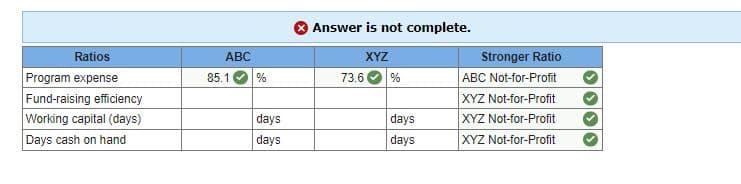

Ratios Program expense Fund-raising efficiency Working capital (days) Days cash on hand 85.1 Answer is not complete. ABC XYZ Stronger Ratio % 73.6 % ABC Not-for-Profit XYZ Not-for-Profit days days XYZ Not-for-Profit days days XYZ Not-for-Profit

Ratios Program expense Fund-raising efficiency Working capital (days) Days cash on hand 85.1 Answer is not complete. ABC XYZ Stronger Ratio % 73.6 % ABC Not-for-Profit XYZ Not-for-Profit days days XYZ Not-for-Profit days days XYZ Not-for-Profit

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter15: Capital Investment Analysis

Section: Chapter Questions

Problem 15.1.3MBA: Financial leverage MicrosoCortrepotied (MSFT) reported the following data (in millions) for a tern...

Question

Presented below are financial statements (except cash flows) for two not-for-profit organizations.

| ABC Not-for-Profit | XYZ Not-for-Profit | |||

|---|---|---|---|---|

| Statement of Activities | Unrestricted | Donor-Restricted | Unrestricted | Donor- Restricted |

| Revenues | ||||

| Program service revenue | $ 5,595,000 | $ 2,250,000 | ||

| Contribution revenues | 3,327,500 | $ 750,000 | 3,200,000 | |

| Grant revenue | 96,000 | $ 1,025,000 | ||

| Net gains on endowment investments | 17,500 | |||

| Net assets released from restriction | ||||

| Satisfaction of program restrictions | 450,000 | (450,000) | 377,000 | (377,000) |

| Total revenues | 9,390,000 | 396,000 | 5,827,000 | 648,000 |

| Expenses | ||||

| Education program expenses | 5,525,000 | 1,680,000 | ||

| Research program expense | 1,350,000 | 2,232,000 | ||

| Total program service expenses | 6,875,000 | 3,912,000 | ||

| Fund-raising | 550,000 | 412,000 | ||

| Administration | 650,000 | 990,000 | ||

| Total supporting service expenses | 1,200,000 | 1,402,000 | ||

| Total expenses | 8,075,000 | 5,314,000 | ||

| Increase in net assets | 1,315,000 | 396,000 | 513,000 | 648,000 |

| Net assets, January, 1 | 4,208,000 | 759,000 | 1,037,500 | 320,000 |

| Net assets, December, 31 | $ 5,523,000 | $ 1,155,000 | $ 1,550,500 | $ 968,000 |

| Statement of Net Assets | ABC Not-for-Profit | XYZ Not-for-Profit |

|---|---|---|

| Current assets | ||

| Cash | $ 205,000 | $ 356,000 |

| Short-term cash equivalents | 265,000 | 99,000 |

| Supplies inventories | 32,000 | 150,000 |

| Receivables | 439,500 | 188,500 |

| Total current assets | 941,500 | 793,500 |

| Noncurrent assets | ||

| Noncurrent pledges receivable | 173,000 | 86,000 |

| Endowment investments | 2,590,000 | |

| Land, buildings, and equipment (net) | 3,175,000 | 1,768,000 |

| Total noncurrent assets | 5,938,000 | 1,854,000 |

| Total assets | $ 6,879,500 | $ 2,647,500 |

| Current liabilities | ||

| Accounts payable | $ 23,000 | $ 129,000 |

| Total current liabilities | 23,000 | 129,000 |

| Noncurrent liabilities | ||

| Notes payable | 178,500 | |

| Total noncurrent liabilities | 178,500 | |

| Total liabilities | 201,500 | 129,000 |

| Net Assets | ||

| Unrestricted | 5,523,000 | 1,550,500 |

| Donor restricted for purpose | 155,000 | 0 |

| Donor restricted for endowment | 1,000,000 | 968,000 |

| Total net assets | 6,678,000 | 2,518,500 |

| Total liabilities and net assets | $ 6,879,500 | $ 2,647,500 |

Required:

-

Calculate the following ratios (assume

depreciation expense is $480,000 for both organizations and is allocated among program and supporting expenses):- Program expense.

- Fund-raising efficiency.

- Days cash on hand.

Working capital (expressed in days).

Transcribed Image Text:Ratios

Program expense

Fund-raising efficiency

Working capital (days)

Days cash on hand

85.1

Answer is not complete.

ABC

XYZ

Stronger Ratio

%

73.6

%

ABC Not-for-Profit

XYZ Not-for-Profit

days

days

XYZ Not-for-Profit

days

days

XYZ Not-for-Profit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning