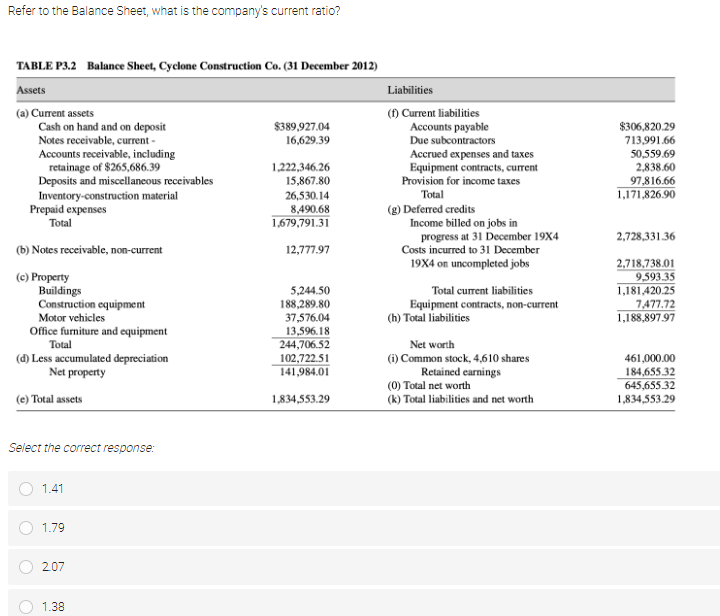

Refer to the Balance Sheet, what is the company's current ratio? TABLE P3.2 Balance Sheet, Cyclone Construction Co. (31 December 2012) Assets (a) Current assets 8389,927.04 16,629.39 Cash on hand and on deposit Notes receivable, current- Accounts receivable, including retainage of $265,686.39 1,222,346.26 15,867.80 Deposits and miscellaneous receivables 26,530.14 Inventory-construction material Prepaid expenses Total 8,490.68 1,679,791.31 (b) Notes receivable, non-current 12,777.97 (c) Property Buildings 5,244.50 Construction equipment 188,289.80 Motor vehicles 37,576.04 13,596.18 Office furniture and equipment Total (d) Less accumulated depreciation 244,706.52 102,722.51 141,984.01 Net property (e) Total assets 1,834,553.29 Select the correct response: 1.41 1.79 2.07 1.38 Liabilities (f) Current liabilities Accounts payable Due subcontractors Accrued expenses and taxes Equipment contracts, current Provision for income taxes Total (g) Deferred credits Income billed on jobs in progress at 31 December 19X4 Costs incurred to 31 December 19X4 on uncompleted jobs Total current liabilities Equipment contracts, non-current (h) Total liabilities Net worth (i) Common stock, 4,610 shares Retained earnings (0) Total net worth (k) Total liabilities and net worth $306,820.29 713,991.66 50,559.69 2,838.60 97,816.66 1,171,826.90 2,728,331.36 2,718,738.01 9,593.35 1,181,420.25 7,477.72 1,188,897.97 461,000.00 184,655.32 645,655.32 1,834,553.29

Bad Debts

At the end of the accounting period, a financial statement is prepared by every company, then at that time while preparing the financial statement, the company determines among its total receivable amount how much portion of receivables is collected by the company during that accounting period.

Accounts Receivable

The word “account receivable” means the payment is yet to be made for the work that is already done. Generally, each and every business sells its goods and services either in cash or in credit. So, when the goods are sold on credit account receivable arise which means the company is going to get the payment from its customer to whom the goods are sold on credit. Usually, the credit period may be for a very short period of time and in some rare cases it takes a year.

Step by step

Solved in 2 steps