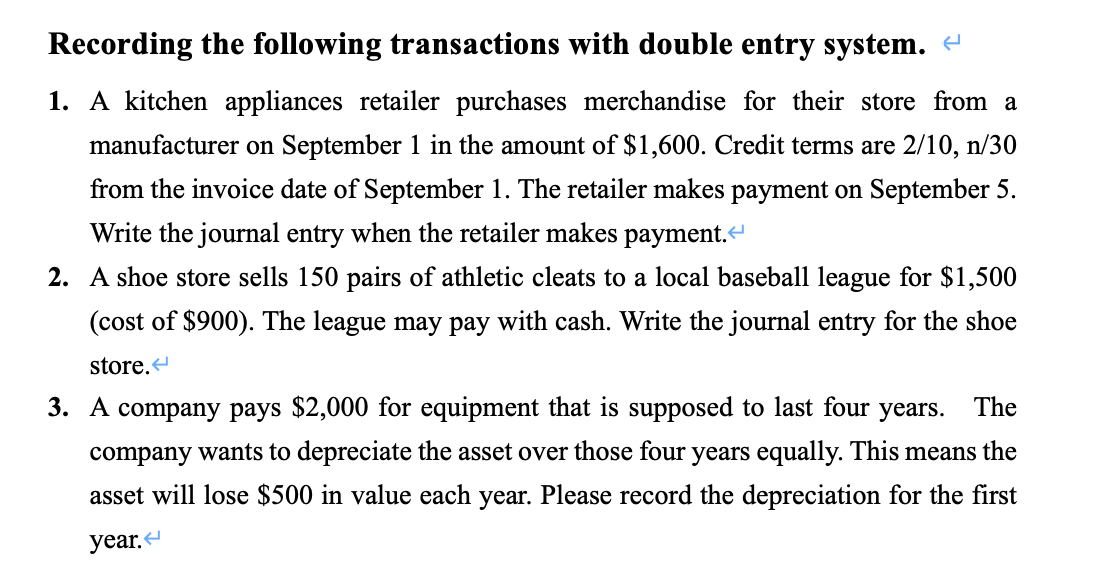

Recording the following transactions with double entry system. - 1. A kitchen appliances retailer purchases merchandise for their store from a manufacturer on September 1 in the amount of $1,600. Credit terms are 2/10, n/30 from the invoice date of September 1. The retailer makes payment on September 5. Write the journal entry when the retailer makes payment.« 2. A shoe store sells 150 pairs of athletic cleats to a local baseball league for $1,500 (cost of $900). The league may pay with cash. Write the journal entry for the shoe store. 3. A company pays $2,000 for equipment that is supposed to last four years. The company wants to depreciate the asset over those four years equally. This means the asset will lose $500 in value each year. Please record the depreciation for the first year.

Recording the following transactions with double entry system. - 1. A kitchen appliances retailer purchases merchandise for their store from a manufacturer on September 1 in the amount of $1,600. Credit terms are 2/10, n/30 from the invoice date of September 1. The retailer makes payment on September 5. Write the journal entry when the retailer makes payment.« 2. A shoe store sells 150 pairs of athletic cleats to a local baseball league for $1,500 (cost of $900). The league may pay with cash. Write the journal entry for the shoe store. 3. A company pays $2,000 for equipment that is supposed to last four years. The company wants to depreciate the asset over those four years equally. This means the asset will lose $500 in value each year. Please record the depreciation for the first year.

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 5PA: Review the following transactions, and prepare any necessary journal entries. A. On July 16, Arrow...

Related questions

Question

1-3

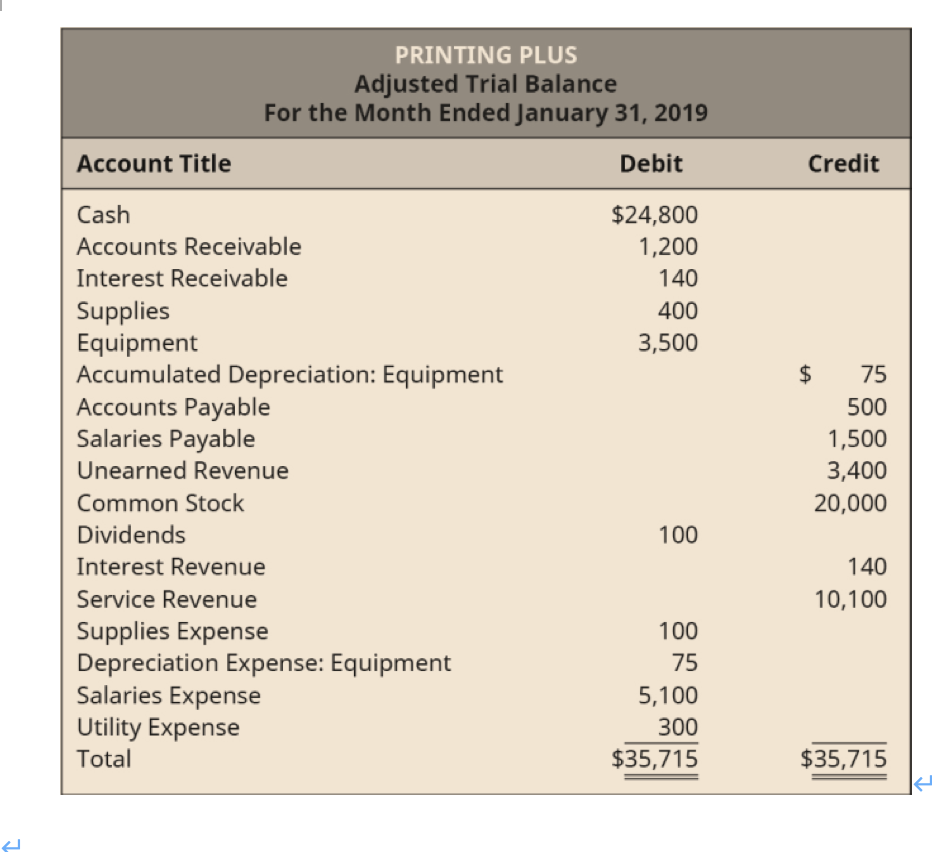

Transcribed Image Text:PRINTING PLUS

Adjusted Trial Balance

For the Month Ended January 31, 2019

Account Title

Debit

Credit

Cash

$24,800

Accounts Receivable

1,200

Interest Receivable

140

Supplies

Equipment

Accumulated Depreciation: Equipment

Accounts Payable

Salaries Payable

400

3,500

75

500

1,500

Unearned Revenue

3,400

Common Stock

20,000

Dividends

100

Interest Revenue

140

Service Revenue

10,100

Supplies Expense

Depreciation Expense: Equipment

Salaries Expense

Utility Expense

Total

100

75

5,100

300

$35,715

$35,715

Transcribed Image Text:Recording the following transactions with double entry system. e

1. A kitchen appliances retailer purchases merchandise for their store from a

manufacturer on September 1 in the amount of $1,600. Credit terms are 2/10, n/30

from the invoice date of September 1. The retailer makes payment on September 5.

Write the journal entry when the retailer makes payment.

2. A shoe store sells 150 pairs of athletic cleats to a local baseball league for $1,500

(cost of $900). The league may pay with cash. Write the journal entry for the shoe

store.

3. A company pays $2,000 for equipment that is supposed to last four years.

The

company wants to depreciate the asset over those four years equally. This means the

asset will lose $500 in value each year. Please record the depreciation for the first

year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage