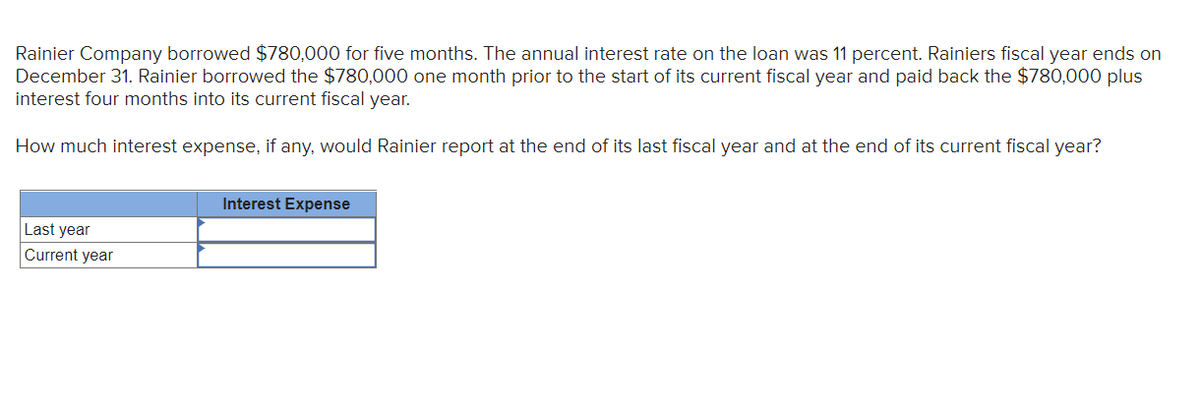

Rainier Company borrowed $780,000 for five months. The annual interest rate on the loan was 11 percent. Rainiers fiscal year ends on December 31. Rainier borrowed the $780,000 one month prior to the start of its current fiscal year and paid back the $780,000 plus interest four months into its current fiscal year. How much interest expense, if any, would Rainier report at the end of its last fiscal year and at the end of its current fiscal year? Last year Current year Interest Expense

Rainier Company borrowed $780,000 for five months. The annual interest rate on the loan was 11 percent. Rainiers fiscal year ends on December 31. Rainier borrowed the $780,000 one month prior to the start of its current fiscal year and paid back the $780,000 plus interest four months into its current fiscal year. How much interest expense, if any, would Rainier report at the end of its last fiscal year and at the end of its current fiscal year? Last year Current year Interest Expense

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 1PA: On January 1, 2018, King Inc. borrowed $150,000 and signed a 5-year, note payable with a 10%...

Related questions

Question

Transcribed Image Text:Rainier Company borrowed $780,000 for five months. The annual interest rate on the loan was 11 percent. Rainiers fiscal year ends on

December 31. Rainier borrowed the $780,000 one month prior to the start of its current fiscal year and paid back the $780,000 plus

interest four months into its current fiscal year.

How much interest expense, if any, would Rainier report at the end of its last fiscal year and at the end of its current fiscal year?

Last year

Current year

Interest Expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning