Renting: Monthly Rent: $1,800 Renter’s Insurance: $200 per year Security Deposit: $2,000 After-tax Savings Rate: 5% Buying: Home Price: $250,000 Down Payment: $50,000 Loan Amount: $200,000 Loan Term: 25 years Interest Rate: 3.5% Property Taxes: 1.25% of the home price Homeowner’s Insurance: 0.4% of the home price Maintenance Costs: 1.5% of the home price Closing Costs: $5,000

Renting: Monthly Rent: $1,800 Renter’s Insurance: $200 per year Security Deposit: $2,000 After-tax Savings Rate: 5% Buying: Home Price: $250,000 Down Payment: $50,000 Loan Amount: $200,000 Loan Term: 25 years Interest Rate: 3.5% Property Taxes: 1.25% of the home price Homeowner’s Insurance: 0.4% of the home price Maintenance Costs: 1.5% of the home price Closing Costs: $5,000

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter6: Using Credit

Section: Chapter Questions

Problem 3FPE

Related questions

Question

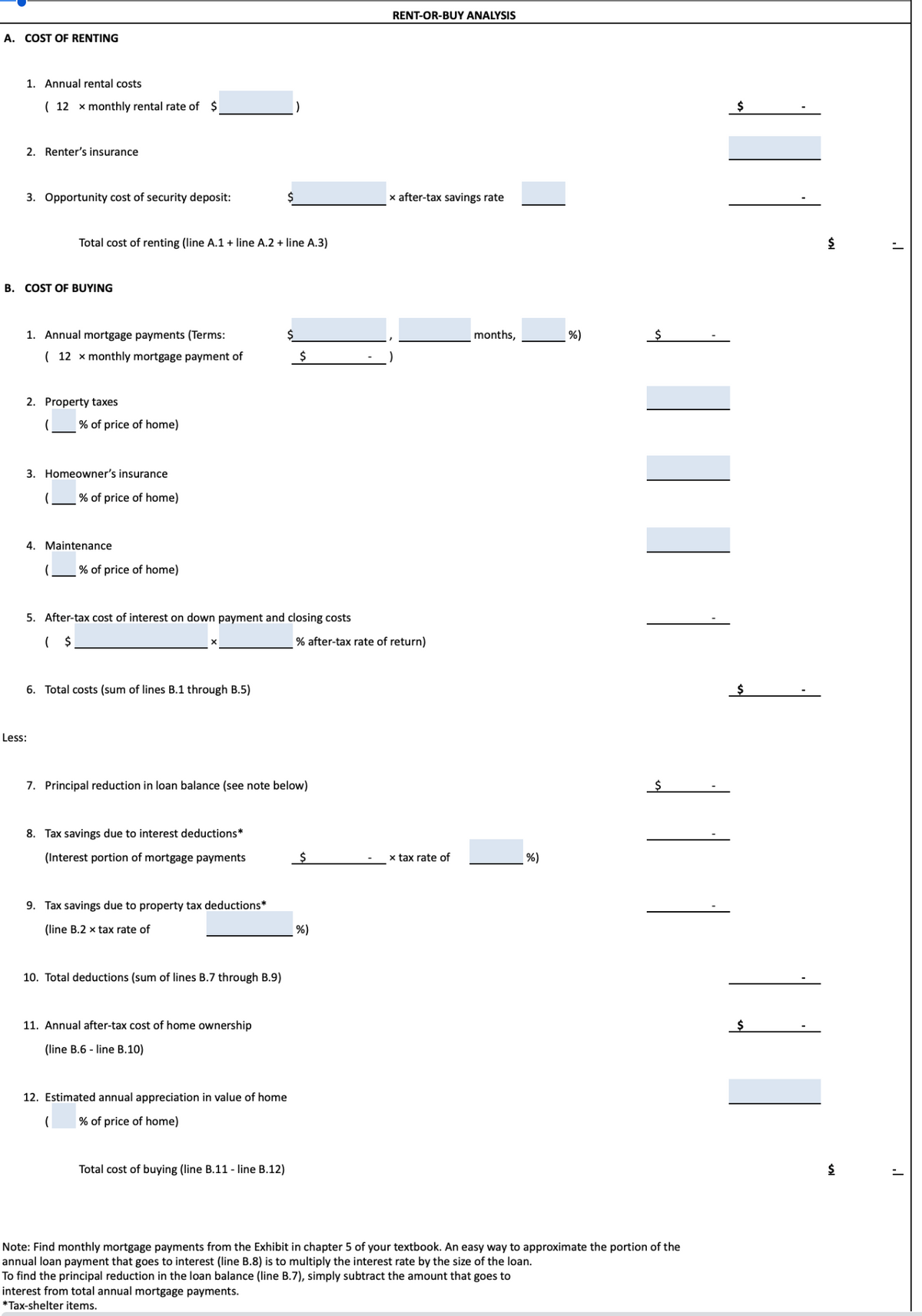

fill out the worksheet using the following information:

Theoretical Housing Situation:

Renting:

- Monthly Rent: $1,800

- Renter’s Insurance: $200 per year

- Security Deposit: $2,000

- After-tax Savings Rate: 5%

Buying:

- Home Price: $250,000

- Down Payment: $50,000

- Loan Amount: $200,000

- Loan Term: 25 years

- Interest Rate: 3.5%

- Property Taxes: 1.25% of the home price

- Homeowner’s Insurance: 0.4% of the home price

- Maintenance Costs: 1.5% of the home price

- Closing Costs: $5,000

- After-tax

Rate of Return : 4% - Tax Rate: 25%

- Estimated Annual Appreciation: 2%

Transcribed Image Text:A. COST OF RENTING

1. Annual rental costs

(12 x monthly rental rate of $

2. Renter's insurance

3. Opportunity cost of security deposit:

B. COST OF BUYING

Total cost of renting (line A.1 + line A.2 + line A.3)

1. Annual mortgage payments (Terms:

( 12 x monthly mortgage payment of

2. Property taxes

% of price of home)

3. Homeowner's insurance

% of price of home)

4. Maintenance

Less:

% of price of home)

6. Total costs (sum of lines B.1 through B.5)

5. After-tax cost of interest on down payment and closing costs

( $

8. Tax savings due to interest deductions*

(Interest portion of mortgage payments

9. Tax savings due to property tax deductions*

(line B.2 x tax rate of

7. Principal reduction in loan balance (see note below)

10. Total deductions (sum of lines B.7 through B.9)

$

11. Annual after-tax cost of home ownership

(line B.6-line B.10)

$

$

12. Estimated annual appreciation in value of home

(

% of price of home)

Total cost of buying (line B.11-line B.12)

% after-tax rate of return)

$

RENT-OR-BUY ANALYSIS

%)

x after-tax savings rate

x tax rate of

months,

%)

%)

$

Note: Find monthly mortgage payments from the Exhibit in chapter 5 of your textbook. An easy way to approximate the portion of the

annual loan payment that goes to interest (line B.8) is to multiply the interest rate by the size of the loan.

To find the principal reduction in the loan balance (line B.7), simply subtract the amount that goes to

interest from total annual mortgage payments.

*Tax-shelter items.

$

$

$

$

$

I'

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning