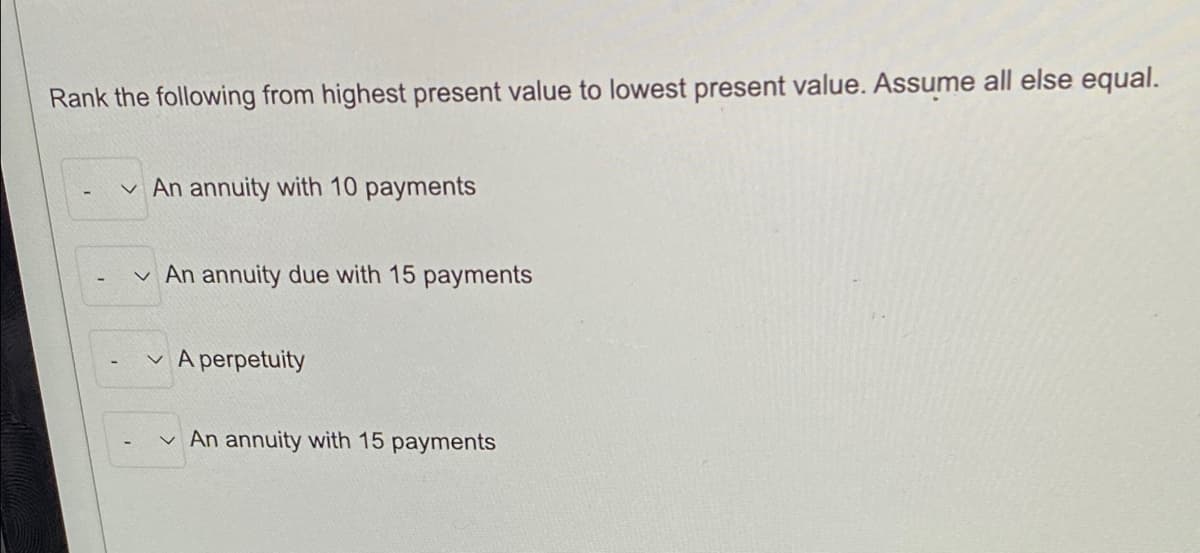

Rank the following from highest present value to lowest present value. Assume all else equal. v An annuity with 10 payments An annuity due with 15 payments A perpetuity v An annuity with 15 payments

Rank the following from highest present value to lowest present value. Assume all else equal. v An annuity with 10 payments An annuity due with 15 payments A perpetuity v An annuity with 15 payments

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter11: Liabilities: Bonds Payable

Section: Chapter Questions

Problem 11E

Related questions

Question

Transcribed Image Text:Rank the following from highest present value to lowest present value. Assume all else equal.

v An annuity with 10 payments

v An annuity due with 15 payments

v A perpetuity

v An annuity with 15 payments

Expert Solution

Step 1

Present value of annuity is the current value of the future payments that are calculated using the interest rate or discount rate , the future cash flow is discounted to find the present value.

The formula of which is:

Present Value of periodic payment= P* (1- (1+r)-n)/r

Where,

P= periodic payments

r= rate of interest

n= number of period

And

Present Value of a single cash flow= Future Value / (1 + interest rate%)^n

Where,

n= number of period

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,