Question: What are the tax consequences to A and to B as a result of these transactions? Be sure to discuss whether (a) Section 351 applies and the reason(s); and (b) what gain or loss or income if any that A and B would recognize as a consequence of these transactions?

Question: What are the tax consequences to A and to B as a result of these transactions? Be sure to discuss whether (a) Section 351 applies and the reason(s); and (b) what gain or loss or income if any that A and B would recognize as a consequence of these transactions?

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 16MCQ

Related questions

Question

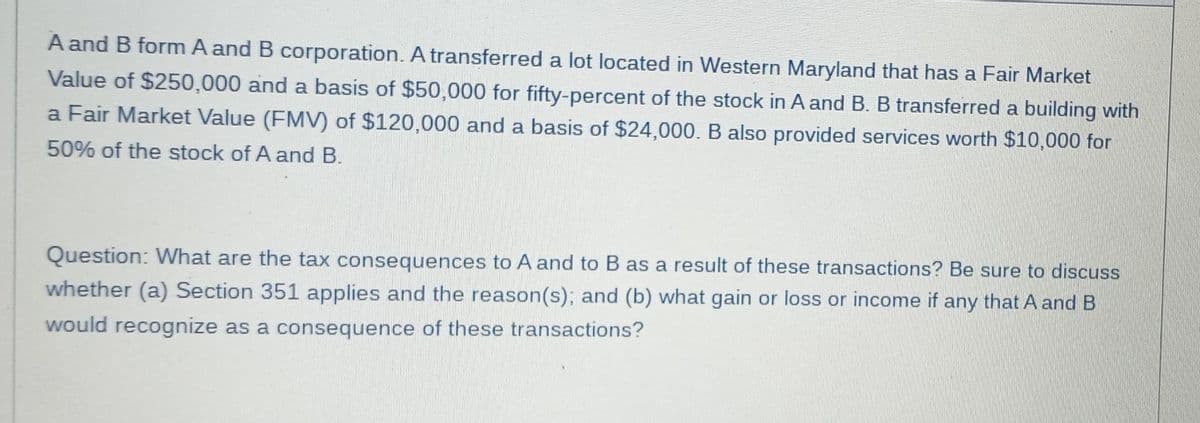

Transcribed Image Text:A and B form A and B corporation. A transferred a lot located in Western Maryland that has a Fair Market

Value of $250,000 and a basis of $50,000 for fifty-percent of the stock in A and B. B transferred a building with

a Fair Market Value (FMV) of $120,000 and a basis of $24,000. B also provided services worth $10,000 for

50% of the stock of A and B.

Question: What are the tax consequences to A and to B as a result of these transactions? Be sure to discuss

whether (a) Section 351 applies and the reason(s); and (b) what gain or loss or income if any that A and B

would recognize as a consequence of these transactions?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you