r classifications of activities reported in the statement of cash flows

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 1P: Classification of Cash Flows A company's statement of cash flows and the accompanying schedule of...

Related questions

Question

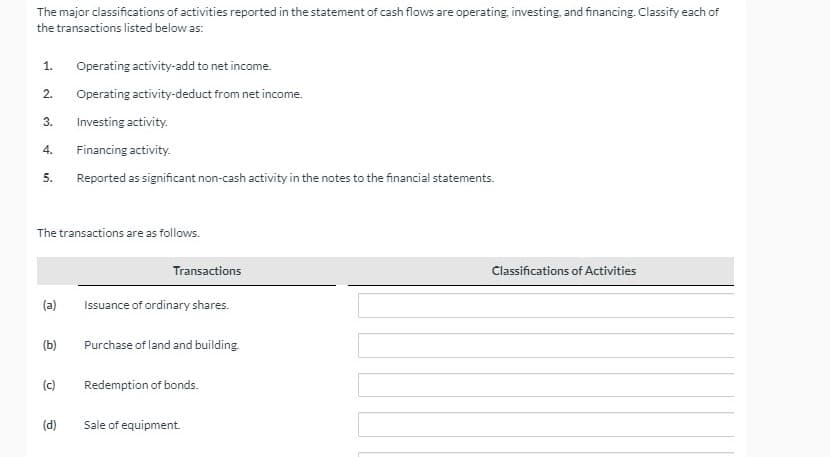

Transcribed Image Text:The major classifications of activities reported in the statement of cash flows are operating, investing, and financing. Classify each of

the transactions listed below as:

1.

Operating activity-add to net income.

2.

Operating activity-deduct from net income.

3.

Investing activity.

4.

Financing activity.

5.

Reported as significant non-cash activity in the notes to the financial statements.

The transactions are as follows.

Transactions

Classifications of Activities

(a)

Issuance of ordinary shares.

(b)

Purchase of land and building.

(c)

Redemption of bonds.

(d)

Sale of equipment.

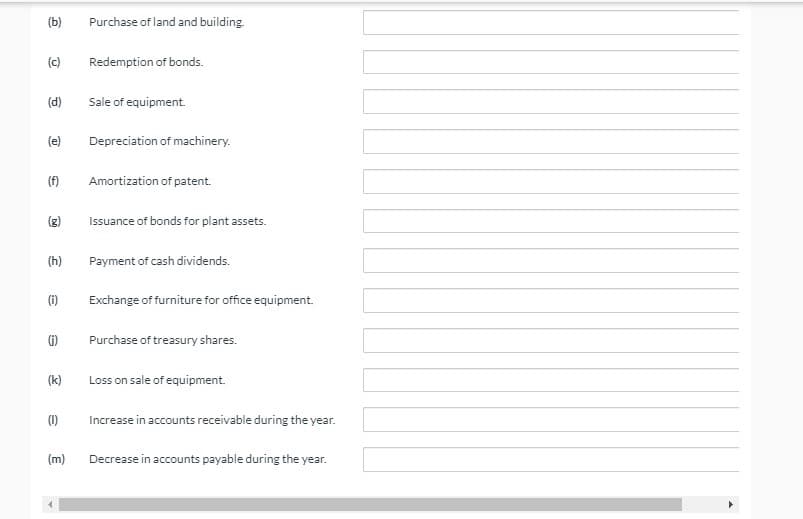

Transcribed Image Text:(b)

Purchase of land and building.

(c)

Redemption of bonds.

(d)

Sale of equipment.

(e)

Depreciation of machinery.

(f)

Amortization of patent.

(g)

Issuance of bonds for plant assets.

(h)

Payment of cash dividends.

(i)

Exchange of furniture for office equipment.

G)

Purchase of treasury shares.

(k)

Loss on sale of equipment.

(1)

Increase in accounts receivable during the year.

(m)

Decrease in accounts payable during the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,