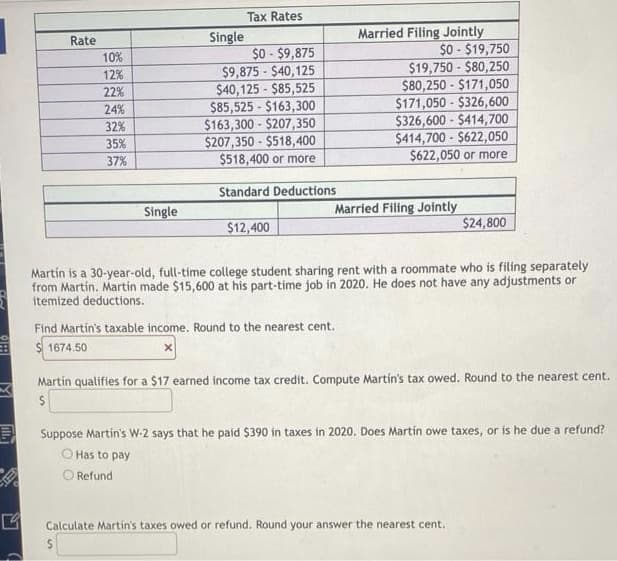

Rate 10% 12% 22% 24% 32% 35% 37% Single Single Tax Rates $0-$9,875 $9,875-$40,125 $40,125-$85,525 $85,525 $163,300 $163,300-$207,350 $207,350-$518,400 $518,400 or more Standard Deductions $12,400 Married Filing Jointly $0-$19,750 $19,750-$80,250 $80,250-$171,050 $171,050-$326,600 $326,600-$414,700 $414,700-$622,050 $622,050 or more Married Filing Jointly $24,800 Martin is a 30-year-old, full-time college student sharing rent with a roommate who is filing se from Martin Martin made $15 600 at his part-time job in 2020. He does not have any adjustm

Rate 10% 12% 22% 24% 32% 35% 37% Single Single Tax Rates $0-$9,875 $9,875-$40,125 $40,125-$85,525 $85,525 $163,300 $163,300-$207,350 $207,350-$518,400 $518,400 or more Standard Deductions $12,400 Married Filing Jointly $0-$19,750 $19,750-$80,250 $80,250-$171,050 $171,050-$326,600 $326,600-$414,700 $414,700-$622,050 $622,050 or more Married Filing Jointly $24,800 Martin is a 30-year-old, full-time college student sharing rent with a roommate who is filing se from Martin Martin made $15 600 at his part-time job in 2020. He does not have any adjustm

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.1APR: Liability transactions The following items were selected from among the transactions completed by...

Related questions

Question

Transcribed Image Text:STEN

Rate

10%

12%

22%

24%

32%

35%

37%

Single

Single

Tax Rates

$0-$9,875

$9,875 - $40,125

$40,125-$85,525

$85,525-$163,300

$163,300 $207,350

$207,350-$518,400

$518,400 or more

Standard Deductions

$12,400

Married Filing Jointly

$0-$19,750

$19,750-$80,250

$80,250-$171,050

$171,050-$326,600

$326,600-$414,700

$414,700-$622,050

$622,050 or more

Married Filing Jointly

Find Martin's taxable income. Round to the nearest cent.

$1674.50

Martín is a 30-year-old, full-time college student sharing rent with a roommate who is filing separately

from Martin. Martin made $15,600 at his part-time job in 2020. He does not have any adjustments or

itemized deductions.

$24,800

Martín qualifies for a $17 earned income tax credit. Compute Martín's tax owed. Round to the nearest cent.

$

Suppose Martin's W-2 says that he paid $390 in taxes in 2020. Does Martín owe taxes, or is he due a refund?

O Has to pay

O Refund

Calculate Martin's taxes owed or refund. Round your answer the nearest cent.

S

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning