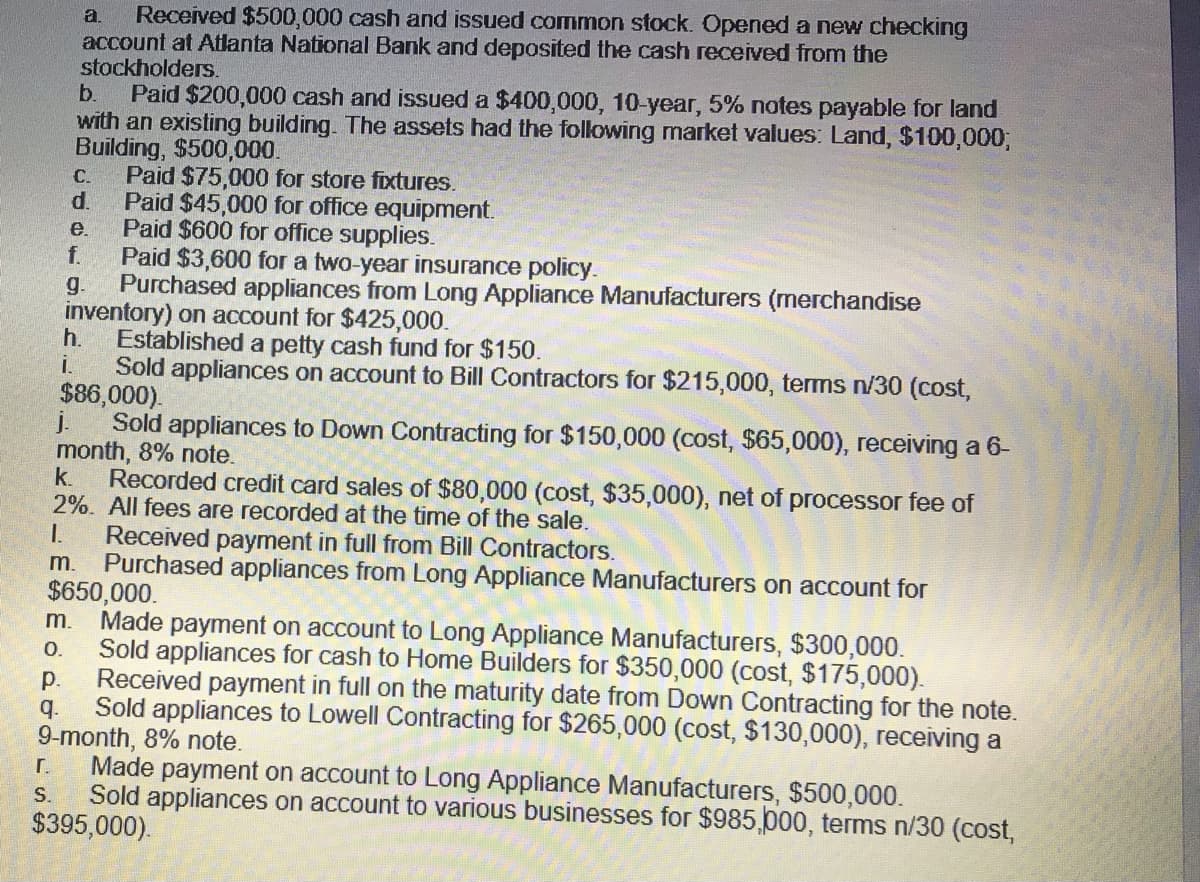

Recerved $500,000 cash and issued common stock. Opened a new checking account at Atlanta National Bank and deposited the cash received from the stockholders. b. a. Paid $200,000 cash and issued a $400,000, 10-year, 5% notes payable for land with an existing building. The assets had the following market values: Land, $100,0003; Building, $500,000. Paid $75,000 for store fixtures. d. C. Paid $45,000 for office equipment. Paid $600 for office supplies. Paid $3,600 for a two-year insurance policy. e. f. g. Purchased appliances from Long Appliance Manufacturers (merchandise inventory) on account for $425,000. h. Established a petty cash fund for $150. i. Sold appliances on account to Bill Contractors for $215,000, terms n/30 (cost, $86,000). j. Sold appliances to Down Contracting for $150,000 (cost, $65,000), receiving a 6- month, 8% note. k. Recorded credit card sales of $80,000 (cost, $35,000), net of processor fee of 2%. All fees are recorded at the time of the sale. I. Received payment in full from Bill Contractors. Purchased appliances from Long Appliance Manufacturers on account for $650,000. Made payment on account to Long Appliance Manufacturers, $300,000. Sold appliances for cash to Home Builders for $350,000 (cost, $175,000). Received payment in full on the maturity date from Down Contracting for the note. m. m. 0. р. Sold appliances to Lowell Contracting for $265,000 (cost, $130,000), receiving a 9-month, 8% note. Made payment on account to Long Appliance Manufacturers, $500,000. Sold appliances on account to various businesses for $985,0p00, terms n/30 (cost, $395,000). q. г. S.

Recerved $500,000 cash and issued common stock. Opened a new checking account at Atlanta National Bank and deposited the cash received from the stockholders. b. a. Paid $200,000 cash and issued a $400,000, 10-year, 5% notes payable for land with an existing building. The assets had the following market values: Land, $100,0003; Building, $500,000. Paid $75,000 for store fixtures. d. C. Paid $45,000 for office equipment. Paid $600 for office supplies. Paid $3,600 for a two-year insurance policy. e. f. g. Purchased appliances from Long Appliance Manufacturers (merchandise inventory) on account for $425,000. h. Established a petty cash fund for $150. i. Sold appliances on account to Bill Contractors for $215,000, terms n/30 (cost, $86,000). j. Sold appliances to Down Contracting for $150,000 (cost, $65,000), receiving a 6- month, 8% note. k. Recorded credit card sales of $80,000 (cost, $35,000), net of processor fee of 2%. All fees are recorded at the time of the sale. I. Received payment in full from Bill Contractors. Purchased appliances from Long Appliance Manufacturers on account for $650,000. Made payment on account to Long Appliance Manufacturers, $300,000. Sold appliances for cash to Home Builders for $350,000 (cost, $175,000). Received payment in full on the maturity date from Down Contracting for the note. m. m. 0. р. Sold appliances to Lowell Contracting for $265,000 (cost, $130,000), receiving a 9-month, 8% note. Made payment on account to Long Appliance Manufacturers, $500,000. Sold appliances on account to various businesses for $985,0p00, terms n/30 (cost, $395,000). q. г. S.

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 16EA: Discuss how each of the following transactions for Watson, International, will affect assets,...

Related questions

Topic Video

Question

Record each transaction in a journal entry . Explanations are not required.

Transcribed Image Text:Received $500,000 cash and issued common stock. Opened a new checking

account at Atlanta National Bank and deposited the cash received from the

stockholders.

b.

a.

Paid $200,000 cash and issued a $400,000, 10-year, 5% notes payable for land

with an existing building. The assets had the following market values: Land, $100,000;

Building, $500,000.

Paid $75,000 for store fixtures.

d.

C.

Paid $45,000 for office equipment.

Paid $600 for office supplies.

Paid $3,600 for a two-year insurance policy.

e.

f.

g.

Purchased appliances from Long Appliance Manufacturers (merchandise

inventory) on account for $425,000.

h.

Established a petty cash fund for $150.

i.

Sold appliances on account to Bill Contractors for $215,000, terms n/30 (cost,

$86,000).

j.

Sold appliances to Down Contracting for $150,000 (cost, $65,000), receiving a 6-

month, 8% note.

k.

Recorded credit card sales of $80,000 (cost, $35,000), net of processor fee of

2%. All fees are recorded at the time of the sale.

I.

Received payment in full from Bill Contractors.

Purchased appliances from Long Appliance Manufacturers on account for

$650,000.

Made payment on account to Long Appliance Manufacturers, $300,000.

Sold appliances for cash to Home Builders for $350,000 (cost, $175,000).

m.

m.

O.

р.

Received payment in full on the maturity date from Down Contracting for the note.

q.

Sold appliances to Lowell Contracting for $265,000 (cost, $130,000), receiving a

9-month, 8% note.

Made payment on account to Long Appliance Manufacturers, $500,000.

Sold appliances on account to various businesses for $985 000, terms n/30 (cost,

$395,000).

r.

S.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning