Question Help v Benefits of diversification. Sally Rogers has decided to invest her wealth equally across the following three assets: What are her expected returns and the risk from her investment in the three assets? How do they compare with investing in asset M alone? Hint. Find the standard deviations of asset M and of the portfolio equally invested in assets M, N, and O. What is the expected return of investing equally in all three assets M, N. and 0? % (Round to two decimal places.)

Question Help v Benefits of diversification. Sally Rogers has decided to invest her wealth equally across the following three assets: What are her expected returns and the risk from her investment in the three assets? How do they compare with investing in asset M alone? Hint. Find the standard deviations of asset M and of the portfolio equally invested in assets M, N, and O. What is the expected return of investing equally in all three assets M, N. and 0? % (Round to two decimal places.)

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 13MC: Which of the following discounts future cash flows to their present value at the expected rate of...

Related questions

Question

Transcribed Image Text:Question Help

Benefits of diversification. Sally Rogers has decided to invest her wealth equally across the following three assets:

What are her expected returns and the risk from her investment in the three assets? How do they compare

with investing in asset M alone? Hint Find the standard deviations of asset M and of the portfolio equally invested in assets M, N, and O.

What is the expected return of investing equally in all three assets M, N, and O?

| % (Round to two decimal places.)

Transcribed Image Text:Question Help

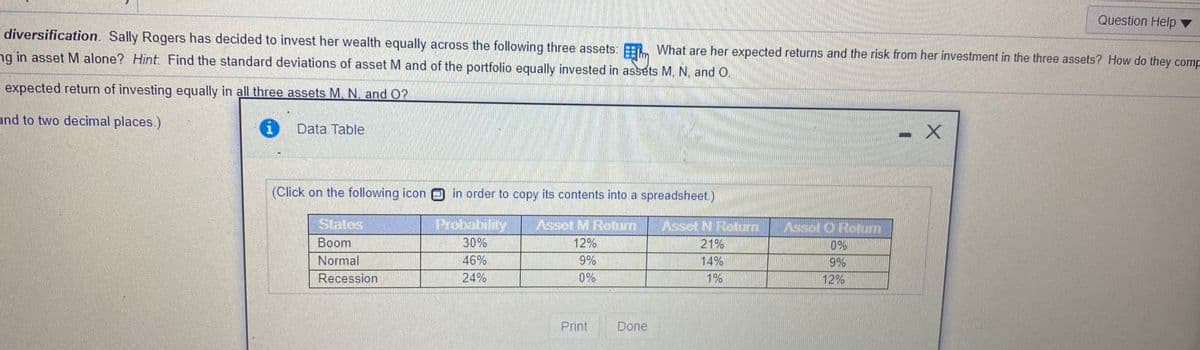

diversification. Sally Rogers has decided to invest her wealth equally across the following three assets: E What are her expected returns and the risk from her investment in the three assets? How do they comp

ng in asset M alone? Hint Find the standard deviations of asset M and of the portfolio equally invested in assets M, N, and O.

expected return of investing equally in all three assets M. N. and O?

und to two decimal places.)

Data Table

- X

(Click on the following icon O in order to copy its contents into a spreadsheet.)

States

Probabilily

Asset M Roturn

Asset N Return

Asset O Return

Boom

30%

12%

21%

0%

9%

Normal

46%

9%

14%

Recession

24%

0%

1%

12%

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning