Read the scenario below and answer the following question. Chen at Chen Construction works on new neighbourhood developments that take many months to complete. They often cross a fiscal year. He typically requires a deposit from the homeowners. When a 3rd customer called to complain that they had recently overpaid for a home build, Chen discovered that their $200,000 deposit was still sitting in the Customer Deposits liability account. Due to this and other errors, he has just fired his bookkeeper and hired you to review and fix his books. He's looking for you to advise him on correct procedures to use going forward What step was missed from the Unearned Income workflow to cause this scenario? A Recording the customer deposit into the Customer Deposits liability account BO Recording a credit memo to reflect the amount of the deposit CO Writing a cheque to refund the overpayment DO Recording the deposit as a negative amount on invoices E Mapping the Customer Deposit product/service item to the correct income account

Read the scenario below and answer the following question. Chen at Chen Construction works on new neighbourhood developments that take many months to complete. They often cross a fiscal year. He typically requires a deposit from the homeowners. When a 3rd customer called to complain that they had recently overpaid for a home build, Chen discovered that their $200,000 deposit was still sitting in the Customer Deposits liability account. Due to this and other errors, he has just fired his bookkeeper and hired you to review and fix his books. He's looking for you to advise him on correct procedures to use going forward What step was missed from the Unearned Income workflow to cause this scenario? A Recording the customer deposit into the Customer Deposits liability account BO Recording a credit memo to reflect the amount of the deposit CO Writing a cheque to refund the overpayment DO Recording the deposit as a negative amount on invoices E Mapping the Customer Deposit product/service item to the correct income account

Chapter9: Deductions: Employee And Self-employed-related Expenses

Section: Chapter Questions

Problem 35P

Related questions

Question

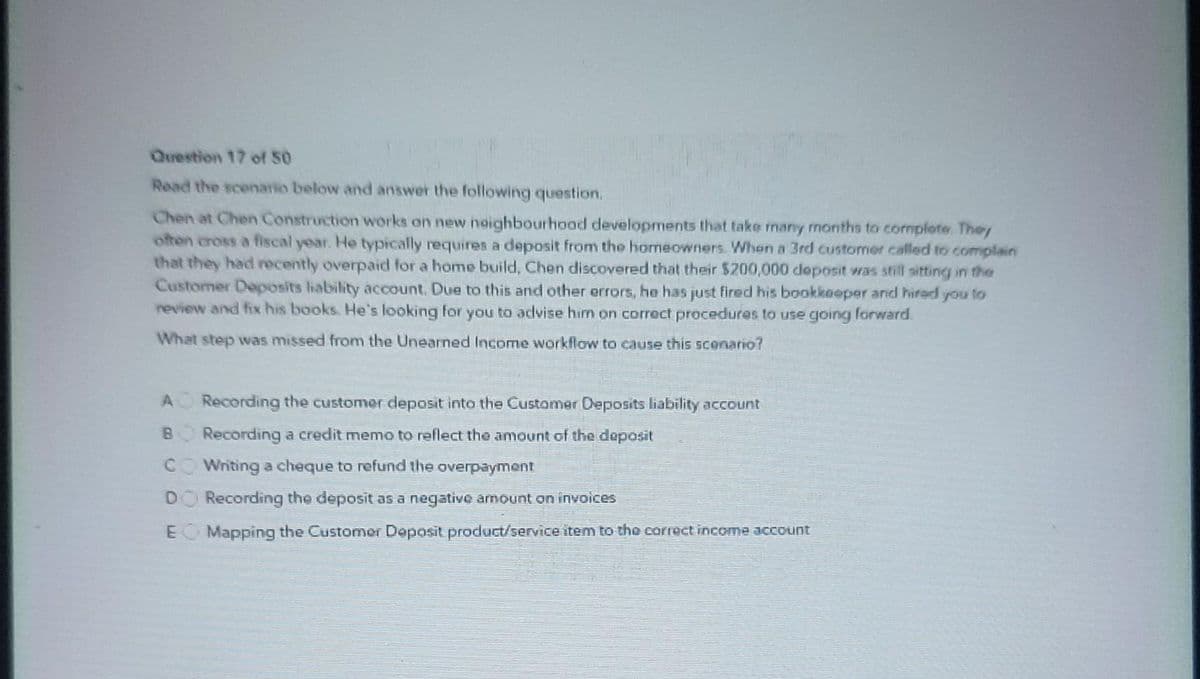

Transcribed Image Text:Question 17 of 50

Read the scenario below and answer the following question.

Chen at Chen Construction works on new neighbourhood developments that take many months to complete. They

often cross a fiscal year. He typically requires a deposit from the homeowners. When a 3rd customer called to complain

that they had recently overpaid for a home build, Chen discovered that their $200,000 deposit was still sitting in the

Customer Deposits liability account. Due to this and other errors, he has just fired his bookkeeper and hired you to

review and fix his books. He's looking for you to advise him on correct procedures to use going forward.

What step was missed from the Unearned Income workflow to cause this scenario?

A

Recording the customer deposit into the Customer Deposits liability account

B

Recording a credit memo to reflect the amount of the deposit

CO Writing a cheque to refund the overpayment

DO Recording the deposit as a negative amount on invoices

E Mapping the Customer Deposit product/service item to the correct income account

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,