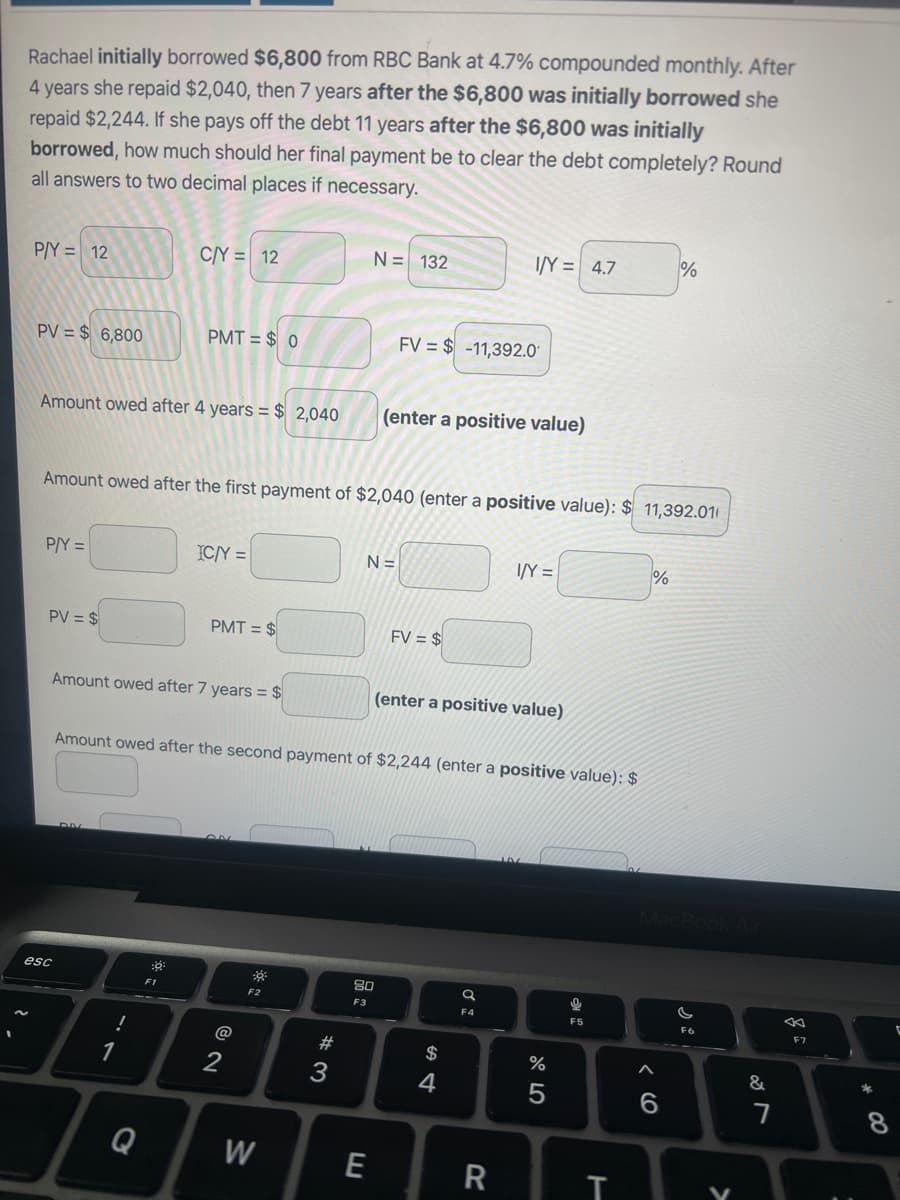

Rachael initially borrowed $6,800 from RBC Bank at 4.7% compounded monthly. After 4 years she repaid $2,040, then 7 years after the $6,800 was initially borrowed she repaid $2,244. If she pays off the debt 11 years after the $6,800 was initially borrowed, how much should her final payment be to clear the debt completely? Round all answers to two decimal places if necessary.

Rachael initially borrowed $6,800 from RBC Bank at 4.7% compounded monthly. After 4 years she repaid $2,040, then 7 years after the $6,800 was initially borrowed she repaid $2,244. If she pays off the debt 11 years after the $6,800 was initially borrowed, how much should her final payment be to clear the debt completely? Round all answers to two decimal places if necessary.

Chapter6: Deductions And Losses: In General

Section: Chapter Questions

Problem 25DQ

Related questions

Question

Answequestion! Lol

Transcribed Image Text:Rachael initially borrowed $6,800 from RBC Bank at 4.7% compounded monthly. After

4 years she repaid $2,040, then 7 years after the $6,800 was initially borrowed she

repaid $2,244. If she pays off the debt 11 years after the $6,800 was initially

borrowed, how much should her final payment be to clear the debt completely? Round

all answers to two decimal places if necessary.

P/Y= 12

PV = $ 6,800

Amount owed after 4 years = $ 2,040

P/Y =

PV = $

esc

C/Y = 12

PMT= $0

1

Amount owed after the first payment of $2,040 (enter a positive value): $11,392.01

Amount owed after 7 years = $

Q

F1

IC/Y =

PMT= $

2

-

F2

W

N = 132

#3

Amount owed after the second payment of $2,244 (enter a positive value): $

E

N=

FV$-11,392.0

(enter a positive value)

80

F3

FV = $

I/Y = 4.7

(enter a positive value)

$

4

da

I/Y =

R

%

5

म :

F5

T

%

%

MacBook Air

6

G

F6

←

F7

&

AR

7

*

C

Transcribed Image Text:ab

1

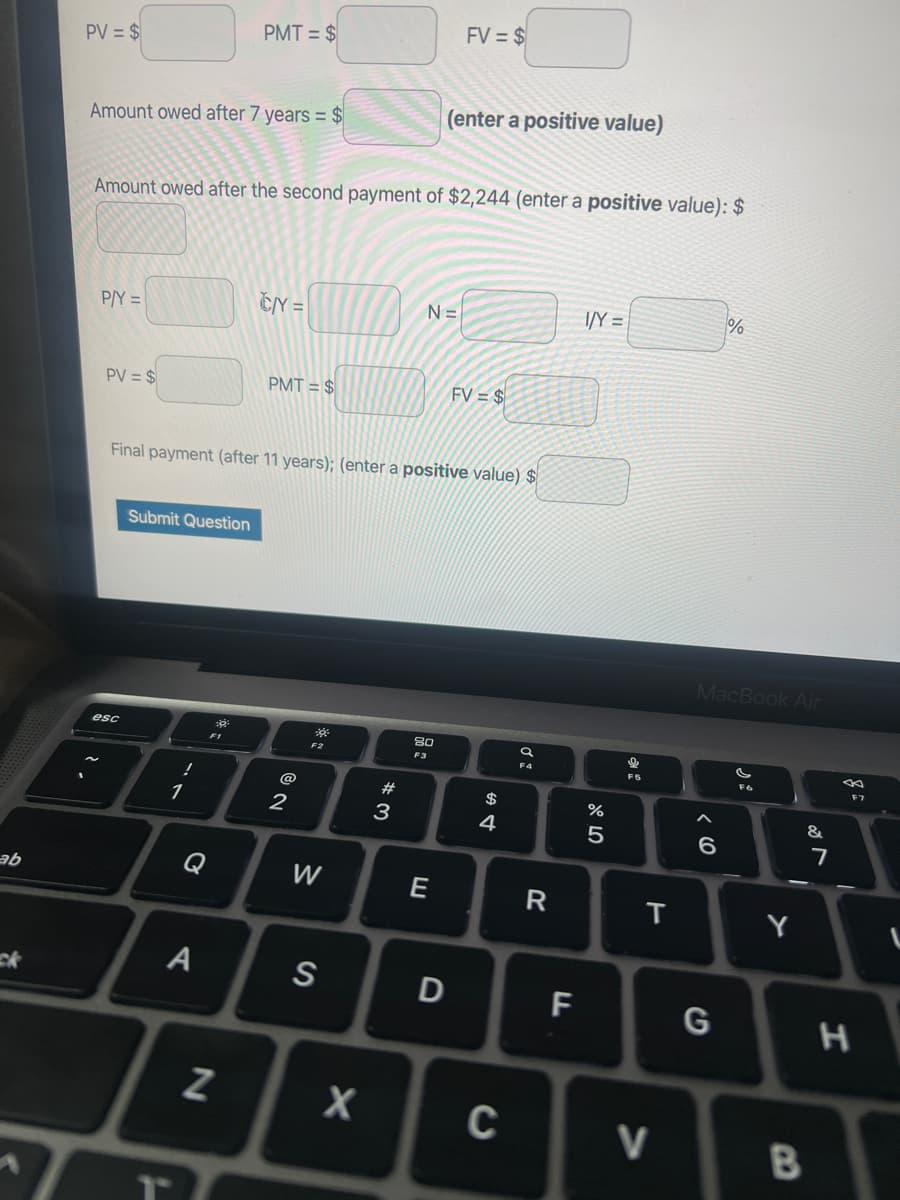

PV = $

Amount owed after 7 years = $

P/Y=

PV = $

Amount owed after the second payment of $2,244 (enter a positive value): $

esc

Submit Question

!

1

Q

PMT = $

A

Final payment (after 11 years); (enter a positive value) $

☀t

N

CY=

PMT= $

2

F2

W

S

X

#3

N=

(enter a positive value)

80

F3

FV = $

E

D

FV = $

$ 4

C

Ơ

R

F

I/Y=

%

5

F5

T

V

MacBook Air

6

%

G

F6

Y

B

&

7

F7

H

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you