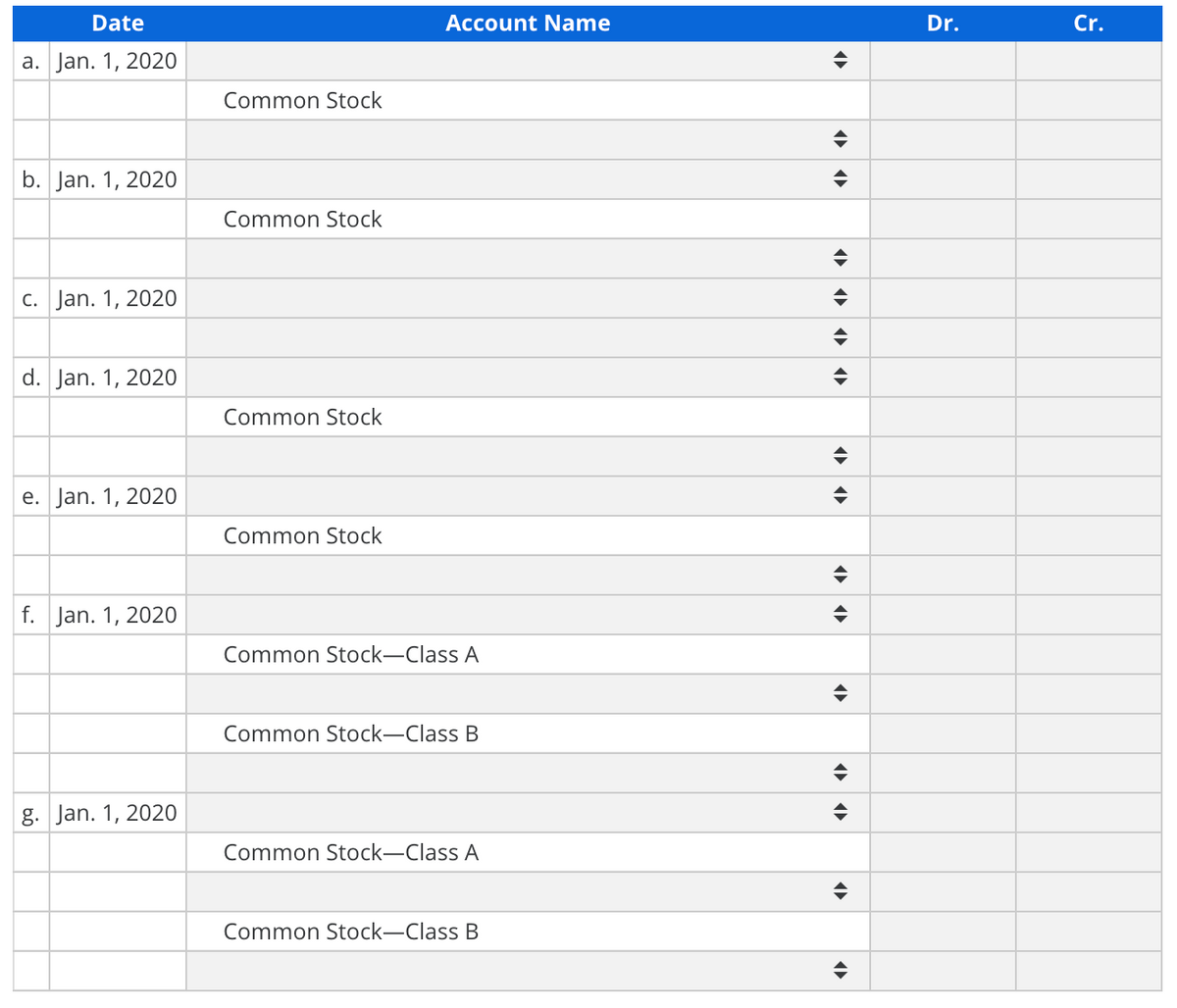

Record journal entries for the following separate transactions. a. Max Inc. issued 15,000 shares of $1 par value common stock for $20 per share on January 1, 2020. b. Max Inc. issued 3,000 shares of no-par common stock for $25 per share on January 1, 2020. The state of incorporation requires a minimum value per share of $2. c. Max Inc. issued 1,500 shares of no-par common stock for $18 per share on January 1, 2020. d. Max Inc. issued 15,000 shares of $1 par value common stock for $18 per share on January 1, 2020, and incurred $3,000 in legal fees related to the stock issuance. e. Max Inc. issued 30,000 shares of common stock ($1 par) in exchange for equipment with a fair value of $534,000. f. Max Inc. issued 9,000 shares of Class A common stock ($1 par) and 12,000 shares of Class B common stock ($2 par) at a price of $240,000. At the time of issuance, the market price of the Class A common stock is $15 per share, and the market price of the Class B common stock is $10 per share. g. Max Inc. issued 9,000 shares of Class A common stock ($1 par) and 12,000 shares of Class B common stock ($2 par) at a price of $255,000. At the time of issuance, the market price of the Class A common stock is $16 per share, and the market price of the Class B common stock is unknown

Recording Entries for Common Stock Issuance

Record

a. Max Inc. issued 15,000 shares of $1 par value common stock for $20 per share on January 1, 2020.

b. Max Inc. issued 3,000 shares of no-par common stock for $25 per share on January 1, 2020. The state of incorporation requires a minimum value per share of $2.

c. Max Inc. issued 1,500 shares of no-par common stock for $18 per share on January 1, 2020.

d. Max Inc. issued 15,000 shares of $1 par value common stock for $18 per share on January 1, 2020, and incurred $3,000 in legal fees related to the stock issuance.

e. Max Inc. issued 30,000 shares of common stock ($1 par) in exchange for equipment with a fair value of $534,000.

f. Max Inc. issued 9,000 shares of Class A common stock ($1 par) and 12,000 shares of Class B common stock ($2 par) at a price of $240,000. At the time of issuance, the market price of the Class A common stock is $15 per share, and the market price of the Class B common stock is $10 per share.

g. Max Inc. issued 9,000 shares of Class A common stock ($1 par) and 12,000 shares of Class B common stock ($2 par) at a price of $255,000. At the time of issuance, the market price of the Class A common stock is $16 per share, and the market price of the Class B common stock is unknown

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images