Question Completion Status: QUESTION 23 Which is NOT a provision of Sarbanes-Oxley? O A. Auditors of public companies are under the scrutiny of the Public Company Accounting Oversight Board. O B. Those who commit securities fraud may be sentenced to 25 years in prison. O C. Accounting firms are allowed to provide both auditing services and a full range of consulting services to their public company clients. O D. Public companies must issue an internal control report evaluated by an outside auditor. QUESTION 24 A check was written by a business for $205, but was recorded in the business' books as $502. How would this error be recorded on the bank reconciliation? (Hint: what has to be done to correct the error and who needs to correct it?) O A. A deduction on the book side O B. An addition on the book side O C. An addition on the bank side O D.A deduction on the bank side Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers BUS communication acc 101 practice fin.. Take Test: ACC 101.

Question Completion Status: QUESTION 23 Which is NOT a provision of Sarbanes-Oxley? O A. Auditors of public companies are under the scrutiny of the Public Company Accounting Oversight Board. O B. Those who commit securities fraud may be sentenced to 25 years in prison. O C. Accounting firms are allowed to provide both auditing services and a full range of consulting services to their public company clients. O D. Public companies must issue an internal control report evaluated by an outside auditor. QUESTION 24 A check was written by a business for $205, but was recorded in the business' books as $502. How would this error be recorded on the bank reconciliation? (Hint: what has to be done to correct the error and who needs to correct it?) O A. A deduction on the book side O B. An addition on the book side O C. An addition on the bank side O D.A deduction on the bank side Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers BUS communication acc 101 practice fin.. Take Test: ACC 101.

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter2: The Auditor’s Responsibilities Regarding Fraud And Mechanisms To Address Fraud: Regulation And Corporate Governance

Section: Chapter Questions

Problem 19CYBK

Related questions

Question

#23

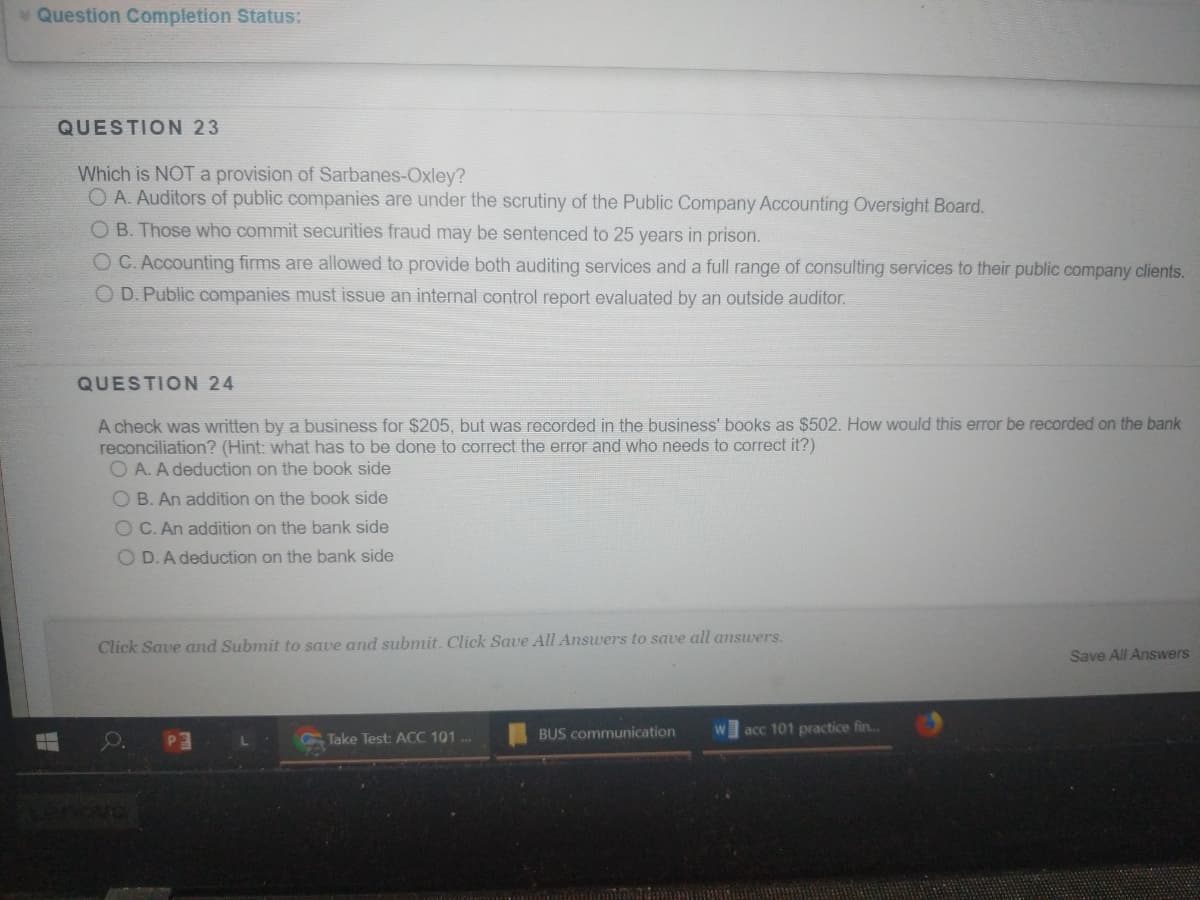

Transcribed Image Text:Question Completion Status:

QUESTION 23

Which is NOT a provision of Sarbanes-Oxley?

O A. Auditors of public companies are under the scrutiny of the Public Company Accounting Oversight Board.

O B. Those who commit securities fraud may be sentenced to 25 years in prison.

O C. Accounting firms are allowed to provide both auditing services and a full range of consulting services to their public company clients.

O D. Public companies must issue an internal control report evaluated by an outside auditor.

QUESTION 24

A check was written by a business for $205, but was recorded in the business' books as $502. How would this error be recorded on the bank

reconciliation? (Hint: what has to be done to correct the error and who needs to correct it?)

O A. A deduction on the book side

O B. An addition on the book side

O C. An addition on the bank side

O D.A deduction on the bank side

Click Save and Submit to save and submit. Click Save All Answers to save all answers.

Save All Answers

BUS communication

acc 101 practice fin..

Take Test: ACC 101.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,