Question : Insolvency Charle the Cheap Ltd went into voluntary liquidation on 30 June 2021. Its stammarised statement of financial position at that date is as follows: Equity Share capital Total equity Charlie the Cheap Ltd Statement of Financial Position As at 30 June 201 Current assets Date 48 000 Cash (Transfer cash) Inventory Non current assets Land Total assets Current liabilities Payables 48 000 Net assets (Realisation of assets) All assets realised amounted to $48 000. Payables allowed an $800 discount Costs of liquidation were $5 000. Required @ (11) Account Transfer of carrying amounts) Complete the journal entries to liquidation. The narrations for the journal entnes have been provided to you as additional guidance. Si TELE Record the entries in the Liquidation account, the Liquidators receipts & payments, and the Shareholders distribution account. (30 daa ne. Journal for your answer to question 4 part (i). Expand the table as needed to contain your answer. 31000 (Record expenses of liquidation) OKO (Record payment of payables & discount) Dr 13 000 50 000 63 000 15 000 48 000 Cr

Question : Insolvency Charle the Cheap Ltd went into voluntary liquidation on 30 June 2021. Its stammarised statement of financial position at that date is as follows: Equity Share capital Total equity Charlie the Cheap Ltd Statement of Financial Position As at 30 June 201 Current assets Date 48 000 Cash (Transfer cash) Inventory Non current assets Land Total assets Current liabilities Payables 48 000 Net assets (Realisation of assets) All assets realised amounted to $48 000. Payables allowed an $800 discount Costs of liquidation were $5 000. Required @ (11) Account Transfer of carrying amounts) Complete the journal entries to liquidation. The narrations for the journal entnes have been provided to you as additional guidance. Si TELE Record the entries in the Liquidation account, the Liquidators receipts & payments, and the Shareholders distribution account. (30 daa ne. Journal for your answer to question 4 part (i). Expand the table as needed to contain your answer. 31000 (Record expenses of liquidation) OKO (Record payment of payables & discount) Dr 13 000 50 000 63 000 15 000 48 000 Cr

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 23E

Related questions

Question

Transcribed Image Text:Question

Insolvency

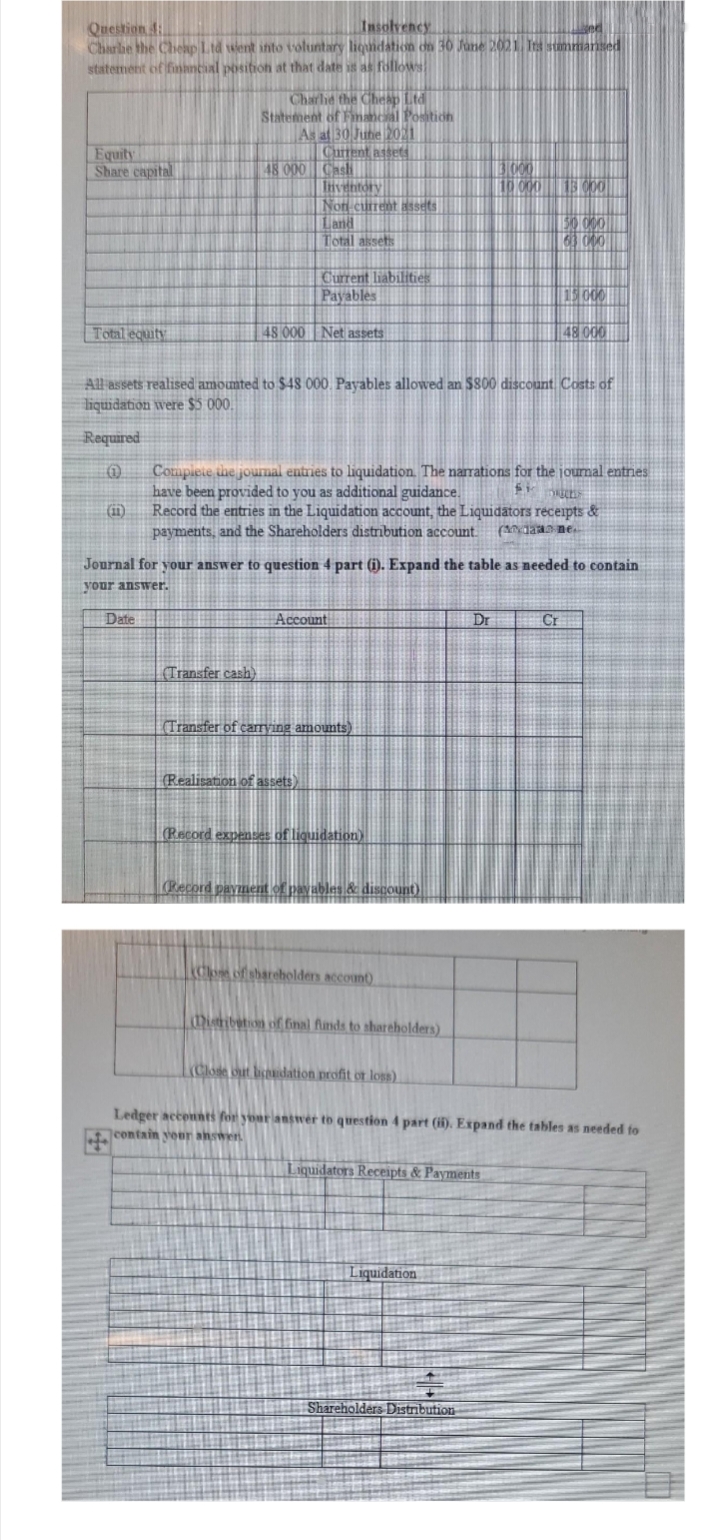

Charle the Cheap Ltd went into voluntary liquidation on 30 June 2021. Its stammarised

statement of financial position at that date is as follows

Equity

Share capital

Total equity

(11)

Charle the Cheap Ltd

Statement of Financial Position

As at 30 June 201

Current assets

Date

48 000 Cash

(Transfer cash)

Inventory

Non current assets

Land

Total assets

Current liabilities

Payables

48 000 Net assets

All assets realised amounted to $48 000. Payables allowed an $800 discount Costs of

liquidation were $5 000.

Required

0

(Realisation of assets)

Complete the journal entries to liquidation. The narrations for the journal entries

have been provided to you as additional guidance.

fi RECESS

Record the entries in the Liquidation account, the Liquidators receipts &

payments, and the Shareholders distribution account. (daa ne.

Journal for your answer to question 4 part (1). Expand the table as needed to contain

your answer.

Account

(Transfer of carrying amounts)

(Record expenses of liquidation)

(Record payment of payables & discount)

Close of shareholders account)

(Distribution of final funds to shareholders)

(Close out bicuidation profit or loss)

31000

10 000

Dr

Liquidators Receipts & Payments

Liquidation

15 000

30 000

63 000

Shareholders Distribution-

15 000

48 000

Cr

Ledger accounts for your answer to question 4 part (ii). Expand the tables as needed to

contain your answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning