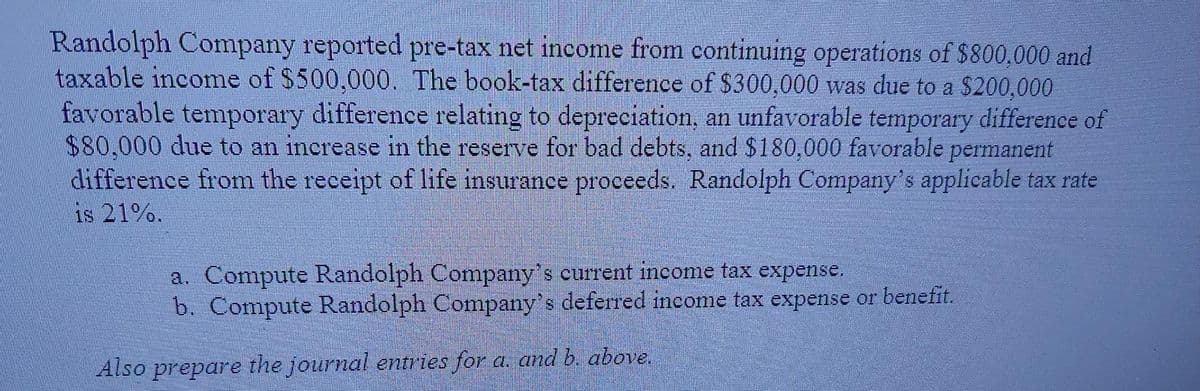

Randolph Company reported pre-tax net income from continuing operations of $800,000 and taxable income of $500,000. The book-tax difference of $300,000 was due to a $200,000 favorable temporary difference relating to depreciation, an unfavorable temporary difference of $80,000 due to an increase in the reserve for bad debts, and $180,000 favorable permanent difference from the receipt of life insurance proceeds. Randolph Company's applicable tax rate is 21%. a. Compute Randolph Company's current income tax expense. b. Compute Randolph Company's deferred income tax expense or benefit. Also prepare the journal entries for a. and b. above.

Randolph Company reported pre-tax net income from continuing operations of $800,000 and taxable income of $500,000. The book-tax difference of $300,000 was due to a $200,000 favorable temporary difference relating to depreciation, an unfavorable temporary difference of $80,000 due to an increase in the reserve for bad debts, and $180,000 favorable permanent difference from the receipt of life insurance proceeds. Randolph Company's applicable tax rate is 21%. a. Compute Randolph Company's current income tax expense. b. Compute Randolph Company's deferred income tax expense or benefit. Also prepare the journal entries for a. and b. above.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter3: Taxes On The Financial Statements

Section: Chapter Questions

Problem 4BCRQ

Related questions

Question

Transcribed Image Text:Randolph Company reported pre-tax net income from continuing operations of $800,000 and

taxable income of $500,000. The book-tax difference of $300,000 was due to a $200,000

favorable temporary difference relating to depreciation, an unfavorable temporary difference of

$80,000 due to an increase in the reserve for bad debts, and $180,000 favorable

difference from the receipt of life insurance proceeds. Randolph Company's applicable tax rate

is 21%.

permanent

a. Compute Randolph Company's current income tax expense.

b. Compute Randolph Company's deferred income tax expense or benefit.

Also prepare the journal entries for a. and b. above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning