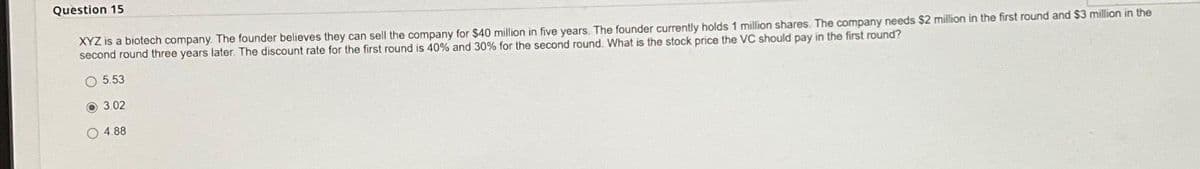

Question XYZ is a biotech company. The founder believes they can sell the company for $40 million in five years. The founder currently holds 1 million shares. The company needs $2 million in the first round and $3 million in the second round three years later. The discount rate for the first round is 40% and 30% for the second round. What is the stock price the VC should pay in the first round? O 5.53 3.02 4.88

Question XYZ is a biotech company. The founder believes they can sell the company for $40 million in five years. The founder currently holds 1 million shares. The company needs $2 million in the first round and $3 million in the second round three years later. The discount rate for the first round is 40% and 30% for the second round. What is the stock price the VC should pay in the first round? O 5.53 3.02 4.88

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter12: Investing In Stocks And Bonds

Section: Chapter Questions

Problem 3FPE

Related questions

Question

Transcribed Image Text:Question 15

XYZ is a biotech company. The founder believes they can sell the company for $40 million in five years. The founder currently holds 1 million shares. The company needs $2 million in the first round and $3 million in the

second round three years later. The discount rate for the first round is 40% and 30% for the second round. What is the stock price the VC should pay in the first round?

O 5.53

3.02

O4.88

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT