* Question Completion Status: Cash flow A ($185,000) $60,000 $75,000 $70,000 $70,000 Cash flow B ($125,000) ($60,000) $95,000 $90,000 $95,000 Sentry's a cost of capital is 14%. It can spend no more than $350,000 on capital projects this year, which of the following statements is applicable when evaluating the projects by the NPV method? a. both projects add shareholder wealth and should be undertaken Ob. project B appears to add more shareholder wealth than project A and should be done Oc. project A appears to add more shareholder wealth than project B and should be done Od. project B should be undertaken because it requires a smaller investment QUESTION 16 Illinois Tool Company's (ITC) fixed operating costs are $1,260,000 and its variable cost ratio (i.e., variable costs as a fraction of sales) is 0.70. The firm's debt consists of a $6,000,000 bond issue (par value) which pays a coupon rate of 9%. Sales are $9 million per year. What is ITC's degree of financial leverage? (Answer in integer rounded to the nearest 10th.) QUESTION 17 Which of the following is correct? a, the variation in ROE and EPS for an unleveraged firm is identical to variation in EBIT in a leveraged firm, the variation in ROE and EPS is always greater than the variation in b. EBIT

* Question Completion Status: Cash flow A ($185,000) $60,000 $75,000 $70,000 $70,000 Cash flow B ($125,000) ($60,000) $95,000 $90,000 $95,000 Sentry's a cost of capital is 14%. It can spend no more than $350,000 on capital projects this year, which of the following statements is applicable when evaluating the projects by the NPV method? a. both projects add shareholder wealth and should be undertaken Ob. project B appears to add more shareholder wealth than project A and should be done Oc. project A appears to add more shareholder wealth than project B and should be done Od. project B should be undertaken because it requires a smaller investment QUESTION 16 Illinois Tool Company's (ITC) fixed operating costs are $1,260,000 and its variable cost ratio (i.e., variable costs as a fraction of sales) is 0.70. The firm's debt consists of a $6,000,000 bond issue (par value) which pays a coupon rate of 9%. Sales are $9 million per year. What is ITC's degree of financial leverage? (Answer in integer rounded to the nearest 10th.) QUESTION 17 Which of the following is correct? a, the variation in ROE and EPS for an unleveraged firm is identical to variation in EBIT in a leveraged firm, the variation in ROE and EPS is always greater than the variation in b. EBIT

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter9: Corporate Valuation And Financial Planning

Section: Chapter Questions

Problem 6P: Additional Funds Needed

The Booth Company’s sales are forecasted to double from $1,000 in 2018 to...

Related questions

Question

Help

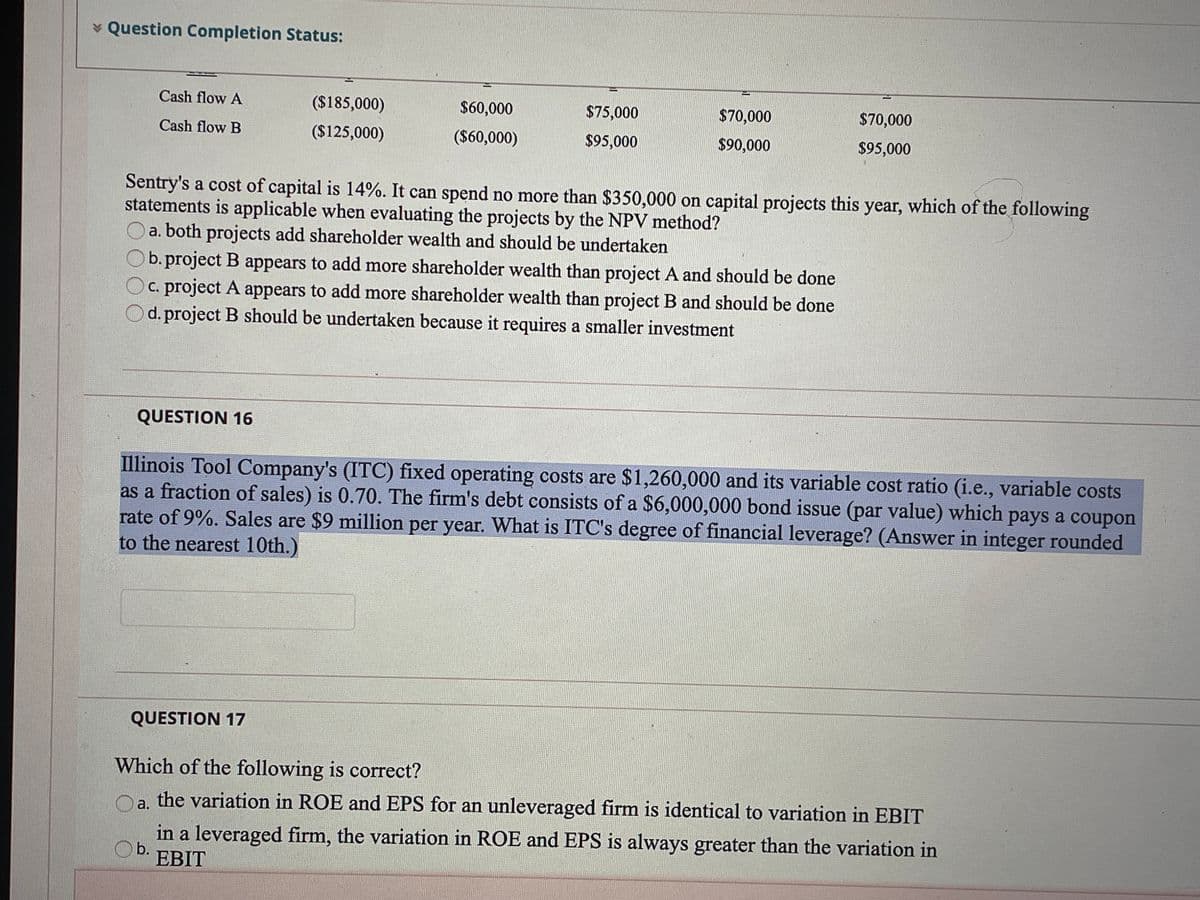

Transcribed Image Text:* Question Completion Status:

Cash flow A

($185,000)

$60,000

$75,000

$70,000

$70,000

Cash flow B

($125,000)

($60,000)

$95,000

$90,000

$95,000

Sentry's a cost of capital is 14%. It can spend no more than $350,000 on capital projects this year, which of the following

statements is applicable when evaluating the projects by the NPV method?

a. both projects add shareholder wealth and should be undertaken

b. project B appears to add more shareholder wealth than project A and should be done

C. project A appears to add more shareholder wealth than project B and should be done

d. project B should be undertaken because it requires a smaller investment

QUESTION 16

Illinois Tool Company's (ITC) fixed operating costs are $1,260,000 and its variable cost ratio (i.e., variable costs

as a fraction of sales) is 0.70. The firm's debt consists of a $6,000,000 bond issue (par value) which pays a coupon

rate of 9%. Sales are $9 million per year. What is ITC's degree of financial leverage? (Answer in integer rounded

to the nearest 10th.)

QUESTION 17

Which of the following is correct?

the variation in ROE and EPS for an unleveraged firm is identical to variation in EBIT

a.

in a leveraged firm, the variation in ROE and EPS is always greater than the variation in

b.

EBIT

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning