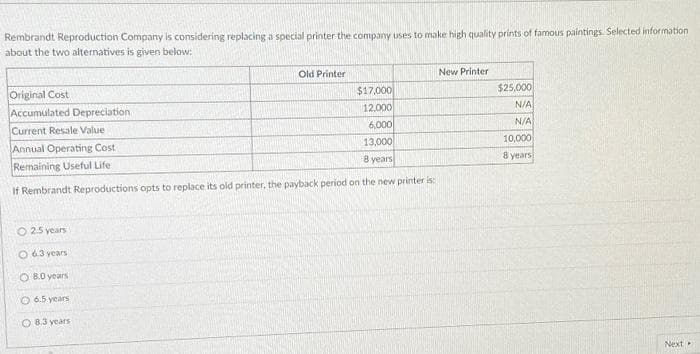

Rembrandt Reproduction Company is considering replacing a special printer the company uses to make high quality prints of famous paintings. Selected information about the two alternatives is given below: Old Printer Original Cost $17,000 Accumulated Depreciation 12,000 6,000 Current Resale Value Annual Operating Cost 13,000 8 years Remaining Useful Life If Rembrandt Reproductions opts to replace its old printer, the payback period on the new printer is: O 2.5 years O 63 years O 8.0 years O 6.5 years O 8.3 years New Printer $25,000 N/A N/A 10,000 8 years

Rembrandt Reproduction Company is considering replacing a special printer the company uses to make high quality prints of famous paintings. Selected information about the two alternatives is given below: Old Printer Original Cost $17,000 Accumulated Depreciation 12,000 6,000 Current Resale Value Annual Operating Cost 13,000 8 years Remaining Useful Life If Rembrandt Reproductions opts to replace its old printer, the payback period on the new printer is: O 2.5 years O 63 years O 8.0 years O 6.5 years O 8.3 years New Printer $25,000 N/A N/A 10,000 8 years

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 18P: Filkins Fabric Company is considering the replacement of its old, fully depreciated knitting...

Related questions

Question

Payback period question thanks

Transcribed Image Text:Rembrandt Reproduction Company is considering replacing a special printer the company uses to make high quality prints of famous paintings. Selected information

about the two alternatives is given below:

Original Cost

$17,000

Accumulated Depreciation

12.000

6,000

Current Resale Value

Annual Operating Cost

13,000

Remaining Useful Life

8 years

If Rembrandt Reproductions opts to replace its old printer, the payback period on the new printer is:

O 2.5 years

O 6.3 years

O 8.0 years

Old Printer

O 6.5 years

O 8.3 years

New Printer

$25,000

N/A

N/A

10,000

8 years

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning