Randall's refrigerator stopped working and he needs a new one right away. He found a highly rated refrigerator that will fit his needs for $1,800. He has $500 in savings and can afford up to $125 more per month in his budget. He is concerned about using up his savings and not having any emergency money. He is also worried about pushing his monthly budget to the limit. Randall's credit card has an APR of 18% and would require a minimum monthly payment of $40 for this purchase. Help Randall consider his options and make a smart decision. • Option 1: Don't use savings and pay the minimum $40 per month. • Option 2: Don't use savings and pay $125 per month. • Option 3: Use the $500 savings and pay the minimum $40 per month. Option 4: Use the $500 savings and pay $125 per month. Option 1 Option 2 Option 3 Option 4 Initial Balance $1,800 $1,800 $1,800 $500 = $1,300 $1,800-$500 = $1,300 $125 $40 $125 Monthly Payment $40 75 months = 18 months = 45 months = 12 months = Time to Pay Off : year(s) + year(s) : year(s) : year(s) $2,043 $2,296 $1,924 Total Paid $3,020 $ %$4 Interest Paid $

Randall's refrigerator stopped working and he needs a new one right away. He found a highly rated refrigerator that will fit his needs for $1,800. He has $500 in savings and can afford up to $125 more per month in his budget. He is concerned about using up his savings and not having any emergency money. He is also worried about pushing his monthly budget to the limit. Randall's credit card has an APR of 18% and would require a minimum monthly payment of $40 for this purchase. Help Randall consider his options and make a smart decision. • Option 1: Don't use savings and pay the minimum $40 per month. • Option 2: Don't use savings and pay $125 per month. • Option 3: Use the $500 savings and pay the minimum $40 per month. Option 4: Use the $500 savings and pay $125 per month. Option 1 Option 2 Option 3 Option 4 Initial Balance $1,800 $1,800 $1,800 $500 = $1,300 $1,800-$500 = $1,300 $125 $40 $125 Monthly Payment $40 75 months = 18 months = 45 months = 12 months = Time to Pay Off : year(s) + year(s) : year(s) : year(s) $2,043 $2,296 $1,924 Total Paid $3,020 $ %$4 Interest Paid $

Chapter12: Sequences, Series And Binomial Theorem

Section12.3: Geometric Sequences And Series

Problem 12.58TI: What is the total effect on the economy of a government tax rebate of $500 to each household in...

Related questions

Question

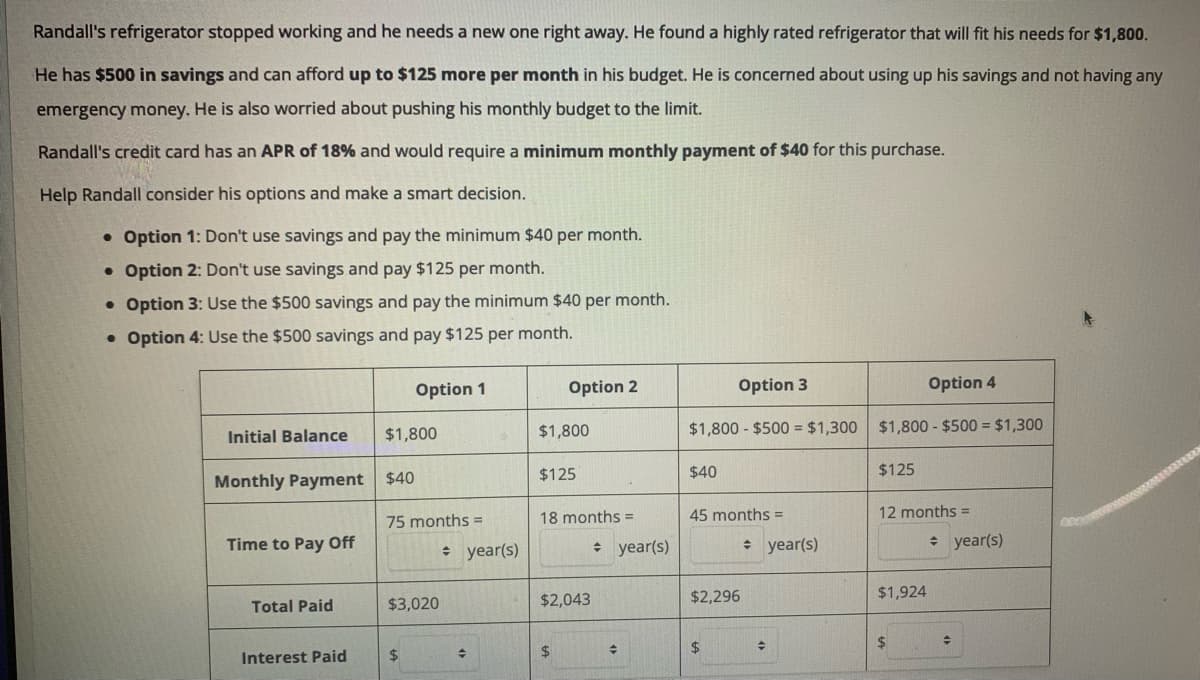

Transcribed Image Text:Randall's refrigerator stopped working and he needs a new one right away. He found a highly rated refrigerator that will fit his needs for $1,800.

He has $500 in savings and can afford up to $125 more per month in his budget. He is concerned about using up his savings and not having any

emergency money. He is also worried about pushing his monthly budget to the limit.

Randall's credit card has an APR of 18% and would require a minimum monthly payment of $40 for this purchase.

Help Randall consider his options and make a smart decision.

• Option 1: Don't use savings and pay the minimum $40 per month.

• Option 2: Don't use savings and pay $125 per month.

• Option 3: Use the $500 savings and pay the minimum $40 per month.

• Option 4: Use the $500 savings and pay $125 per month.

Option 1

Option 2

Option 3

Option 4

$1,800

$1,800

$1,800 - $500 = $1,300

$1,800 - $500 = $1,300

Initial Balance

$125

$40

$125

Monthly Payment

$40

75 months =

18 months =

45 months =

12 months =

Time to Pay Off

+ year(s)

: year(s)

: year(s)

: year(s)

$2,043

$2,296

$1,924

Total Paid

$3,020

2$

수

$4

%2$

Interest Paid

Transcribed Image Text:Randall has turned to you for advice. Which option do you suggest, or do you have a different option in mind? Be sure to explain to Randall why you

think he should choose the option you suggest. Remember, Randall is concerned about not having any money for emergencies and pushing his

monthly budget to the limit.

</>

I

U

T:

Option you suggest:

Reasoning:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Intermediate Algebra

Algebra

ISBN:

9781285195728

Author:

Jerome E. Kaufmann, Karen L. Schwitters

Publisher:

Cengage Learning

Algebra for College Students

Algebra

ISBN:

9781285195780

Author:

Jerome E. Kaufmann, Karen L. Schwitters

Publisher:

Cengage Learning

Intermediate Algebra

Algebra

ISBN:

9781285195728

Author:

Jerome E. Kaufmann, Karen L. Schwitters

Publisher:

Cengage Learning

Algebra for College Students

Algebra

ISBN:

9781285195780

Author:

Jerome E. Kaufmann, Karen L. Schwitters

Publisher:

Cengage Learning