re given financial statements and a Dupont analysis for Tesco and Ahold. What do you conclude about the two compani

Q: Employee and employer OASDI: 6.2% Employer and Employee HI: 1.45% Employee HI: plus an additional…

A: Payroll Taxes: Payroll taxes refer to those taxes paid by both employer and employee in order to…

Q: thleen, age 56, works for MH Incorporated in Dallas, Texas. Kathleen contributes to a Roth 401(k),…

A: The contributions made to 401(K) plan are tax free so on withdrawal you hav to pay taxes. If you…

Q: Required: 1. Prepare a journal entry to record the development costs in each year of 2024 and 2025.…

A: A journal entry is a type of accounting entry that is used to record a business transaction in a…

Q: Computing the amount equity income and preparing [] consolidation journal entrie Assume that a…

A: Particulars Amount Net income reported by subsidiary for 2016 $ 500,000.00 Add: Unrealized…

Q: Larner Corporation is a diversified manufacturer of industrial goods. The company's activity-based…

A: calculation of unit product cost for each product list are as follows

Q: Swifty Corp., a public company using IFRS, signed a long-term non-cancellable purchase commitment…

A: Recording of journal entries is initial step in accounting cycle process, under this atleast one…

Q: Managerial accountants: Multiple Choice are responsible for issuing a company's annual financial…

A: MANAGERIAL ACCOUNTANTS ARE THE PERSON WHO FOCUS AND KEEPS CONTROL OVER DIFFERENT SEGMENTS OF AN…

Q: . Daily Edits Daily Edits: Cell Phones Redo the sentences with corrections. the first cell phone was…

A: The first cell phone was developed in the 1974 by a man named Martin Cooper. It was invented before…

Q: Caribu Company produces sanitation products after processing specialized chemicals; The following…

A: Joint cost allocation is needed to be done when after the split-off point a product is changed into…

Q: On December 31st, 2022 Czervik Construction had 60,000 shares of $50 par value common stock…

A: Lets understand the basics. Shares are listed mainly into two types which are, (1) Common stock (2)…

Q: Lovepreet's buys supplies to make pizzas at a cost of $5.54. Operating expenses of the business are…

A: Operating expenses = 5.54 ×146% = 8.0884

Q: Baab Corporation is a manufacturing firm that uses job-order costing. The company's inventory…

A: Manufacturing overhead is the overhead that includes all the indirect costs of the production of…

Q: Prepare journal entries for the transactions and events described.

A: Reeder company has acquired 82,000 shares of Needed Industries Common stock on March 20, 2016. The…

Q: From the following accounts, prepare in proper form a post-closing trial balance for Dave's Dog…

A: The closing entries are prepared to close the temporary accounts of the business. The post closing…

Q: Catégorie each of the following activities into the expenditures, conversion or revenues cycle and…

A: An company's monetary activities are documented, processed, and summarized using a set of procedures…

Q: Question Workspace Tibbs Inc. had the following data for the most recent year: Net income =…

A: The return on investment represents the net income earned for the average investment made by owner.…

Q: Parent Corporation acquired 90 percent of the outstanding voting stock of Subsidiary, Inc., on…

A: Consolidated financial statements includes all income, expenditure, assets and liabilities of group…

Q: Cummings Inc. had the following reconciliation at December 31, 20X0: Fair value of plan…

A: Honor Code- Since you have posted a question with multiple sub-parts, we will provide the solution…

Q: Three grams of musk oil are required for each bottle of Mink Caress, a very popular perfume made by…

A: Thew question is based on the concept of Cost Accounting. Direct materials purchase budget is based…

Q: The cost of the fine European mixers is expected to increase. Natalie has just negotiated new terms…

A: It has been given that the cost flow assumption for her mixer inventory are to be used for the value…

Q: Required: A sales invoice typically includes the date of sale, salesperson, customer data, items…

A: A foreign key (FK) is a column or combination of columns that is used to establish and enforce a…

Q: Semis Inc. has an average age of inventory of 70 days, an average collection period of 60 days and…

A: Cash conversion cycle (CCC) measures the amount of time a company take to converts its inventory to…

Q: Indicate whether each of the following items of IRS administrative guidance should be cited and…

A: The IRS administrative guidance relates to the different types of documents and guidance issued by…

Q: Financing for high-risk companies is often in the form of: Select one: O a. limited liability…

A: High-risk companies are those that are perceived to have a higher likelihood of defaulting on their…

Q: Splish Inc. had net income for the current year ending December 31, 2023 of $1,158,600. During the…

A:

Q: Prepare a store ledger card for January 2014 using the weight age average method and show the value…

A: Given in the question: The opening stock is 800 Units The total cost of the opening inventory is RM…

Q: Cassi (SSN 412-34-5670) has a home cleaning business she runs as a sole proprietorship. The…

A: Business Deductions: The deductions are allowed for the assets that a business organization…

Q: ocess inventory: ork in process inventory

A: Answer : Calculation of equivalent units : Total Equivalent units Equivalent units…

Q: fee shop wher specialty urtis cannot afford to pay for the mixer for at least 30 days. He asks…

A: The perpetual inventory system is the system of recording the inventory. Under this system, the…

Q: Betty DeRose, Inc. operates two departments, the handling department and the packaging department.…

A: Process costing is the one of the techniques of recording and estimating the costs. It is used when…

Q: Kathleen, age 56, works for MH Incorporated in Dallas, Texas. Kathleen contributes to a Roth 401(k),…

A: Kathleen is below 59 1/2, she is eligible for additional 10% penalty on early withdrawal

Q: Next compute the weighted-average contribution margin per unit. First identify the formula labels,…

A: Break Even Point :— It is the point of production where total cost is equal to total revenue. At…

Q: 8. Judie Co. provided $15,000 of social media consulting services to Soren Enterprises 2 years ago…

A: Account Receivables: Account receivables are one of the important current assets of the company that…

Q: On December 31, 2022, Ditka Incorporated had Retained Earnings of $277,800 before its closing…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Q: Aminu Ltd started a delivery service, Aminu Ltd Deliveries, on June 1, 20X1. The following…

A: Income statement determines the net income of the company which is difference between total revenues…

Q: The following T-accounts contain keyed entries representing five transactions involving the…

A: The journal entries are prepared to record the transactions on regular basis. The paid in capital in…

Q: What is the cost of goods sold for a company that has the following information: Beginning…

A: Cost of Goods Sold (COGS) is a calculation that represents the direct costs associated with…

Q: On January 1, 2025, Wildhorse Company purchased 6% bonds, having a maturity value of $510,000 for…

A: Introduction: An investor invests in bonds to earn regular interest payment over the period of bond…

Q: Speedway Corporation adjusts its books monthly. On September 30, 2021, notes receivable include the…

A: Notes - Notes is an instruments issued by the borrower. It is a promissory note carried fixed rate…

Q: Caribu Company produces sanitation products after processing specialized chemicals; The following…

A: Joint cost allocation: Sales value at split-off method: Total sales value at split-off = (400grams…

Q: The impairment loss $

A: Impairment Loss can be calculated by subtracting the Fair value from the Carrying value of the Net…

Q: In the 30 June 2020 annual report of Johnston Ltd, the equipment was reported as follows: P5,000,000…

A: Revaluation refers to the process of adjusting the value of a company's assets to reflect their…

Q: Prepare the journal entry to record amortization expense for 2020. Prepare the intangible assets…

A: Intangible asset is a type of asset which has no monetary value without any physical substance. Some…

Q: The following information has been extracted from the books of Gordon, a trader in furniture. 2015…

A: ACCOUTING FOR DISCOUNT Trade Discount is not Recorded in the Books of Accounts. Only Cash Discount…

Q: Kingbird Company began operations in 2024 and determined its ending inventory at cost and at…

A: Inventory write down - is the process in accounting that includes the recording of a decrease in the…

Q: Big Tommy Corporation is a local grocery store organized seven years ago as a corporation. The…

A: Income statement is referred to the financial statement which analyzes the financial performance of…

Q: Comparative consolidated balance sheet data for Iverson, Inc., and its 80 percent-owned subsidiary…

A: CASH FLOW STATEMENT Cash flow statement is additional information to user of financial statement.…

Q: Financial data for Joel de Paris, Incorporated, for last year follow: Joel de Paris,…

A: AVERAGE OPERATING ASSETS Average Operating Assets is Computed = (Beginning Operating Assets +…

Q: Record the allocation of over- or underapplied overhead.

A: A journal entry is a record of the a commercial transaction in a company's accounting system.…

Q: Baab Corporation is a manufacturing firm that uses job-order costing. The company's inventory…

A:

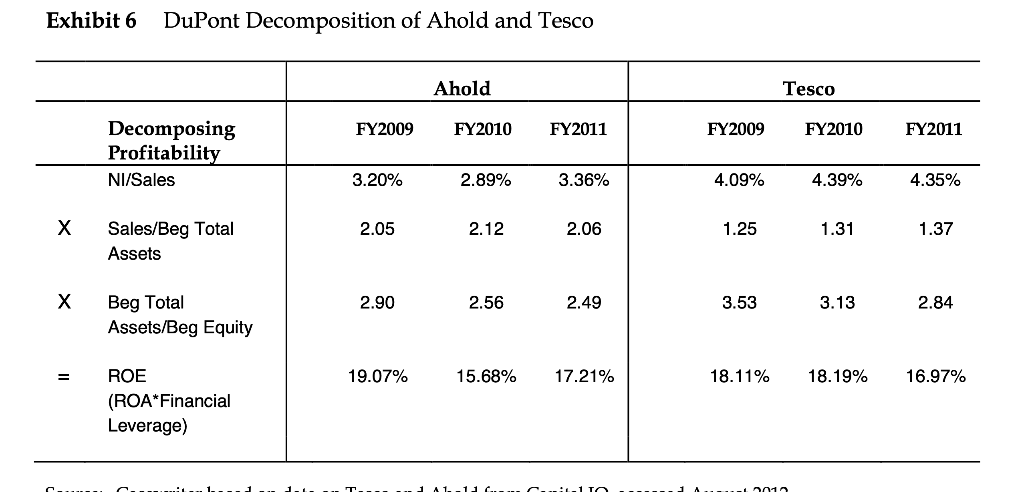

You are given financial statements and a Dupont analysis for Tesco and Ahold. What do you conclude about the two companies’ performances based on these numbers?

Step by step

Solved in 2 steps

- Inventory (01/10/18)Raw materials 28800Work in progress 37000Finished goods 33600Sales (114000 @c5) 57000Carriage on raw materials 1470General expenses 25200Selling expenses 51840Plant and machinery 250280Land 50000Bank overdraft 32120Retained earnings 816Ordinary share capital 2000008% preference share 22000Goodwill 40000Bad debts 830Trade receivables 36433Discount allowed 1440Sundry payable 56636Trade investment 8840Advertising 2250Return inwards 9000Discount received 1920Carriage outwards 2280Production wages 126000Office salaries 4860Purchases of raw materials 168000Noodles 15000Factory rent 13600Office insurance 40800Depreciation on plant and machinery 4920InventoryRaw materials 35400Work in progress 39120Loose tools 3000Additional informationDuring the year, 129000 pieces were completed. The closing inventory of finished goods is valued at the cost price per nose mask produced.Goods manufactured during the year are to be transferred to the trading account at GHc 390000.Provide…CP 13–5The following data are taken from the records of Cronkite Corp.:2019$2,5201,890630510$ 1202018$1,440960480430$ 50SalesCost of goods soldGross profitOther expensesNet incomeRequired: Perform horizontal analysis on the above date and interpretyour resultsROA=10% ROE=11.2% Current ratio=1.5 Quick ratio=0.9 gross profit margin=24% Sales=1650000 Earning available for common stock =140000 How total assets turnover?

- Current Asset 120 000Cash 20 000Accounts Receivable 45 000Short-term investments 12 000Merchandise Inventory 42 000Current Liabilities 68 000 What is the company's current ratio?What is the company's quick ratio?Q31 Each and every individual item in this method is recorded in balance sheet in ________ method taking in to consideration the ________ index according to the cost of replacing all the assets and liabilities rather than original cost. a. Historical cost ; General price index b. Current purchasing; General price index c. Replacement cost ; Specific price index d. Replacement cost ; General price indexCH11_HW_QA3_PIR Required 1: Compute the company’s return on investment (ROI) for the period using the ROI formula stated in terms of margin and turnover. (Round your intermediate calculations and final answer to 2 decimal places.) Margin not attempted % Turnover not attempted ROI not attempted % Required 2: Using Lean Production, the company is able to reduce the average level of inventory by $96,000. (The released funds are used to pay off short-term creditors.) (Round your intermediate calculations and final answers to 2 decimal places.) Effect Margin % Turnover ROI % Required 3: The company achieves a cost savings of $14,000 per year by using less costly materials. (Round your intermediate calculations and final answers to 2 decimal places.) Effect Margin % Turnover ROI % Required 4: The…

- E23.10B (L0 1,4) (Classification of Transactions) Following are selected balance sheet accounts of BioLazer Corp. at December 31, 2020 and 2019, and the increases or decreases in each account from 2019 to 2020. Also presented is selected income statement information for the year ended December 31, 2020, and additional information. Increase Selected balance sheet accounts 2020 2019 (Decrease)AssetsAccounts receivable $154,000 $120,000 $34,000Property, plant, and equipment 631,000 581,000 50,000Accumulated…tion 8Income statement for the year ended 31 December, 2019 of KKMTN Ghana Ltd2018 2019ȼ ‘000 ȼ ‘000Turnover 420,000 523,600Cost of sales (330,000) (417,200)Gross profit 89,000 106,400Expenses:Administration 44,600 50,200Selling and distribution 15,400 (60,000) 19,600 (69,800)Profit before interest 29,000 36,600Debenture interest - (2,800)Net profit before tax 29,000 33,800Taxation (8,000) (10,000)Net Profit after tax 21,000 23,800Ordinary dividend paid 8,400 9,250Ordinary shares issued 12 million and trading at ȼ3 each as at yesterday onGSE.You are required to compute the following investment ratios:a). Earnings per shareb). Dividend per sharec). Payout ratiod). Price earnings ratioe). Earnings yield5. For the movement of the INVEST commodity from 01.01.20X1 to 31.12.20X1 you are given the following information: Initial Inventory and Purchases: Units unit price Total 01/01/20X1 Initial Stock 700 350 245.000,00 12/03/20X1 Market 1 270 400 108.000,00 05/06/20X1 Market 2 400 420 168.000,00 12/09/20X1 Market 3 500 440 220.000,00 21/11/20X1 Market 4 200 460 92.000,00 Total 2070 833.000,00 Sales: Units unit price Total 15/02/20X1 Sale 1 300 710 213.000,00 20/05/20X1 Sale 2 500 730 365.000,00 10/09/20X1 Sale 3 400 740 296.000,00 10/12/20X1 Sale 4 750 750 562.500,00 0,00 Total 1950 1.436.500,00 Whereas: A. ABC determines the cost of its goods sold on the basis of: The FIFO method The method of the weighted average (cost) B. During the inventory of the goods on 31/12/20X1 it was found that its current price amounted to € 520 per unit. It is requested to calculate without calendar entries: the cost of…

- inv 3Company A sells only one product X. At the inventory on 31/12/20X5 it was found that there were 500 pieces of X in the warehouse at a cost of EUR 30 per piece. The net realisable market value of X was estimated at EUR 28 per piece but X also has a written non-cancellable agreement to sell 300 pieces of X to company B at EUR 31 per piece. At what value will X's stock be valued?In FY20X6 all the beginning inventory was sold. In particular, the 200 pieces that were valued to KAP were sold at € 35 per piece.Carry out the journal entries resulting from the above events up to the calculation of gross profit.Question EXHIBIT 1: ANNUAL RETURNS (%) YEAR ALUWORKS AGA Lyxor USDJIA Lyxor World 2009 2.00 5.86 5.56 7.69 2010 4.25 22.40 6.11 5.79 2011 -29.40 -27.07 7.94 -3.28 2012 13.23 0.60 18.29 20.75 2013 8.86 -6.84 17.09 14.14 2014 2.31 33.87 14.20 15.06 2015 -2.96 -9.28 -4.71 -4.28 EXHIBIT 2: PORTFOLIO WEIGHTS (%) ASSETS EXISTING PORTFOLIO NEW PORTFOLIO ALUWORKS 60 40 AGA 40 30 LYXOR 30 Required1.Using the annual return data provided in Exhibit 1 of the case for ALUWORKS and AGA,calculate their mean returns, standard deviations, covariance, and correlation. With these numbers,calculate the standard deviation and return for Desiree Mofakye’s entire portfolio. 2. After adding Lyxor USDJIA, what is the portfolio’s new standard deviation and return? Howdoes the new portfolio compare with the calculation in Question 1? 3. Based on your data analysis, should Desiree Mofakye diversify her portfolio or remain invested in SA and GHANA only? 4. Calculate the…Solution to Ratio Analysis Questions Selected ratios formulars Unilever 2021 BOPP 2021 ROCE PBIT / net assets * 100 (32,424/39,406 *100 = - 82% 102,154 / 192,758 *100 =53% Net Assets Turnover Revenue / Net Assets 526,912 / 39,406 = 13 times 214,174 / 192,758 = 1 time Gross Profit Margin Gross profit / revenue *100 97,046 / 526,912 *100 18.4% 115,462 / 214,174 * 100 54% Net Profit Before Tax PBT / revenue * 100 (35,005) / 526,912* 100 = -6.6% 104,778 / 214,174* 100 =48.9% Current Ratio Current assets / current liabilities 214,665/341,171 = 0.5 139,104 / 30,368 = 4.5 Quick Ratio Current assets – inventory / current liabilities 214,665-91,627 /341,171 = 0.4 139,104 -13,248/ 30,368 = 4.1 Inventory Days Inventory / cost of sales * 365 days 91,627/ 429,866 *365 = 77 days 13,248 / 101,397 *365 = 47 days Receivable Days Receivables / cost of sales * 365 days 24,515 / 429,866 *365 =20 days 92,860 /…