Record entry to adjust the bonds to their fair value for presentation in the December 31, 2024, balance sheet.

Q: Piper Recreational Vehicles (PRV) modifies vans into recreational vehicles. PRV offers two models,…

A: Material and conversion costs are the main types of expenses encountered in manufacturing…

Q: Alford, Beeson, and Carlton have operated a coffee shop for a number of years as a partnership. At…

A: The ending balance is computed in a statement separately from the income statement or balance…

Q: Required information [The following information applies to the questions displayed below) RunHeavy…

A: Journal entry is an art of recording classifying and summarising the business transaction into…

Q: On a statement of cash flows, the net increase (decrease) in cash: is not always determinable…

A: The statement of cash flows is prepared to show the inflows and outflows of the cash. Cash flows are…

Q: 2-a. Using the high-low method, separate each mixed expense into variable and fixed eleme…

A: Classification of expenses:(i) Variable costs: Cost of goods sold(ii) Fixed Cost:…

Q: Calculate Crane's weighted average number common shares outstanding. (For your calculation, round…

A: The weighted average common shares outstanding is calculated by combining the number of common…

Q: Superior Company provided the following data for the year ended December 31 (all raw materials are…

A: Cost of goods sold means the cost incurred on the goods which has been sold out. Cost of goods sold…

Q: Required information [The following information applies to the questions displayed below.] Jacob is…

A: Qualified business income means the deduction of tax which is allowed to small business and…

Q: Which of the following statements regarding constructive dividends is not correct? a. Constructive…

A: It is the tax deduction on dividends received by a corporation from other corporations in which the…

Q: Whirly Corporation's contribution format income statement for the most recent month is shown below:…

A: The income statement shows the financial position of the company whether the business is making a…

Q: Newton Labs leased chronometers from Brookline Instruments on January 1, 2024. Brookline Instruments…

A: Lease is a financial arrangement in which one party agrees to grant the right of use of its asset to…

Q: The periodic inventory records of Synergy Prosthetics indicate the following for the month of July:…

A: Ending inventory is the amount of inventory that an entity has on hand, at the end of the period. It…

Q: Stark Company has five employees. Employees paid by the hour earn $10 per hour for the regular…

A: "Since you have asked a question with sub-parts more than three, as per guidelines, the first three…

Q: The following facts pertain to a non-cancelable lease agreement between Sandhill Leasing Company and…

A: A lease's amortization schedule is a table that shows the monthly lease payments together with…

Q: Newton Labs leased chronometers from Brookline Instruments on January 1, 2024. Brookline Instruments…

A: Lease is a financial arrangement in which one party agrees to grant the right of use of its asset to…

Q: Kenartha Oil recently paid $477,900 for equipment that will last five years and have a residual…

A: Depreciation means the loss in value of assets because of usage of assets, passage of time or change…

Q: Service organization control (SOC) reports may be requested by auditors when a service organization…

A: SOC Type 1 report evaluates the control of service organization over financial reporting. The report…

Q: Determine the amount of the late filing and late payment penalties that apply for the following…

A: Answer:- Any individual or business that fails to pay taxes on time may incur a penalty. Every year,…

Q: On January 1, 2024, Nath - Langstrom Services, Incorporated, a computer software training firm,…

A: A operating lease refers to contract that allows to use the asset. However, ownership rights of the…

Q: On December 31, 2024, the inventory of Tamarisk Company amounts to $912,000. During 2025, the…

A: Inventory is a part of the of the asset of the company and it is generally classified as a current…

Q: and Bobby Morett formed a Determine their participation in the year's net income of $275,000 under…

A: Partnership: A formal agreement between two or more people to run a business together and split the…

Q: Rembrandt Paint Company had the following income statement items for the year ended December 31,…

A: Income Statement -A company's financial success for a given accounting period is reported via the…

Q: Gruman Company purchased a machine for $198,000 on January 2, Year 1. It made the following…

A: The objective of the question is to calculate the book value of the machine under different…

Q: Any sale of securities outside an associated person's or the employing member firm's regular…

A: Sale of Securities:means any issuance, sale, assignment, transfer, distribution or other disposition…

Q: issuance of a written report. Required: a. What is the purpose of the. auditors' opinion and report?…

A: The auditor's report contains either an opinion on the financial statements., taken as a whole, or…

Q: un store, and during the current year purchased $580,000 worth of inventory. Torrey's beginning…

A: COGS is known as Cost of Goods Sold. These are the direct costs which occur in producing the goods…

Q: Cash dividends were $33. The company sold equipment for $63 that was originally purchased for $33…

A: To calculate the net cash provided by or used in investing activities, we need to consider the cash…

Q: Here is financial information for Sheridan Inc. Current assets Plant assets (net) Current…

A: Horizontal Analysis: It refers to a technique that is used by a business to analyze or evaluate it's…

Q: In 2022, Henry Jones (Social Security number 123-45-6789) works as a freelance driver, finding…

A: Note :QBI = (Income - Standard deduction) * 20%

Q: Accounting equation Determine the missing amount for each of the following: a. b. C. Assets = =…

A: Accounting equation is a mathematical equation that shows relationship between assets, liabilities…

Q: Account Title Cash Accounts receivable Inventory Equipment Accumulated depreciation. Accounts…

A: As per dual concept of accounting, every transaction has dual impact on the books of accounts.Trial…

Q: The plant building of Xon Corporation is old (estimated remaining useful life is 12 years) and needs…

A: Repairs & Maintenance Expense: It refers to the expense that is incurred by the business to…

Q: Exercise 4 - 4 (Algo) Multiple - step continuous statement of comprehensive income [LO 4-1, 4-6] The…

A: Comprehensive Income Statement: This refers to a financial statement that reflects or shows both the…

Q: [The following information applies to the questions displayed below. Laker Company reported the…

A: The specific identification method relates to inventory valuation, specifically keeping track of…

Q: a. The cash budget for March shows an ending loan balance of $10,000 and an ending cash balance of…

A: Financial statement means statement which shows the financial position as on date and financial…

Q: Sales Supervisor's Salary Cleaning Sales office Direct labor Fire Insurance - Factory Mo Finished…

A: The manufacturing costs comprise direct materials, direct labor and overhead applied costs. The…

Q: cme Company is a manufacturer. Here are data regarding the current month: Sales revenue Fixed…

A: INCOME STATEMENTIncome Statement is one of the Important Financial Statements of the Company. Income…

Q: Great Furniture Inc. (GF) manufactures a variety of furniture for household use and just two items…

A: Manufacturing Cost -The expenses incurred in the process of producing a product are known as…

Q: Larkspur Corporation borrowed $78,000 on November 1, 2025, by signing a $79,755, 3-month,…

A: Journal entries are part of a bookkeeping system that records day-to-day business-related monetary…

Q: QUESTION 2 Accounting for the exchange of assets depends on whether the transaction has commercial…

A: Introduction:An asset exchange is a type of transaction where two parties exchange assets or goods.…

Q: Indirect Method- Preparing a Statement of Cash Flows Calex Inc. reported the following December 31…

A: The operating section of statement of cash flows under indirect method is prepared by adjusting non…

Q: Roof Living sells outdoor furniture and accessories, It operates in a province which has a 7% PST…

A: GST: The federal government imposes a 5% value-added tax known as the GST. It is applied to…

Q: Two items are omitted from each of the following three lists of cost of goods manufactured statement…

A: Work in process inventory represents the units, upon which manufacturing processes are applied and…

Q: White Mountain Supply Company purchases warehouse shelving for $18,500. Shipping charges were $370,…

A: An item of property, plant and equipment that qualifies for recognition as anasset shall be measured…

Q: Problem 8-70 (LO 8-4) (Algo) Skip to question [The following information applies to the questions…

A: The Child Tax Credit is a tax benefit provided by the U.S. government to parents or guardians who…

Q: A business school has a goal that the average number of years of work experience of its MBA…

A: The objective of the question is to determine whether the business school is meeting its goal of…

Q: Budgeted Cost Activity $ 57,600 Clerical support Facility services Client consultations 20, 160…

A: Under Activity Based Costing, Activity rates are calculated for each Overhead cost pool. Such…

Q: Question Content AreaDuring 2023, Jamal and Judy, a married couple, decided to sell their residence,…

A: To determine the recognized gain on the sale of their residence, we need to calculate the adjusted…

Q: Carla Vista Pine Co. provided the following information on selected transactions during 2021:…

A: Cash flow from investing activity includes transactions like the purchase and sale of long-term…

Q: The following information was drawn from the records of Milan Company. Revenue Cost of goods sold…

A: Income statement is a financial statement that records all the income and expenses of the business…

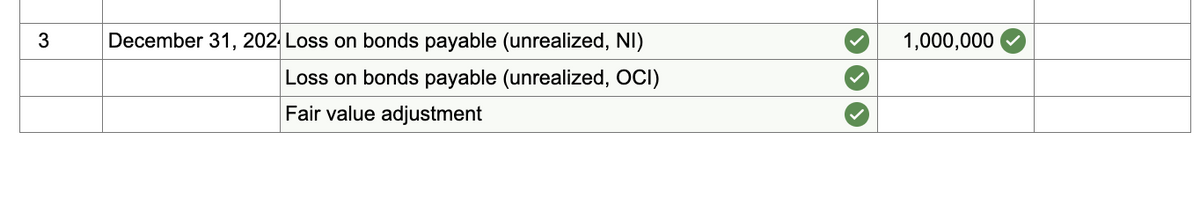

On January 1, 2024, Rapid Airlines issued $205 million of its 6% bonds for $188 million.

- The

bonds were priced to yield 8%. - Interest is payable semiannually on June 30 and December 31.

- Rapid Airlines records interest at the effective rate and elected the option to report these bonds at their fair value.

- On December 31, 2024, the fair value of the bonds was $194 million as determined by their market value in the over-the-counter market.

- Rapid determined that $1,000,000 of the increase in fair value was due to a decline in general interest rates.

Record entry to adjust the bonds to their fair value for presentation in the December 31, 2024, balance sheet.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images

- Ma2. on January 1 2020, marin incorporated redeemed bonds prior to their maturity date of january 1, 2021. the face value of the bonds was $510,000, and the redemption was performed at 97. as at the redemption date, the unamortized premium was $8,780. prepare the corporation's journal entry to record the redemption of the bonds.Bonds Payable has a balance of $987,000 and Premium on Bonds Payable has a balance of $10,857. If the issuing corporation redeems the bonds at 102, what is the amount of gain or loss on redemption? Select the correct answer. a-$10,857 loss b-$8,883 gain c-$10,857 gain d-$8,883 lossl-Itihad Corporation Balance SheetDecember 31, 2019AssetsLiability & EquityCurrent AssetsCurrent LiabilityCash$5,000Accounts payable22,000Short term securities10,000Accrual Account8,000Account Receivables30,000Short term debt6,000Inventory32,000Total Current Liability36,000Long-term debt40,000Total Current Assets77,000TotalLiability76,000Long term AssetsEquityNet Property & equipment70,000CommonStocks64,000Retained earnings17,000Total Equity81,000Total Liability and Equity157,000Other assts 10000Total Assets157,000Sur Corporation Income StatementDecember 31, 2019Other Financial information of Sur corporation December 31, 2019Net sales (revenue)$150,000· Average Number of Common shares outstanding 16,000 Shares· Market price of Common share $3.5Cost of goods sold80,000Gross profit70,000Operating expenses30,000EBIT- (Operating profit)40,000Interest expense10,000EBT- ( Earnings before taxes)30,000Income tax 10,000Net Income (net profit)20,000You have to find the following ratios…

- Refer to the information in RE13-5. Assume that on December 31, 2019, the investment in Smith Corporation bonds has a market value of 12,500. Prepare the year-end journal entry to record the unrealized gain or loss.on may 21 1020, an entity acquired P 1,600,000 9% bonds at 97 plus accrued interest.Interest bond is paayable semiannually on march 1 and september 1 and bonds mature on september 1, 2023. the entity intended to hold these bond until they mature. Due to an isolated events that is beyond the entity control, the entity sold bonds of 480,000 for 103 plus accrued interest on MAy 1, 2021. On July 1, 2022, bonds of 640,000 were exchanged for 90,000 ordinanry shares, to par value, qouted on the market on this date 8 per share. Interest was received on bonds to date of exchage. On september 1, 2023, remaining bonds were redeemed and accrued interest was received. use straight line method. compute for the total interest income for 2020.17. When a debt investment at FVOCI is reclassified to FVPL, an entity willa. Remeasure the investment to the original cost and eliminate the cumulative unrealized gain or loss in OCI.b. Transfer the cumulative unrealized gain or loss to retained earningsc. The cumulative gain or loss previously recognized in OCI is reclassified to profit or loss.d. The effective rate at the date of reclassification shall be the basis for interest income to be recognized in subsequent periods.

- Entries for Available-for-Sale Securities) Assume the same information as in E16.3 except that the securities are classified as available-for-sale. The fair value of the bonds at December 31 of each year-end is as follows. 2025 $320,000 2026 $309,000 2027 $308,000 2028 $310,000 2029 $300,000 Instructions a. Prepare the journal entry at the date of the bond purchase. b. Prepare the journal entries to record the interest revenue and recognition of fair value for 2025. c. Prepare the journal entry to record the recognition of fair value for 2026. E16.3 Carow Corporation purchased on January 1, 2025, as a held-to-maturity investment, $60,000 of the 8%, 5-year bonds of Harrison, Inc. for $65,118, which provides a 6% return. The bonds pay interest semiannually. Prepare Carow’s journal entries for (a) the purchase of the investment, and (b) the receipt of semiannual interest and premium amortization. Assume effective-interest amortization is used.Dodd Co.'s debt securities at December 31 included available-for-sale securities with a cost basis of $24, 000 and a fair value of $30,000. Dodd's income tax rate was 20% . What amount of unrealized gain or loss should Dodd recognize in its income statement at December 31?If the bonds are retired on January 1, 2021, at 103, what will SIGE NA report as a loss on redemption? *see attached a. P 250,000b. P 365,000c. P 400,000d. P 425,000

- #8 ABC Company purchased $3500000 of 9%, 5-year bonds from XYZ, Inc. on January 1, 2021, with interest payable on July 1 and January 1. The bonds sold for $3624740 at an effective interest rate of 8%. Using the effective-interest method, ABC Company decreased the Available-for-Sale Debt Securities account for the XYZ, Inc. bonds on July 1, 2021 and December 31, 2021 by the amortized premiums of $11620 and $11980, respectively.On December 31, 2021, the fair value of the XYZ, Inc. bonds was $3680000. What should ABC report as other comprehensive income and as a separate component of stockholders' equity? $78860. No entry should be made. $55260. $23600.How much should be recorded as the purchase price of theindividual PPE items: 4. Issued bonds with face value of P5,000,000 and fair value ofP5,100,000 to purchase equipment with a fair value ofP4,900,000.16. When a debt investment at FVOCI is reclassified to amortized cost, the entity will a. Remeasure the financial asset to original cost. b. The effective rate used for amortization shall be the effective rate at the date of reclassification. c. The cumulative gain or loss previously recognized in OCI is removed from equity and adjusted against the fair value at the reclassification date. d. The cumulative gain or loss previously recognized in OCI is removed from equity and transferred to profit and loss.