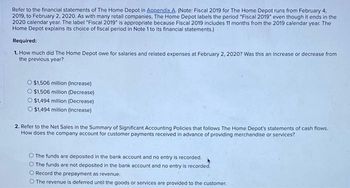

Refer to the financial statements of The Home Depot in Appendix A. (Note: Fiscal 2019 for The Home Depot runs from February 4, 2019, to February 2, 2020. As with many retail companies. The Home Depot labels the period "Fiscal 2019" even though it ends in the 2020 calendar year. The label "Fiscal 2019" is appropriate because Fiscal 2019 includes 11 months from the 2019 calendar year. The Home Depot explains its choice of fiscal period in Note 1 to its financial statements.) Required: 1. How much did The Home Depot owe for salaries and related expenses at February 2, 2020? Was this an increase or decrease from the previous year? O $1,506 million (Increase) O $1,506 million (Decrease) $1,494 million (Decrease) O $1,494 million (Increase) 2. Refer to the Net Sales in the Summary of Significant Accounting Policies that follows The Home Depot's statements of cash flows. How does the company account for customer payments received in advance of providing merchandise or services? The funds are deposited in the bank account and no entry is recorded. O The funds are not deposited in the bank account and no entry is recorded. O Record the prepayment as revenue. The revenue is deferred until the goods or services are provided to the customer. 3. What adjusting journal entry must The Home Depot make when it provides services paid by gift card? O debit Deferred Revenue, credit Cash debit Net Sales Revenue, credit Deferred Revenue O debit Deferred Revenue, credit Net Sales Revenue O debit Cash, credit Deferred Revenue

Refer to the financial statements of The Home Depot in Appendix A. (Note: Fiscal 2019 for The Home Depot runs from February 4, 2019, to February 2, 2020. As with many retail companies. The Home Depot labels the period "Fiscal 2019" even though it ends in the 2020 calendar year. The label "Fiscal 2019" is appropriate because Fiscal 2019 includes 11 months from the 2019 calendar year. The Home Depot explains its choice of fiscal period in Note 1 to its financial statements.) Required: 1. How much did The Home Depot owe for salaries and related expenses at February 2, 2020? Was this an increase or decrease from the previous year? O $1,506 million (Increase) O $1,506 million (Decrease) $1,494 million (Decrease) O $1,494 million (Increase) 2. Refer to the Net Sales in the Summary of Significant Accounting Policies that follows The Home Depot's statements of cash flows. How does the company account for customer payments received in advance of providing merchandise or services? The funds are deposited in the bank account and no entry is recorded. O The funds are not deposited in the bank account and no entry is recorded. O Record the prepayment as revenue. The revenue is deferred until the goods or services are provided to the customer. 3. What adjusting journal entry must The Home Depot make when it provides services paid by gift card? O debit Deferred Revenue, credit Cash debit Net Sales Revenue, credit Deferred Revenue O debit Deferred Revenue, credit Net Sales Revenue O debit Cash, credit Deferred Revenue

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts need more information to provide you with a solution. Incomplete data for the required questions Please resubmit your question, making sure it's detailed and complete. We've credited a question to your account.

Your Question:

Transcribed Image Text:Refer to the financial statements of The Home Depot in Appendix A. (Note: Fiscal 2019 for The Home Depot runs from February 4,

2019, to February 2, 2020. As with many retail companies. The Home Depot labels the period "Fiscal 2019" even though it ends in the

2020 calendar year. The label "Fiscal 2019" is appropriate because Fiscal 2019 includes 11 months from the 2019 calendar year. The

Home Depot explains its choice of fiscal period in Note 1 to its financial statements.)

Required:

1. How much did The Home Depot owe for salaries and related expenses at February 2, 2020? Was this an increase or decrease from

the previous year?

O $1,506 million (Increase)

O $1,506 million (Decrease)

$1,494 million (Decrease)

O $1,494 million (Increase)

2. Refer to the Net Sales in the Summary of Significant Accounting Policies that follows The Home Depot's statements of cash flows.

How does the company account for customer payments received in advance of providing merchandise or services?

The funds are deposited in the bank account and no entry is recorded.

O The funds are not deposited in the bank account and no entry is recorded.

O Record the prepayment as revenue.

The revenue is deferred until the goods or services are provided to the customer.

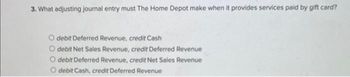

Transcribed Image Text:3. What adjusting journal entry must The Home Depot make when it provides services paid by gift card?

O debit Deferred Revenue, credit Cash

debit Net Sales Revenue, credit Deferred Revenue

O debit Deferred Revenue, credit Net Sales Revenue

O debit Cash, credit Deferred Revenue

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College