of an $18,000 note to be paid in quarterlyinstallments of $3,000 each. The first payment is to be made on June 30. How willthe note be represented on the balance sheet for May 31?A. $18,000 long-term liabilityB. $3,000 expense, $15,000 long-term liabilityC. $3,000 expense, $9,000 current liability, $6,000 long-term liabilityD. $12,000 current liability, $6,000 long-term liabilityH9.C2 Paloma Company has four employees. FICA Social Security taxes are 6.2% of the first $137,700 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. Also, for the first $7,000 paid to each employee, the company's FUTA taxes are 0,6% and SUTA taxes are 5.4%. The company Is preparing its payroll calculations for the week ended August 25. Payroll records show the following Information for the company's four employees. Name Dali Trey Kiesha Chee Gross Pay through August 18 Dali: $ 136,600 Trey: 136,800 Kiesha: 6,900 Chee: 1,250 gross Pav Dali: $ 2,000 Trey: 900 Kiesha: 450 Chee: 400 Current Week Income Tax Withholding Dali: $284 Trey: 145 Kiesha: 39 Chee: 30 In addition to gross pay, the company must pay two-thirds of the $60 per employee weekly health insurance; each employee pays the remalning one-third. The company also contributes an extra 8% of each employee's gross pay (at no cost to employees) to a pension fund. Required: places.) Compute the following for the…

- Bought delivery van P850,000 terms 20% down and the balance payable in oneyear. Required: 1. Record the transaction in the general journal.ACCT 3303, Spring 2022PROJECT 1Due March 6Transactions for Blackberry Mountain Inc for the month of January is as follows: 1 Company issued common stock for $21,000 2a Supplies are purchased for $3,000. 2b Insurance is paid for 6 months beginning January 1: $5,400 (record as an asset) 2c Rent is paid for 3 months beginning in January: $4,500 (record as an asset) 3 Blackberry Mountain Inc borrows $45,000 from 1st State Bank at 12% annual interest. 6 An equipment is purchased for $22,500 cash. It will be used for 3 years and will be depreciated monthly using straight-line depreciation with no salvage value. A full month of depreciation will be charged in January. 9 Services are performed for customers on account. Invoices totaling $9,800 are mailed. 10 Services are performed for cash customers: $7,600. 15 Blackberry Mountain Inc borrows $16,000 from 2nd State Bank at 9% annual interest. 16 Wages for the first half of the month are paid on January 16: $4,200 20 The company receives $3,000…15. On March 1, 20XX, ABM company sold 300 one-year subscriptions for ₱15 each. The total amount received was credited to subscriptions revenue. How much should be recorded as liability? A. ₱750 B. ₱4,500 C. ₱3,750 D. ₱0