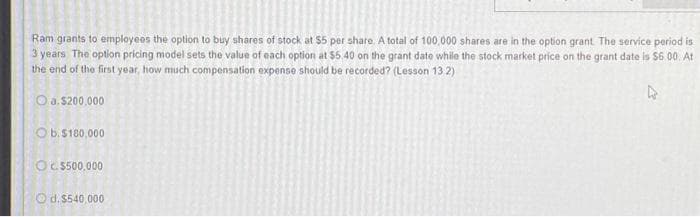

Ram grants to employees the option to buy shares of stock at $5 per share. A total of 100,000 shares are in the option grant. The service period is 3 years. The option pricing model sets the value of each option at $5.40 on the grant date while the stock market price on the grant date is $6.00. At the end of the first year, how much compensation expense should be recorded? (Lesson 13.2) 4 O a. $200,000 Ob. $180,000 O c. $500,000 O d. $540,000

Ram grants to employees the option to buy shares of stock at $5 per share. A total of 100,000 shares are in the option grant. The service period is 3 years. The option pricing model sets the value of each option at $5.40 on the grant date while the stock market price on the grant date is $6.00. At the end of the first year, how much compensation expense should be recorded? (Lesson 13.2) 4 O a. $200,000 Ob. $180,000 O c. $500,000 O d. $540,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 7RE: On January 1, 2019, Phoenix Corporation adopts a performance-based share option plan for 25...

Related questions

Question

Ram grants to employees the option to buy shares of stock at $5 per share. A total of 100,000 shares are in the option grant. The service period is 3 years. The option pricing model sets the value of each option at $5.40 on the grant date while the stock market price on the grant date is $6.00. At the end of the first year, how much compensation expense should be recorded? (Lesson 13.2) 4 O a. $200,000 Ob. $180,000 O c. $500,000 O d. $540,000

Transcribed Image Text:Ram grants to employees the option to buy shares of stock at $5 per share. A total of 100,000 shares are in the option grant. The service period is

3 years The option pricing model sets the value of each option at $5.40 on the grant date while the stock market price on the grant date is $6.00. At

the end of the first year, how much compensation expense should be recorded? (Lesson 132)

O a. $200,000

Ob.$180,000

Oc.$500,000

Od.$540,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning