Recording Entries for HTM Debt Securities— Effective Interest Method On July 1, 2020, West Company purchased for cash, sixteen $10,000 bonds of North Corporation to yield 10%. The bonds pay 9% interest, payable on a semiannual basis each July 1 and January 1, and mature on July 1, 2023. The bonds are classified as held-to-maturity securities. The annual reporting period ends December 31. Assume the effective interest method of amortization of any discount or premium. d. Indicate the effects of this investment on the 2020 income statement and year-end balance sheet. Note: List accounts in alphabetical order

Recording Entries for HTM Debt Securities— Effective Interest Method On July 1, 2020, West Company purchased for cash, sixteen $10,000 bonds of North Corporation to yield 10%. The bonds pay 9% interest, payable on a semiannual basis each July 1 and January 1, and mature on July 1, 2023. The bonds are classified as held-to-maturity securities. The annual reporting period ends December 31. Assume the effective interest method of amortization of any discount or premium. d. Indicate the effects of this investment on the 2020 income statement and year-end balance sheet. Note: List accounts in alphabetical order

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 76E

Related questions

Question

Recording Entries for HTM Debt Securities— Effective Interest Method

On July 1, 2020, West Company purchased for cash, sixteen $10,000 bonds of North Corporation to yield 10%. The bonds pay 9% interest, payable on a semiannual basis each July 1 and January 1, and mature on July 1, 2023. The bonds are classified as held-to-maturity securities. The annual reporting period ends December 31. Assume the effective interest method of amortization of any discount or premium.

d. Indicate the effects of this investment on the 2020 income statement and year-end balance sheet.

Note: List accounts in alphabetical order.

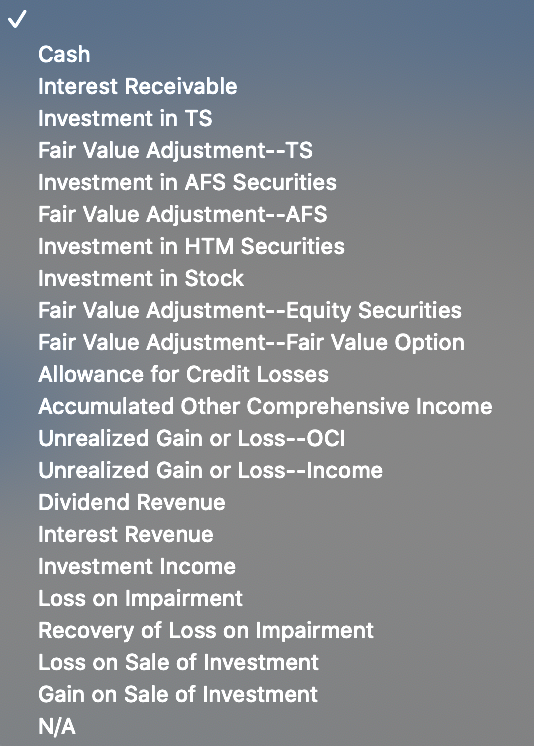

Transcribed Image Text:Cash

Interest Receivable

Investment in TS

Fair Value Adjustment--TS

Investment in AFS Securities

Fair Value Adjustment--AFS

Investment in HTM Securities

Investment in Stock

Fair Value Adjustment--Equity Securities

Fair Value Adjustment--Fair Value Option

Allowance for Credit Losses

Accumulated Other Comprehensive Income

Unrealized Gain or Loss--OCI

Unrealized Gain or Loss--Income

Dividend Revenue

Interest Revenue

Investment Income

Loss on Impairment

Recovery of Loss on Impairment

Loss on Sale of Investment

Gain on Sale of Investment

N/A

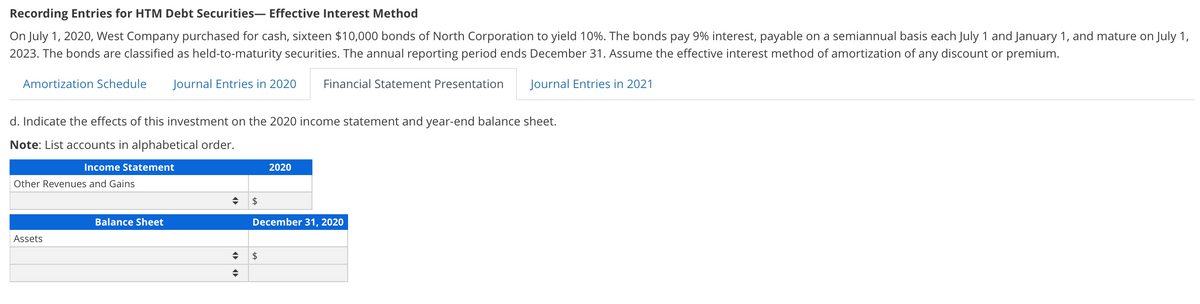

Transcribed Image Text:Recording Entries for HTM Debt Securities- Effective Interest Method

On July 1, 2020, West Company purchased for cash, sixteen $10,000 bonds of North Corporation to yield 10%. The bonds pay 9% interest, payable on a semiannual basis each July 1 and January 1, and mature on July 1,

2023. The bonds are classified as held-to-maturity securities. The annual reporting period ends December 31. Assume the effective interest method of amortization of any discount or premium.

Amortization Schedule

Journal Entries in 2020

Financial Statement Presentation

Journal Entries in 2021

d. Indicate the effects of this investment on the 2020 income statement and year-end balance sheet.

Note: List accounts in alphabetical order.

Income Statement

2020

Other Revenues and Gains

Balance Sheet

December 31, 2020

Assets

2$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College