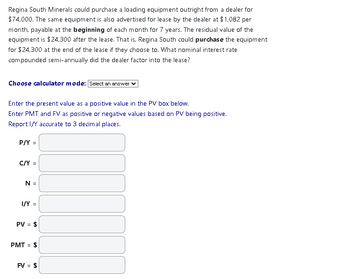

Regina South Minerals could purchase a loading equipment outright from a dealer for $74,000. The same equipment is also advertised for lease by the dealer at $1,082 per month, payable at the beginning of each month for 7 years. The residual value of the equipment is $24,300 after the lease. That is, Regina South could purchase the equipment for $24,300 at the end of the lease if they choose to. What nominal interest rate compounded semi-annually did the dealer factor into the lease? Choose calculator mode: Select an answer Enter the present value as a positive value in the PV box below. Enter PMT and FV as positive or negative values based on PV being positive. Report I/Y accurate to 3 decimal places. P/Y = C/Y = N = I/Y = = PV = $ PMT= $ FV = $

Regina South Minerals could purchase a loading equipment outright from a dealer for $74,000. The same equipment is also advertised for lease by the dealer at $1,082 per month, payable at the beginning of each month for 7 years. The residual value of the equipment is $24,300 after the lease. That is, Regina South could purchase the equipment for $24,300 at the end of the lease if they choose to. What nominal interest rate compounded semi-annually did the dealer factor into the lease? Choose calculator mode: Select an answer Enter the present value as a positive value in the PV box below. Enter PMT and FV as positive or negative values based on PV being positive. Report I/Y accurate to 3 decimal places. P/Y = C/Y = N = I/Y = = PV = $ PMT= $ FV = $

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts need more information to provide you with a solution. Provide the question with correct figures as with the given figures answer is coming in negative values.Please resubmit your question, making sure it's detailed and complete. We've credited a question to your account.

Your Question:

Transcribed Image Text:Regina South Minerals could purchase a loading equipment outright from a dealer for

$74,000. The same equipment is also advertised for lease by the dealer at $1,082 per

month, payable at the beginning of each month for 7 years. The residual value of the

equipment is $24,300 after the lease. That is, Regina South could purchase the equipment

for $24,300 at the end of the lease if they choose to. What nominal interest rate

compounded semi-annually did the dealer factor into the lease?

Choose calculator mode: Select an answer

Enter the present value as a positive value in the PV box below.

Enter PMT and FV as positive or negative values based on PV being positive.

Report I/Y accurate to 3 decimal places.

P/Y =

C/Y =

N =

I/Y =

=

PV = $

PMT= $

FV = $

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning