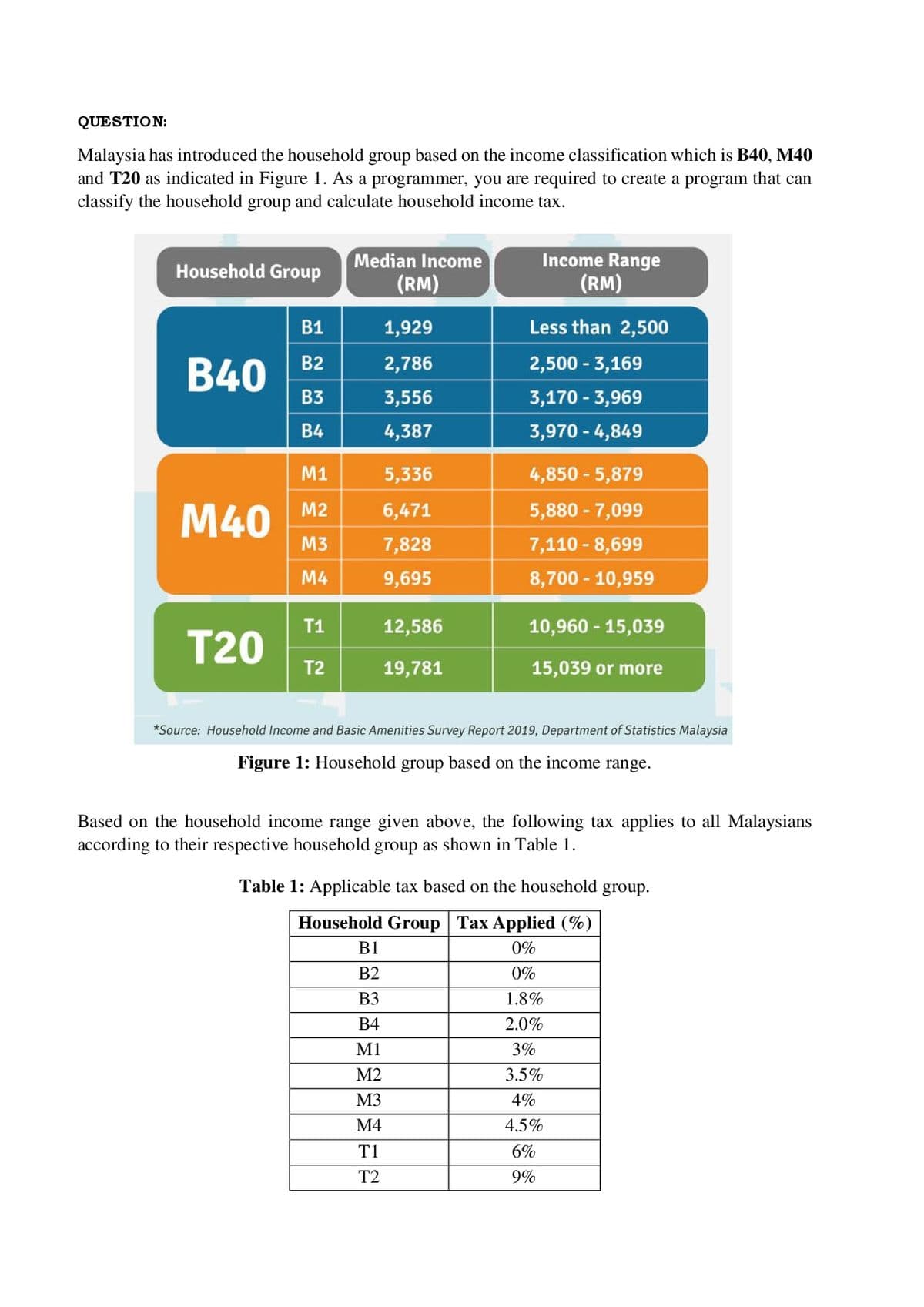

QUESTION: Malaysia has introduced the household group based on the income classification which is B40, M40 and T20 as indicated in Figure 1. As a programmer, you are required to create a program that can classify the household group and calculate household income tax.

QUESTION: Malaysia has introduced the household group based on the income classification which is B40, M40 and T20 as indicated in Figure 1. As a programmer, you are required to create a program that can classify the household group and calculate household income tax.

Computer Networking: A Top-Down Approach (7th Edition)

7th Edition

ISBN:9780133594140

Author:James Kurose, Keith Ross

Publisher:James Kurose, Keith Ross

Chapter1: Computer Networks And The Internet

Section: Chapter Questions

Problem R1RQ: What is the difference between a host and an end system? List several different types of end...

Related questions

Question

C languange

Transcribed Image Text:QUESTION:

Malaysia has introduced the household group based on the income classification which is B40, M40

and T20 as indicated in Figure 1. As a programmer, you are required to create a program that can

classify the household group and calculate household income tax.

Median Income

Income Range

Household Group

(RM)

(RM)

В1

1,929

Less than 2,500

B2

2,786

2,500 - 3,169

В40

B3

3,556

3,170 - 3,969

B4

4,387

3,970 - 4,849

M1

5,336

4,850 - 5,879

M2

6,471

5,880 - 7,099

M40

M3

7,828

7,110 - 8,699

M4

9,695

8,700 - 10,959

T1

12,586

10,960 - 15,039

T20

T2

19,781

15,039 or more

*Source: Household Income and Basic Amenities Survey Report 2019, Department of Statistics Malaysia

Figure 1: Household group based on the income range.

Based on the household income range given above, the following tax applies to all Malaysians

according to their respective household group as shown in Table 1.

Table 1: Applicable tax based on the household group.

Household Group Tax Applied (%)

B1

0%

B2

0%

B3

1.8%

В4

2.0%

M1

3%

M2

3.5%

M3

4%

M4

4.5%

T1

6%

T2

9%

![Your program must be able to collect personal information and their household income. Then

calculate the tax that must be paid according to the household group. Figure 2 and Figure 3 are

examples of program input and output.

Your program must provide an option for the user whether to proceed or exit the program.

Personal Information

Name: NG ZHI KANG

Identification Card: 851210-13-6237

Address: Perumahan Gambang Damai

Household Income

Basic Salary RM: 2500.50

Allowance RM: 250.00

Side Income RM: 100

Household income from the spouse?

[y/n]:

n

Name: NG ZHI KANG

Total household income is RM 2850.50

You are in the B40 group and your Sub Category is B2

You are taxable at a

rate of 0%

Tax to pay RM: 0.00

Exit Program? [y/n]: n

Figure 2: Example of input and output for husband/wife only.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fa0fbea03-6025-4485-a61e-d5d9af2bf8a3%2F17186dca-393d-484d-a9a8-991e5aa30b5f%2Fynxgji_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Your program must be able to collect personal information and their household income. Then

calculate the tax that must be paid according to the household group. Figure 2 and Figure 3 are

examples of program input and output.

Your program must provide an option for the user whether to proceed or exit the program.

Personal Information

Name: NG ZHI KANG

Identification Card: 851210-13-6237

Address: Perumahan Gambang Damai

Household Income

Basic Salary RM: 2500.50

Allowance RM: 250.00

Side Income RM: 100

Household income from the spouse?

[y/n]:

n

Name: NG ZHI KANG

Total household income is RM 2850.50

You are in the B40 group and your Sub Category is B2

You are taxable at a

rate of 0%

Tax to pay RM: 0.00

Exit Program? [y/n]: n

Figure 2: Example of input and output for husband/wife only.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Recommended textbooks for you

Computer Networking: A Top-Down Approach (7th Edi…

Computer Engineering

ISBN:

9780133594140

Author:

James Kurose, Keith Ross

Publisher:

PEARSON

Computer Organization and Design MIPS Edition, Fi…

Computer Engineering

ISBN:

9780124077263

Author:

David A. Patterson, John L. Hennessy

Publisher:

Elsevier Science

Network+ Guide to Networks (MindTap Course List)

Computer Engineering

ISBN:

9781337569330

Author:

Jill West, Tamara Dean, Jean Andrews

Publisher:

Cengage Learning

Computer Networking: A Top-Down Approach (7th Edi…

Computer Engineering

ISBN:

9780133594140

Author:

James Kurose, Keith Ross

Publisher:

PEARSON

Computer Organization and Design MIPS Edition, Fi…

Computer Engineering

ISBN:

9780124077263

Author:

David A. Patterson, John L. Hennessy

Publisher:

Elsevier Science

Network+ Guide to Networks (MindTap Course List)

Computer Engineering

ISBN:

9781337569330

Author:

Jill West, Tamara Dean, Jean Andrews

Publisher:

Cengage Learning

Concepts of Database Management

Computer Engineering

ISBN:

9781337093422

Author:

Joy L. Starks, Philip J. Pratt, Mary Z. Last

Publisher:

Cengage Learning

Prelude to Programming

Computer Engineering

ISBN:

9780133750423

Author:

VENIT, Stewart

Publisher:

Pearson Education

Sc Business Data Communications and Networking, T…

Computer Engineering

ISBN:

9781119368830

Author:

FITZGERALD

Publisher:

WILEY