ramon hernandez saw the following advertisement for a used volkswagen bug and decided to work out the numbers to be sure the ad had no errors. cash price $7,880 down payment $0 annual percentage rate 14.53% deferred price $11,131.80 or 60 payments at $185.53 per month a. calculate the amount financed: b. calculate the finance charge. (round your answer to the nearest cent.): c. calculate the apr by table lookup. (use table 14.1(b).) (round your answers to 2 decimal places.): d. calculate the monthly payment by formula. (round your answer to the nearest cent.): Calculate the monthly payment by table lookup at 14.50% (Use table 14.2 round your answer to the nearest cent):

ramon hernandez saw the following advertisement for a used volkswagen bug and decided to work out the numbers to be sure the ad had no errors. cash price $7,880 down payment $0 annual percentage rate 14.53% deferred price $11,131.80 or 60 payments at $185.53 per month a. calculate the amount financed: b. calculate the finance charge. (round your answer to the nearest cent.): c. calculate the apr by table lookup. (use table 14.1(b).) (round your answers to 2 decimal places.): d. calculate the monthly payment by formula. (round your answer to the nearest cent.): Calculate the monthly payment by table lookup at 14.50% (Use table 14.2 round your answer to the nearest cent):

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 83E

Related questions

Question

ramon hernandez saw the following advertisement for a used volkswagen bug and decided to work out the numbers to be sure the ad had no errors. cash price $7,880 down payment $0 annual percentage rate 14.53% deferred price $11,131.80 or 60 payments at $185.53 per month

a. calculate the amount financed:

b. calculate the finance charge. (round your answer to the nearest cent.):

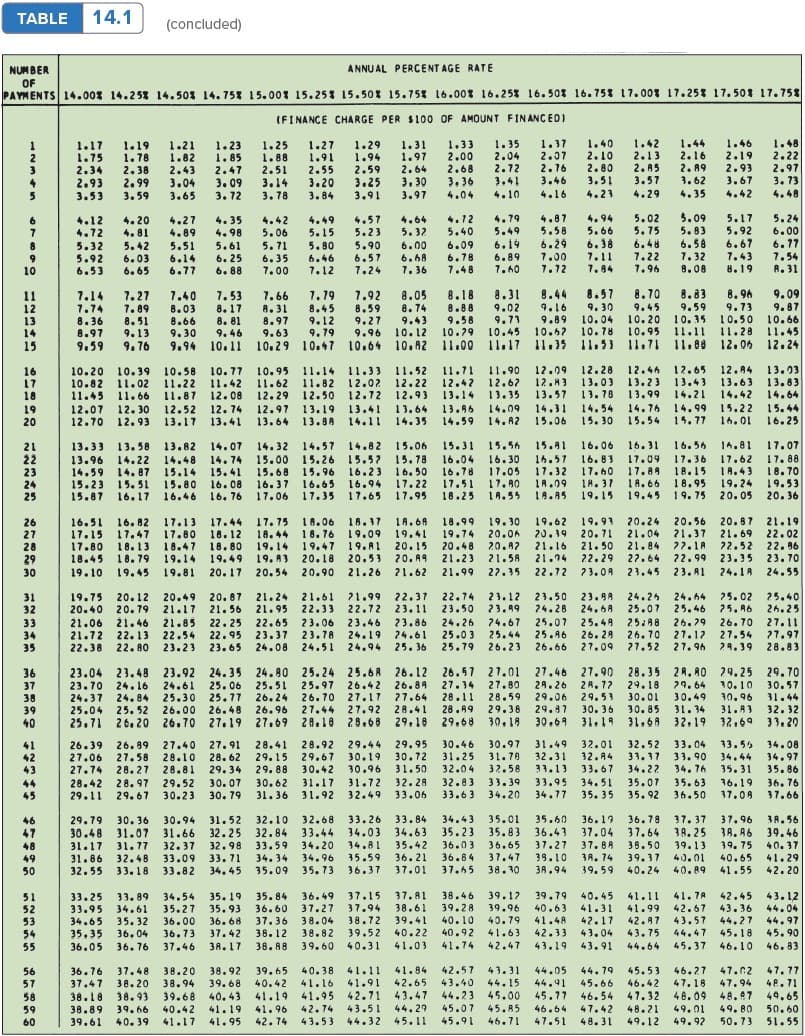

c. calculate the apr by table lookup. (use table 14.1(b).) (round your answers to 2 decimal places.):

d. calculate the monthly payment by formula. (round your answer to the nearest cent.):

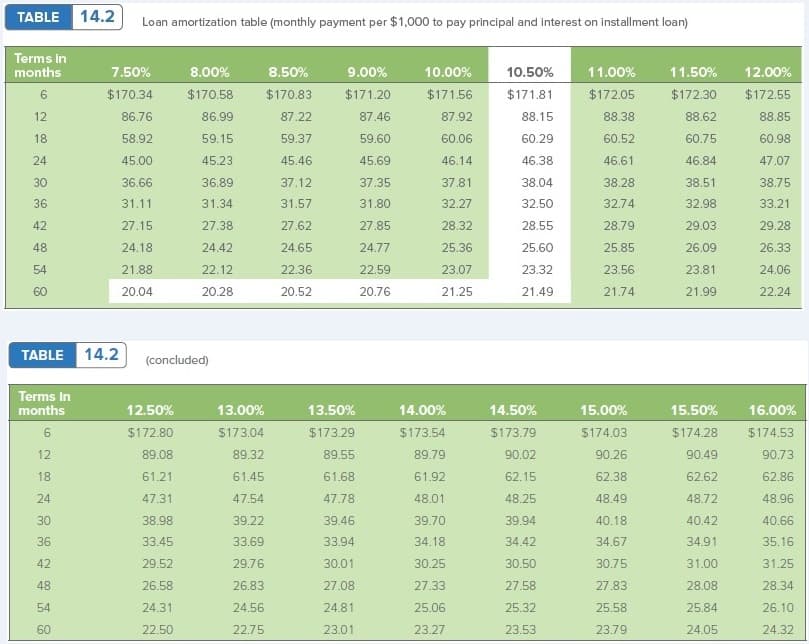

Calculate the monthly payment by table lookup at 14.50% (Use table 14.2 round your answer to the nearest cent):

Transcribed Image Text:TABLE 14.2

Loan amortization table (monthly payment per $1,000 to pay principal and interest on installment loan)

Terms in

months

7.50%

8.00%

8.50%

9.00%

10.00%

10.50%

11.00%

11.50%

12.00%

6

$170.34

$170.58

$170.83

$171.20

$171.56

$171.81

$172.05

$172.30

$172.55

12

86.76

86.99

87.22

87.46

87.92

88.15

88.38

88.62

88.85

18

58.92

59.15

59.37

59.60

60.06

60.29

60.52

60.75

60.98

24

45.00

45.23

45.46

45.69

46.14

46.38

46.61

46.84

47.07

30

36.66

36.89

37.12

37.35

37.81

38.04

38.28

38.51

38.75

36

31.11

31.34

31.57

31.80

32.27

32.50

32.74

32.98

33.21

42

27.15

27.38

27.62

27.85

28.32

28.55

28.79

29.03

29.28

48

24.18

24.42

24.65

24.77

25.36

25.60

25.85

26.09

26.33

54

21.88

22.12

22.36

22.59

23.07

23.32

23.56

23.81

24.06

60

20.04

20.28

20,52

20.76

21.25

21.49

21.74

21.99

22.24

TABLE 14.2

(concluded)

Terms In

months

12.50%

13.00%

13.50%

14.00%

14.50%

15.00%

15.50%

16.00%

6

$172.80

$173.04

$173.29

$173.54

$173.79

$174.03

$174.28

$174.53

12

89.08

89.32

89.55

89.79

90.02

90.26

90.49

90.73

18

61.21

61.45

61.68

61.92

62.15

62.38

62.62

62.86

24

47.31

47.54

47.78

48.01

48.25

48.49

48.72

48.96

30

38.98

39.22

39.46

39.70

39.94

40.18

40.42

40.66

36

33.45

33.69

33.94

34.18

34.42

34.67

34.91

35.16

42

29.52

29.76

30.01

30.25

30.50

30.75

31.00

31.25

48

26.58

26.83

27.08

27.33

27.58

27.83

28.08

28.34

54

24.31

24.56

24.81

25.06

25.32

25.58

25.84

26.10

60

22.50

22.75

23.01

23.27

23.53

23.79

24.05

24.32

Transcribed Image Text:TABLE

14.1

(concluded)

ANNU AL PERCENT AGE RATE

NUM BER

OF

PAYMENTS 14.00% 14.25% 14.50% 14.75% 15.00% 15.25% 15.50% 15.75% L6.00% 16.25 16.50% 16.751 17.00% 17.25% 17.501 17.758

(FINANCE CHARGE PER $100 OF AMOUNT FINANCEDI

1.17

1.19

1.75 1,78

1.40 1.42

1.44

2.16

1.46

2.19

2.93

3.67

4.42

1.48

2.22

2.97

3. 73

4.48

1.21

1.82

1.25

1.88

1.33

2.00

2.68

3.36

1.35

2.04

2.72

3.41

1.37

2.07

2.16

3.46

1.23

1.85

1.27 1.29

1.94

2.59

3.25

3.91

1.31

1.97

2.64

3, 30

1.91

2.10

2.13

2.34

2.38

2.43

2.47

2.80

2.A5

2. A9

2.51

3.14

3.78

2.55

2.93

3.51

3.57

3.62

2.99

3.59

3.04

3.09

3.72

3.20

3.84

5

3.53

3.65

3.97

4.04

4.10

4.16

4.21

4.29

4.35

5.09

4.12

5.40

4.79

5.49

4.87

5.58

4.94

5.02

5.17

5.24

6.00

6.77

7.54

R. 31

4.57

4.64

4.12

4.72

4.20

4.27

4.89

4.35

4.98

4.42

5.06

5.71

6.35

7.00

4.49

5.15

5.80

5.66

6.38

7.11

7.84

4. 81

5.23

5.32

5.75

5.83

5.92

6.19

6.89

7.40

6.58

7.32

6.67

7.43

8.19

6.29

6.48

7.22

5.51

5.61

6. 25

6. 88

5.90

6.00

5.32

5.92

6.53

5.42

6.03

6.09

6.78

7.48

6.46

7.00

6.57

7.24

6.68

6.14

6.77

7. 36

10

6.65

7.12

7.12

1.96

8.08

9.09

9.87

10.66

11.45

7. 53

8.31

9.02

8.44

9.16

8. 96

8.57

9. 30

10.04

10.78 10.95 11.11

8.70

9.45

11

8.05

8.18

8.83

7.14

7.74

8.36

8.97

7.27

1.89

7.40

7.66

8.31

1.19

8.45

9.12

1.92

9.59

8.17

8. 81

9. 46

9.73

10.50

11.28

8.59

8.74

8.88

9.58

12

13

14

15

8.03

8.66

9.30

9.27 9.43

9.79 9.96 10.12 10.79

9.71

10.45 10.5?

9.89

10.20 10.35

8.51

9.13

9.76

8.97

9.63

9.59

9.94 10.11 10.29 10.47 10.64 10.A2 11.00 11.17 11.35 11.33 11.71 1l.08 12.06

10.95 11.14 11.33 11.52 11.71 11.90

12.09

12.43 13.03

13.57 13.99 14.21

12.28

16

17

10.20 10.39 10.58 10.77

10.82 11.02

11.45 11.66

12.46 12.65 12.84

13.23

13.03

13.83

14.64

11.22

12.42

12.67

13.14 13.35

13.43 13.63

11.42 11.62 11.82 12.02 12.22

12.08 12.29

12.74

18

11.87

12.50 12.72 12.93

13.78

14.42

12.97 13.19 13.41

12.70 12.93 13.17 13.41 13.64 13.8A 14.11 14.35 14.59 14.A2

14.31 14.54 14.76 14.99 15.22

15.06 15. 30 15.54 15.77 16.01

19

12.07 12.30

12.52

13.64

13.96 14.09

15.44

20

16.25

13.33 13.58 13.82 14.07

14.32 14.57 14.82 15.06

15.31 15.56

15.A1 16.06 16.31 16.56 16.81

17.07

21

22

23

24

25

15.00 15.26 15.5? 15.78

15.68

16.37

16.83

17.32 17.60 17.84 18.15

17. 88

18.70

19.53

19.45 19. 75 20.05 20. 36

16.04

16.78

16.30

17.05

16.57

17.09 17.36 17.62

IA.43

13.96 14.22 14.48 14. 74

15.14

15.80

15.87 16.17 16.46 16. 76 17.06

16.50

16.94 17.22

17.95

16.23

14.59 14.87

15.23 15.51

15.41

16.08

15.96

16.65

17.35 17.65

17.51 17. A0 LA.09 1H.37 1A.66 18.95 19.24

1H. 37

1A. 66

18.25 1A.55

18.85 19.15

20.24 20.56 20.87 21.19

21.69

21.84 27.1A 22.52 22.86

23.35

26

27

16.51 16.82 17.13 17.44 18.06

17.15 17.47 17.80 18.12

17.80 18.13 18.47

18.45 18.79

1A.6A

19.41

18.80 19.14 19.47 19.A1 20.15

20. A9

17.75

16.17

18.76 19.09

18.99 19.30

20.0A

20.A2

21.58

19.62 19.93

20.19 20.7I

18.44

21.04 21.37

22.02

19.74

20.48

21.16 21.50

21.14

22.29

21.99 27.35 22.72 ?3.0A 23.45 23. A1

28

29

19.14

19.49

19. A3 20.18

20.53

21.23

27.64 22.99

23.70

30

19.10 19.45 19.81 20.17 20.54 20.90 21.26 21.62

24.1A 24.55

19.75

20.40 20.79 21.17 21.56 21.95

22.37

23.11

22.74 23.12

23.50

23.49

23.50 23.9A 24.25

24.28 24.6A

25.02 25,40

25. A6 26.25

24.64

25.46

25:88 26.29

26.70 27.1?

27. 96

31

32

20.12 20.49 20.87 21.24 21.61

21.99

22.33 22.72

25.07

21.85 22.25

22.54

22.80 23.23 23.65

22.65 23.06

23.46

23.86

33

34

35

21.06 21.46

21.72 22. I3

22.38

24.26

25.03

24.67

25.44

26.23

25.07

25.46

25.49

26. 24

26.70

27.11

27.54

27.97

24.39 28.83

22.95 23.37 23.78

24.19

24.61

24.08 24.51 24.94 25. 36

25.79

26.66 27.09

27.52

27.46 27.90 28.35 2A.R0 29.25 29.70

30.57

23.92 24.35 24.80 25.24 25.6A 26.12 26.57

25.97

26.24 26.7O 27.17

26.96 27.44

25.71 26.20 26.70 27.19 27.69 28.18 28.68 29.18 29,68 30. 18

36

27.01

23.04 23.48

23.70 24.16

24.61

25.06

25.51

26.42

2A, 7?

26.8A

27.34

27.64

28.11

28.41 28.R9

27.80

28.59

29.38

28.26

29.64

30.49

30.85 31.34

29.18

37

38

39

40

10.10

30.96

31. A3

29.06 29.53 30.01

31.44

32.32

30.69 32.60 33.20

24.37 24.84

25.30 25.77

25.04 25.52

26.00 26.48

27.92

29.37

30. 36

31.19 31.6A 32.19

30.46

31.25

29.44

31.49

29.95

30.72

30.97

31.78

32.58

32.01

32.52

33.17

33.04

13.55

41

42

26.39 26.89 27.40 27. 91 28.41 28.92

28.10 28. 62

27.74 28.27 28.81 29.34 29. 88

34.08

34.97

35.86

27.06

27.58

29.15

32.31 32. A4

33. 90

29.67

30.42

30.19

30.96

34.44

35.31

43

31.50

32.04

33.13

33.67

34.22

34. 76

33.39

34.20

35.07 35.63

35. 92

30.62 31.17

31.72

31.92 32.49

32.28

32.83

28.42

29.11

33.95

34.77

34.51

35. 35

36.19

37.08

28.97

29.52 30.07

36.76

37.66

44

45

29.67

30.23

30. 79

31.36

33.06

33.63

36.50

32.10 32.68 33.26

32.84

33.59

33.84

34.43

35.01

35.23 35.83

35.60 36.139 36.78

37. 37

37.96

3A. A6

39. 75

40.65

46

29.79

30. 36

30.94 31.52

38.56

31.66 32.25

32.37

32.98

33.44 34.03

34.63

36.43

37.04 37.64

39.46

40.37

47

30.48 31.07

31.77

32.48 33.09

3A.25

39.13

34.20

35.42

34.81

35.59 36.21

36.65

36.84 37. 47

37.65

36.03

37.27

37. 8A 38.5o

3A. 74 39.37 40.01

40.24

48

31.17

31.86

33.71

39.10

34. 34

35.09 35. 73 36.37

34.96

49

50

41.29

42.20

32.55

33.18

33.82 34. 45

37.01

38.30

3A.94

39.59

40.89 41.55

33. 89

36.49 37.15

37.94

38.72

41.7A 42.45

43.36

43.57 44.27

37. A1

38.46

39.12

34.54

35.27

36.00

36.73

39.79 40.45 41.11

41.31

42.17

43.04

35. 19 35.84

51

52

53

54

33.25

33.95

34.65

35.35

34.61

35. 32

36. 04

35.93

36. 68

37.42

36.60 37.27

37.36

38.04

38.82

38.12

39.28

40.10 40.79

40.92 41.63

41.99 42.67

42.97

43.75

43.12

44.04

44.97

45.90

38.61

39.41

39.96

40.63

41.48

39.52

40.22

42.33

44.47

45.18

55

36.05

36.76

37.46

ЗА. 17

38.88 39.60

40.31

41.03

41.74

42.47

43.19

43.91

44.64

45.37 46.10

46.83

45.53

46.42

46.54 47.32 48.09

48.21

38.20 38.92

42.57

43.40

44.23

43.51 44.29 45.07

45.11 45.91

41.84

42.65

43.47

43.31

44.05

44.79

45.66

56

47.02

47.77

36.76

37.47

38.18 38.93 39.68 40. 43

37.48

39.65

40.42

41.19 41.95 42.71

40.38 41.11

41.16

41.91

46.27

47.18

38.20

38.94 39. 68

44.15

44.41

45.77

57

47.94

4P.71

58

45.00

48.47

49.65

45.85

46.64

47.51 48.31

39. 66

41.19

41.96

42.74

47.42

49.01

49.92

49.80

50.60

59

60

38.89

40.42

39.61 40.39

41.17 41.95

42.74 43.53 44.32

46.71

49.12

50.73

51.55

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning