Rekya Mart Inc. is a general merchandise retail company that began operations on January 1, Year 1. The following transactions relate to debt investments acquired by Rekya Mart Inc., which has a fiscal year ending on December 31: Year 1 Apr. 1. Purchased $54,000 of Smoke Bay 4%, 10-year bonds at their face amount plus accrued interest of $360. The bonds pay interest semiannually on February 1 and August 1. May 16. Purchased $132,000 of Geotherma Co. 6%, 12-year bonds at their face amount plus accrued interest of $330. The bonds pay interest semiannually on May 1 and November 1. Aug. 1. Received semiannual interest on the Smoke Bay bonds.

Rekya Mart Inc. is a general merchandise retail company that began operations on January 1, Year 1. The following transactions relate to debt investments acquired by Rekya Mart Inc., which has a fiscal year ending on December 31:

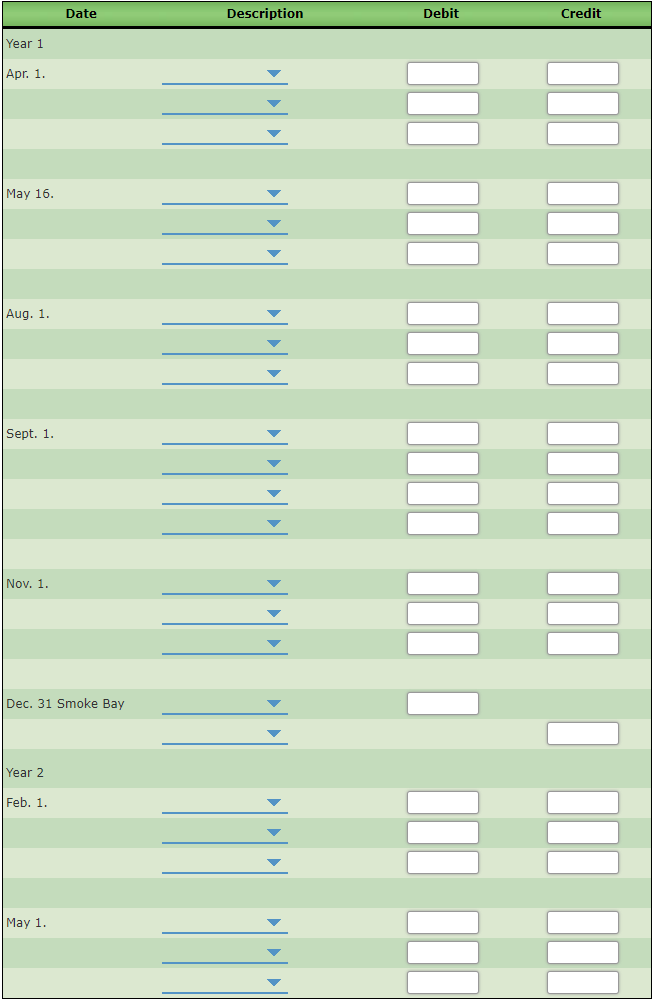

| Year 1 | ||

| Apr. 1. | Purchased $54,000 of Smoke Bay 4%, 10-year bonds at their face amount plus accrued interest of $360. The bonds pay interest semiannually on February 1 and August 1. | |

| May 16. | Purchased $132,000 of Geotherma Co. 6%, 12-year bonds at their face amount plus accrued interest of $330. The bonds pay interest semiannually on May 1 and November 1. | |

| Aug. 1. | Received semiannual interest on the Smoke Bay bonds. | |

| Sept. 1. | Sold $21,600 of Smoke Bay bonds at 103 plus accrued interest of $72. | |

| Nov. 1. | Received semiannual interest on the Geotherma Co. bonds. | |

| Dec. 31 | Accrued $432 interest on Smoke Bay bonds. | |

| Dec. 31 | Accrued $660 interest on Geotherma Co. bonds. | |

| Year 2 | ||

| Feb. 1. | Received semiannual interest on the Smoke Bay bonds. | |

| May 1. | Received semiannual interest on the Geotherma Co. bonds. |

Required:

1.

(picture 1)

2. If the bond portfolio is classified as available for sale, what impact would this have on financial statement disclosure?

If the bonds are classified as available-for-sale securities, then the portfolio of bonds would need to be adjusted to ______ (fair value OR historical cost). This would be accomplished by using a valuation allowance account and ______ ( a realized gain [loss] OR an unrealized gain [loss]) account.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images